Sustainability in LDI

- Sustainability is becoming more central to Liability Driven Investment (LDI), driven by regulation and increasing recognition that climate and nature risks are financially material.

- Integration is expanding across asset types, from liquidity and credit to sovereign debt, using exclusions, tilts, and labelled bonds (i.e. green, social, sustainable, climate transition, and sustainability-linked bonds aligned with the ICMA Principles).

- LDI and sustainability can align by leveraging data, reporting, and bond issuer engagement enabling investors to meet both hedging and sustainability goals.

Introduction

Sustainability has become an increasingly important consideration in the formulation of investment strategies for many UK and European pension schemes. This trend reflects changing regulatory requirements, heightened stakeholder expectations, and growing recognition that sustainability factors can present material risks and opportunities. In the UK, the Pensions Regulator promotes sustainability integration, including voluntary net-zero transition plans for occupational schemes, aligned with the Sustainable Disclosure Requirements and the Transition Plan Taskforce framework.1 Across Europe, initiatives such as the EU Action Plan on Financing Sustainable Growth and the European Green Deal seek to channel private capital towards sustainable investments.

How Can Sustainability Be Incorporated into LDI Strategies?

In our view whilst sustainability objectives can be more readily integrated into asset classes such as equities, corporate bonds and money market instruments, incorporating these objectives within LDI presents unique challenges. Areas such as government bonds, counterparty restrictions and in engagement with sovereign issuers and regulators often involve constraints that limit the scope for direct sustainability integration.

Our approach is to work in close partnership with clients to truly understand their specific objectives and design portfolios and investment principles that meet their objectives. Below are some key factors to consider:

1. Corporate Bonds

For corporate bond holdings, we offer a range of approaches to cater for clients’ sustainability requirements:

- Negative Screening: A “Negative Screen” (also known as an exclusionary screen) is a screen incorporated into the investment strategy that results in the exclusion of securities of issuers that fail to satisfy certain sustainability criteria. Negative Screens include, but are not limited to, SSGA Point of View (“POV”) screens, norms-based screens, socially responsible Investing (SRI) screens, and screens provided by clients or other third-parties.

- Positive Screening: A “Positive Screen” is a screen incorporated into the investment strategy that intentionally includes securities of issuers identified as having positive sustainability characteristics (including positive characteristics of sub-components of sustainability such as environmental, climate or social characteristics) relative to the issuer’s industry or sector peers. Positive Screens include, but are not limited to, targeting an overall improvement of a portfolio’s sustainability profile as compared to a benchmark or stated investment guideline, measured in sustainability scores or metrics, or investing in issuers within an industry or sector that score higher relative to its peers.

- Third Party ESG/Sustainable Index Investment Strategies: An index is deemed to be a “Third Party ESG/Sustainable Index” if the index methodology incorporates ESG/sustainability factors or characteristics that are utilized by the third-party index provider to determine which securities and/or their weight are included as index constituents. Customisation is available at both index and portfolio levels for separately managed accounts. Our proprietary frameworks enable us to tailor parameters to suit individual client needs.

Case Study

In an LDI setting, an example of how sustainability can be built into credit portfolios is by using a climate-aligned corporate bond index or by incorporating multiple data sources directly into the investment process while still achieving a low tracking-error to a reference benchmark.

A client could have the desire to reduce the portfolio’s carbon footprint while maintaining the interest-rate and credit-spread characteristics needed for liability matching. Starting from a standard GBP investment-grade index, the custom version could target a 30% lower financed-emissions initially, with a 7% annual reduction thereafter. It could remove issuers linked to coal, oil sands, controversial weapons, and severe controversies. Risk is managed by controlling duration, spread duration, sector weights, and credit quality within tight limits, and by applying liquidity screens and issuer caps. Green bonds and companies with credible transition plans are favoured where possible. The index is rebalanced quarterly with turnover limits to manage costs. For more examples, please see The Climate Files.

Clients can receive monthly reports showing carbon metrics, temperature alignment, and progress against the decarbonization path, alongside risk and performance attribution.

It is also important for investors to be aware that the quality, consistency and coverage of sustainability data for corporate issuers can vary across providers, and coverage is more likely to be limited for smaller issuers or private companies. Applying exclusions or positive screens can lead to sector concentration (e.g., underweighting energy or utilities) and potentially change the liquidity risk exposure, which may affect risk-return characteristics.

2. Sovereign Bonds

Investors can also use scoring models and third-party data to assess governance quality, climate vulnerability, and social development indicators. Sovereign debt differs fundamentally from corporate bonds and equities and historically sovereign exposure has received relatively less attention from market participants. This has led to challenges when it comes to data availability, range of metrics, methodologies, and available tools for assessing climate or other sustainability-related risks and opportunities.

Recent efforts from international organisations, investor-led initiatives (e.g. UN PRI, IIGCC and ASCOR), academia, non-governmental and governmental organisations have improved the landscape, providing well-defined methodologies and net zero guidance for the sovereign bond investors. While carbon metrics may be linked to a country’s exposure to transition risks, we find that carbon intensity emissions metrics of sovereigns raises double-counting issues and conceptual differences compared to corporate carbon metrics.

With governments issuing green, social, sustainability (GSS), climate transition, and sustainability-linked bonds, investors may seek to use these to align portfolios with environmental or social objectives, or alignment with the UN Sustainable Development Goals (SDGs), for example..

The number of sovereign issuers that investors can consider is limited compared to a typical corporate bond strategy. Consequently, the extent to which sustainability goals can be applied in a portfolio will depend on:

- Breadth of the eligible investment universe

- Data coverage

- Sustainability-related targets set by the investor

- The targeted risk-return characteristics relative to the policy benchmark

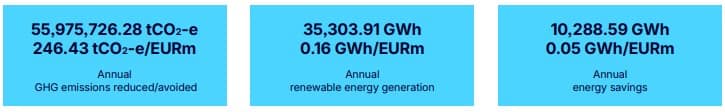

We can deliver detailed reporting on the sustainability credentials of labelled government bonds, including:

- Analysis on use-of-proceeds

- Impact reporting, on environmental and social outcomes

- Additional metrics such as SDG contributions

Main Impact Metrics

Source: United Nations, UN.org, LuxSE’s LGX DataHub . The information contained above is for illustrative purposes only.

Green Gilts – Four Years On

Green gilts have been part of the market for several years — with the first issuance taking place in 20212— yet appetite from our LDI investor base for targeted allocations remains limited.

Whilst there remain general concerns around the use of proceeds for few green sovereign bonds, regular disclosures from the UK government indicate that proceeds are being effectively deployed in the UK, which may alleviate some concerns.3

The below chart shows how the proceeds of green gilts were spent in 2024:

Recently, green gilts have underperformed conventional gilts, and the “greenium” has largely eroded — suggesting that integrating sustainability into LDI portfolios may no longer carry an additional cost.5 The UK Debt Management Office (DMO) remains committed to green gilt issuance and is expected to expand the curve by adding a third maturity point to complement the existing 2033 and 2053 issues, although a green index-linked gilt remains unlikely.6

Green European Sovereign Bonds

The market for European green government bonds continues to grow, driven by individual EU member states and the European Union itself.7 The largest sovereign issuers include Germany, France and Italy, with the EU as the largest single issuer.8 It is aiming to fund its NextGenerationEU programme partly through green bonds.9 The EU Green Bond Standard, which entered into force in December 2025, aims to establish a new standard for transparency and credibility, but its application remains voluntary.10 Within Europe, the majority of sovereign green bond issuances have been aligned with ICMA’s Green Bond Principles.11

Across euro area green sovereign bonds, the current average greenium (the yield discount for green bonds relative to conventional bonds) is around 2bps, though this can change significantly across sovereign issuers and matunities.2

While the green sovereign bond market is expanding in terms of issuers, absolute size and percentage of the investable market, it nonetheless remains a relatively small proportion of the overall market index (see Figure 3) and as such, it is unlikely to make up a substantial part of an LDI portfolio in the near term.

3. Liquidity Funds

For liquidity funds used for cash collateral, the primary objectives are usually principal preservation, liquidity and yield, while some funds may also promote environmental and social characteristics. These funds often apply exclusion policies and positive tilts based on sustainability criteria, aiming to allocate a significant proportion of the portfolio to issuers that meet defined sustainability standards.

4. Counterparty Approval

State Street Investment Management (“State Street IM”) maintains a list of approximately 385 counterparties12 that are approved for trading. Counterparty Risk Management may consider sustainable investment factors in the onboarding and oversight process to the extent that such factors materially affect a trading counterparty’s creditworthiness. Unless otherwise specifically directed by a client, best-execution principles are applied. However, should a client request restrictions on trading with a specific counterparty for sustainability-related concerns, we are able to promptly implement this within the client’s portfolio.

Restricting counterparties requires robust systems and governance to ensure compliance across all trading desks and instruments, and may reduce the pool of available dealers, potentially impacting liquidity and execution efficiency, especially in less liquid instruments such as long-dated swaps or bespoke derivatives. While sustainability integration is encouraged, current regulations (e.g. UK TCFD reporting, EU SFDR frameworks) do not mandate counterparty exclusions, so these measures are typically client-driven and voluntary. Typically, any approved or restricted counterparty lists included in account governing documents are coded in the compliance system.

5. Engaging with Regulators and Policymakers

The adoption of the Paris Agreement in December 2015 triggered a wave of new policies, standards and initiatives aimed at integrating climate considerations into financial regulation and corporate governance frameworks. State Street Corporation’s Public Policy division is responsible for monitoring policy, legislative, or regulatory developments globally, and for engaging regulators and policymakers on these issues. We publish letters to regulators and policymakers on State Street’s website13, as well as details of our lobbying activities.14

We participate in working groups, task forces and research projects where we can contribute, to help inform frameworks, platforms and approaches that impact global and local markets and may affect the long-term value of our clients’ assets. We advocate for transparency through proportionate disclosure, ultilising global sustainability standards as a baseline. Our ongoing interactions with regulators, asset owners, asset managers, data providers, and other key stakeholders from across the globe give us unique insight to engage in evolving policy debates.

6. Stewardship

Fixed income stewardship engagement with bond issuers is naturally distinct from equity stewardship. State Street Investment Management’s fixed income stewardship program is centered on issuer engagement, as outlined in our Global Proxy Voting and Engagement Policy. In fixed income, engagements may be initiated for example when issuers approach investors with proposed changes to bond terms or convene bondholder meetings. Our engagements with corporate debt also us to leverage expertise from our equity stewardship program and extend it to our fixed income stewardship program. We are starting proactive engagements with SSA (supranationals, sovereigns and agencies) issuers regarding labelled bonds (green, social, sustainable, and sustainability-linked).

These markets have grown significantly, with some issuances now reaching sizes large enough for inclusion in both sustainable and standard indices. Through these engagements, we aim to:

- Encourage enhanced disclosures on use-of-proceeds and impact reporting.

- Exchange information to better understand how labelled bonds are structured and how they can be incorporated into indices and client portfolios.

- Providing comparative insights to help issuers enhance transparency and support issuers sustainability reporting.

How Can Investors Embed Sustainability with Confidence?

Integrating sustainability considerations into investment strategies has been an increasing priority for many UK and European pension schemes. At State Street IM, we have extensive experience embedding sustainability across asset classes and markets. While sustainability integration into all aspects of an LDI strategy may be challenging in some areas, there are multiple solutions and tools available to help investors achieve their sustainability objectives.

State Street IM is committed to supporting clients throughout their sustainability journey. We combine investment expertise, deep research, proprietary tools and robust reporting to provide actionable insights and transparency. This enables clients to make informed decisions, align portfolios with their unique objectives, and to achieve their goals with confidence. As sustainability standards evolve, unique objectives change and new instruments emerge, we remain committed to innovation and partnership to help investors navigate this dynamic landscape