The Top 5 Themes for the US Market in 2026

We highlight distinct areas of the US market that warrant attention as we begin the new year. These focus areas may overlap or diverge in their impact and relevance.

Introduction

We begin the year optimistic about 2026. However, we recognize that institutional investors face a dynamic landscape shaped by stretched valuations, evolving AI adoption, and persistent macro risks, as geopolitics and shifting US policies continue to impact asset allocation. We emphasize the need for diversified portfolios, selective sector exposure, and a focus on quality, despite the constructive backdrop.

1. Geopolitics and US policy

We revised our 2026 growth estimates higher due to expected tax refunds, ongoing deregulation, robust capex continuing, and easier financial conditions. However, policy uncertainty remains elevated heading into the midterms, as trade and immigration frameworks remain fluid.

Geopolitical tensions—spanning Russia/Ukraine, Venezuela, Iran, China, and even NATO allies—remain mostly discounted by markets, but still affect supply chains, foreign exchange (FX) dynamics, and risk premia. For example, sovereignty-driven industrial policy is redirecting capex toward strategic technology and energy sectors, often at higher cost structures.

Investment implications:

Expect short-lived, episodic shocks around major political dates and policy headlines. These shocks heighten the importance of asset allocation and risk repricing, where capital flows may increasingly support gold and a more dynamic currency view.

2. The US consumer

Consumption accounts for roughly 68% of US GDP.1 Core inflation should moderate as the Fed delivers non recessionary rate cuts (our baseline is for ~50-75 bps of cuts in 2026). While this should ease borrowing costs, affordability pressures for lower income cohorts will persist. Consumer strength is therefore likely to remain K-shaped.

While our outlook is constructive, wage indicators across employer and worker surveys (Average Hourly Earnings, Employment Cost Index, Atlanta Fed Wage Growth Tracker) suggest cooling wage growth heading into late 2025, underscoring that the labor market is the key macro risk for 2026.

Investment implications:

A softer US dollar could benefit emerging markets. Equity positioning should be selective across discretionary and macro-sensitive sectors, such as industrials and financials (Figure 1). In fixed income, we continue to expect curve steepening and see opportunity in securitized non-agency investment grade (IG) bonds, including mortgage-backed securities.

3. AI industrialization

The coming year marks a transition from hype—exemplified by the Magnificent 7’s five year cumulative return of 173%2—to enterprise-level AI buildout.

If what we observe in geopolitics is the symptom, the structural implications of AI dominance are the root cause.

We think that AI is not a bubble, but instead a fundamental driver of markets and policy, and a key differentiator of global power moving forward.

This year, data centers, semiconductors, and software deployments are set to scale further, with productivity gains emerging first in tech-adjacent verticals (industrial automation, healthcare IT, energy infrastructure), before broader diffusion.

To be clear, 2026 is likely too soon to see AI deliver major economy-wide productivity gains. But we do expect the beginnings of ROI in specific areas (see tech-adjacent verticals).

Investment implications:

Consider a barbell approach between AI infrastructure enablers (cloud, semiconductors, power, and thermal systems) and operational adopters with margin leverage. Monitor electricity markets and grid-related capex bottlenecks.

4. Valuations (Everything is rich!)

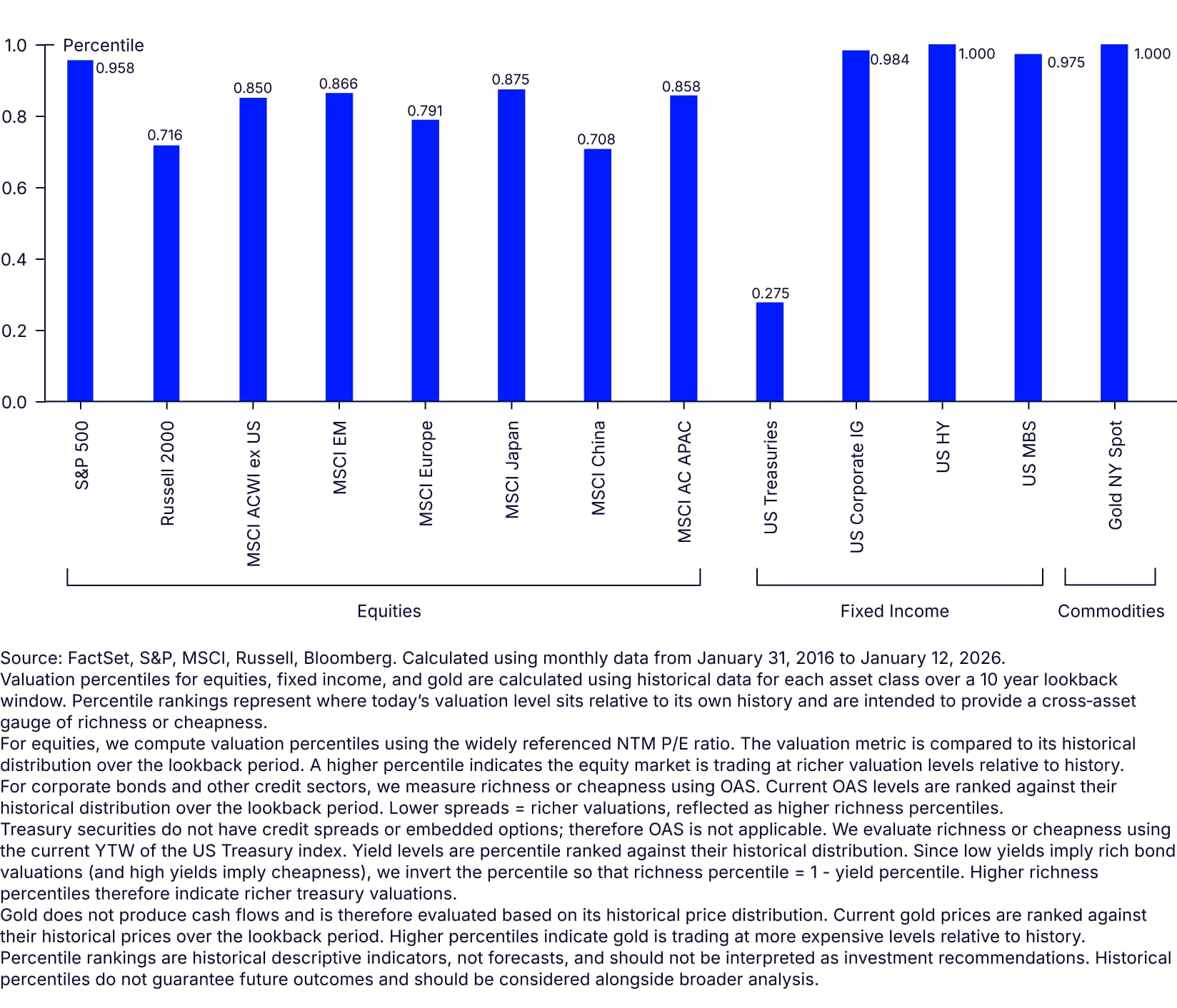

Across equities, credit, and private markets, elevated valuations define the cross-asset backdrop heading into 2026 (Figure 2). US equities trade near cycle high multiples amid disinflation and policy hopes; credit spreads remain tight versus long-run medians; and private assets face exit and liquidity constraints. Some estimates for North American private-equity buyouts are at morethan seven years,3 as IPO windows and secondaries reopen gradually.

Figure 2: Valuations remain stretched across asset classes

Breadth of Richness Across Asset Classes (Percentile Ranked Across 10 Years of History)

Tight spreads reflect economic confidence but also intense demand for income, as IG issuance remains active despite some slow-down (1H2025) in non-IG segments in response to policy uncertainty. On the corporate side, companies with strong cash flows, compelling ROI, and healthy balance sheets are best positioned to support higher valuations.

Investment implications:

Diversify with real assets and alternatives, and build portfolio resiliency. Investors can consider tilting to active management over passive, and exploiting valuation dispersion.

5. US exceptionalism

The “US leader” investment narrative took a hit in 2025, as the MSCI World ex US outperformed the US (+14.7%, with the US dollar down ~9.4%). But US exceptionalism isn’t over yet. Early 2026 demand should benefit from ~$100 billion in tax refunds4 and continued corporate full expensing, which will support consumption and capex. AI-related capex alone is projected to exceed $500 billion.5

S&P 500 earnings growth is expected to reach 14.8% for CY 2026,6 outpacing most major regions. The debate continues over the “push and pull” of capital, where the US could begin getting capital back as valuations no longer look as attractive overseas, and fundamentals become a primary driver of equity returns again. However, investors’ concerns about aggressive foreign policy in the US could weaken capital flows to the US.

US Treasuries remain dominant—representing ~68% of global sovereign issuance and 45% of corporate issuance. While competing forces shape long-end yield dynamics, the unparalleled depth and liquidity of Treasuries—especially during periods of geopolitical stress—reinforce their appeal versus other markets. Baseline 2026 forecasts project US growth at ~2.4%,7 beating consensus expectations and running significantly ahead of Europe and APAC, where trajectories remain more modest and uncertainty persists.

Investment implications:

Lean into US cyclicals with pricing power and AI-linked capex exposure. Balance rate risk amid curve steepening, while maintaining selective ex-US exposure where fiscal stance and FX create positive carry.