Navigating the concentration conundrum: A Core-Satellite approach to active equity investing

Concentration risk has increased alongside strong earnings growth from hyperscalers, and investors are tasked with managing the growing influence of AI on global index performance. In this piece, we consider how asset allocators can use a Core-Satellite approach to invest via active management in today’s environment, but ensure that risk is mitigated and tracking error is controlled.

The recent extraordinary rise in equity index concentration has important consequences for active managers of bottom-up focused portfolios. Stock picking in the prevailing concentrated market environment leads to relatively large overweight and underweight positions outside the top of the index. This in turn can lead to large return deviation and significant tracking error (TE) relative to the market cap-weighted benchmark.

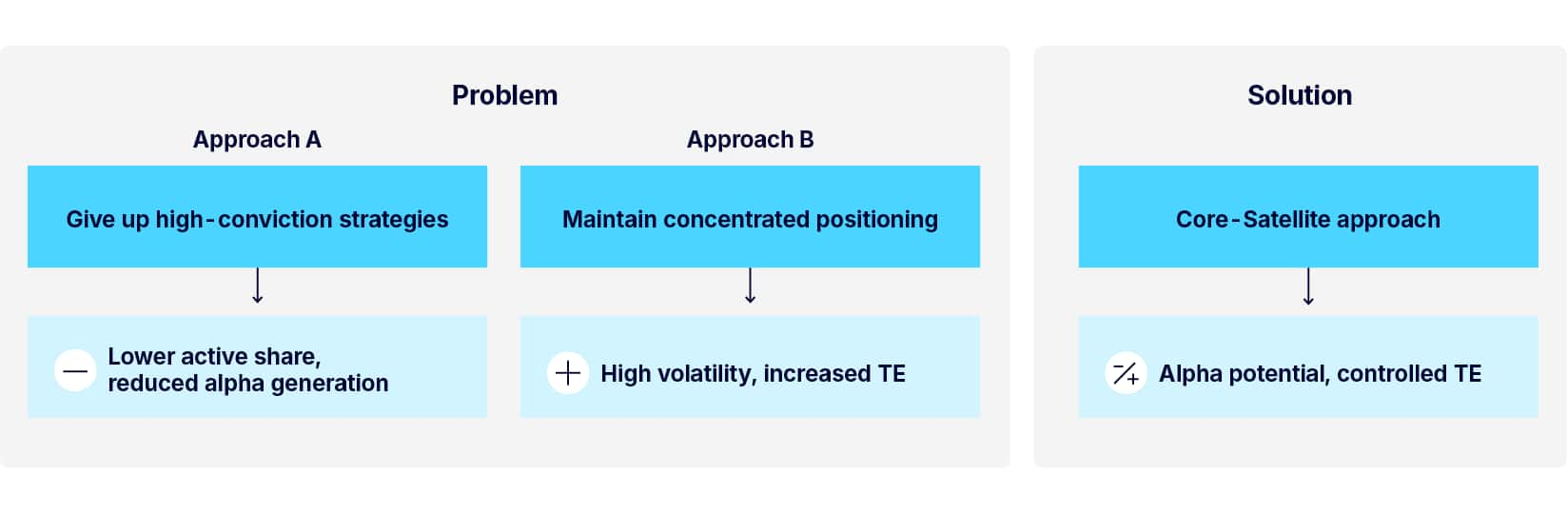

Figure 1: Managing highly concentrated market cap-weighted benchmarks

This piece explains how a Core-Satellite approach can allow investors to continue using an active management approach, but while mitigating risks and TE.

Find out more by downloading the full research report

Combining our Global Equity Select (GES) strategy with the Global Enhanced strategy in a Core-Satellite construction could help investors manage rising concentration risk. The Core-Satellite version, a blended portfolio, has demonstrated robust excess performance with a low and controlled TE versus the benchmark.1

An enduring trend

In our view, AI is not a bubble that is about to burst; rather, AI is a long-term earnings driver for firms that can boost their earnings by using the tools that AI provides. AI could potentially transform the way the global economy operates in the next five to 10 years, including the following:

- Stiffer competition. Competition in this new era will require firms to work harder to maintain market position as a competitor’s successful adoption of AI can increase its efficiency.

- Equity performance broadening out. The timing and the speed of the broadening out is difficult to predict, given that AI will take time to be implemented across sectors. This will create both opportunity2 and short-term tracking risk where equities are concerned.

- New investment lens. The implementation of AI as an important corporate productivity tool is adding a major new dimension to the way we, as equity investors, evaluate our portfolio holdings, our earnings forecasts, and our qualitative Confidence Quotient, or “CQ” scoring system.

- Industry themes. Healthcare is set to be transformed by AI, as are the Logistics and Auto sectors. Industrials will be the beneficiaries of a vast build-out of data centres for AI, and automated plants, driven by AI. The Defense sector is leaning towards sophisticated cyber and space technologies, many of which will rely on AI.

- Importance to sustainability. Climate resilience and the management of climate-related events increasingly relies on AI. The electric grid is faced with more and more sources of energy supply and this, coupled with fluctuations in demand, is more easily handled using AI.

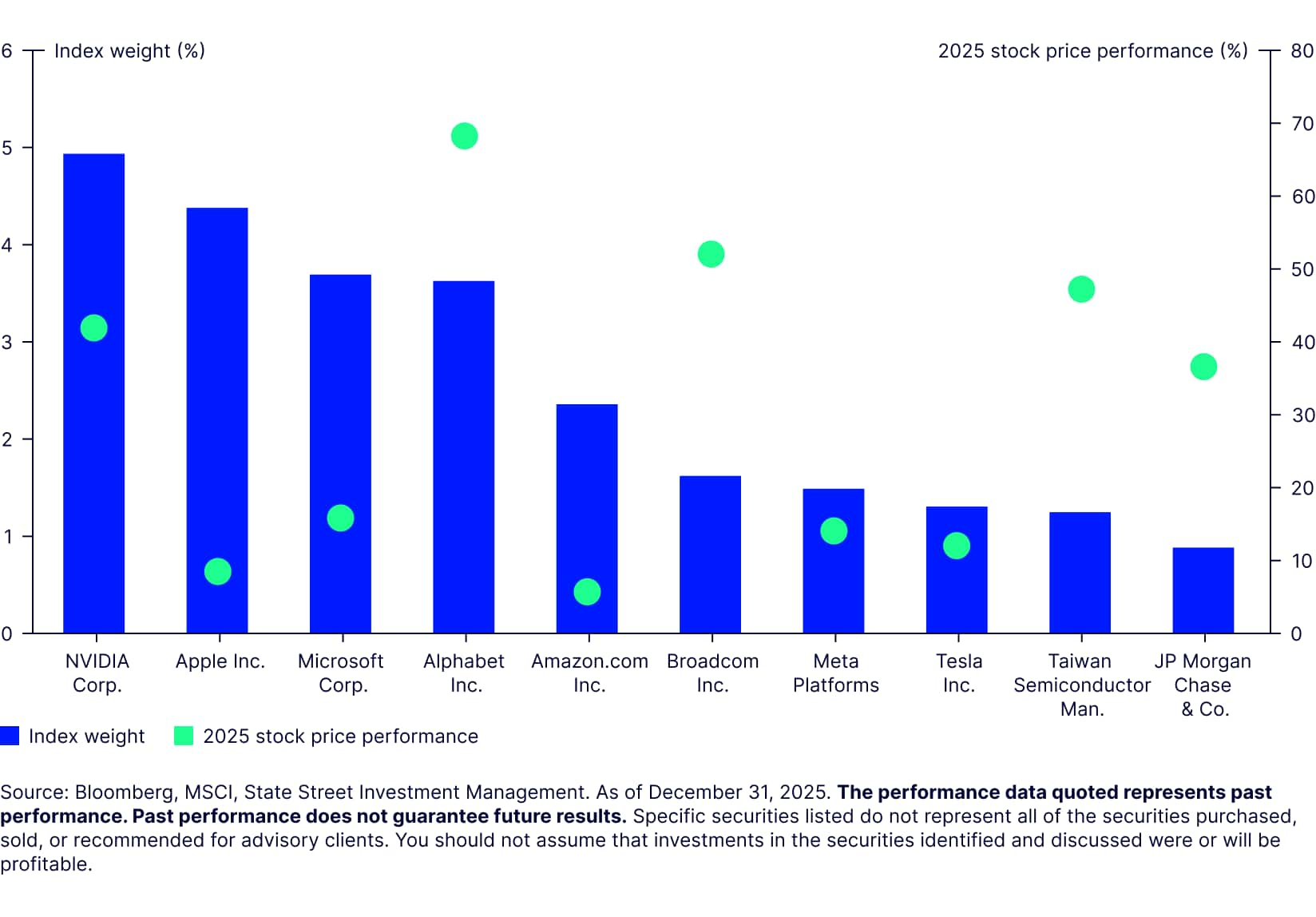

AI’s entrenchment into global markets (Figure 2) means that investors in high-conviction portfolios are operating in a new world of investing, in which risk of increased concentration can lower diversification and dramatically increase TE.

Figure 2: Dominance of the top 10 names persists due to strong outperformance

Managing concentrated equity markets using diversification

Diversification can be helpful in navigating strongly concentrated markets while retaining a high-conviction strategy to boost alpha. This can be done in the following ways:

- Combine the high-conviction strategy with the reference benchmark index in a Core-Satellite construction. Adjust exposure to the high-conviction strategy by targeting the desired level of TE versus the reference market cap index.

- Combine the high-conviction strategy with a quantitative benchmark-aware strategy in a Core-Satellite construction. To manage risk, the TE is controlled versus the reference market cap index. In this paper, we present the Global Enhanced strategy developed by State Street Investment Management’s Systematic Equity Active (SEA) team.

We demonstrate that when the Enhanced strategy (which holds roughly 500 names) is combined with our high-conviction Global Equity Select (GES) strategy (which holds 30-40 names) in a Core-Satellite approach, investors get an optimal blend of alpha and TE control. - Combine the high-conviction strategy with other high-conviction strategies. For example, investors could allocate to three equal-weighted high-conviction strategies that have low correlation, but are comparable in terms of their more general characteristics (e.g. global in nature, benchmark, and number of names). However, with this approach, there is no control of TE.

Diversifying by increasing the number of stocks in the high-conviction portfolio is another alternative, but this would change the strategy as intended, and may also become too much of a burden for the portfolio manager.

Case study: Combining our Global Equity Select (GES) and Global Enhanced strategies to promote diversification

In our example, we combine GES with the Enhanced strategy in a Core-Satellite construction, with the Enhanced – a more diversified, lower-TE active portfolio – as the Core holding. Note that the Enhanced strategy is a blend of 90% World Enhanced (benchmark MSCI World), and 10% Emerging Enhanced (benchmark MSCI Emerging). Figure 3 outlines the key characteristics of the two strategies.

Figure 3: How these two State Street Investment Management active strategy styles compare

| Systematic Equity Active (SEA) Enhanced | Active Fundamental Equity (AFE) | |

|---|---|---|

| Description | An active systematic option with an explicit relative risk budget and alpha target. Stocks are statistically selected based on their historical characteristics and/or attributes. | High conviction portfolios based on in-depth fundamental research and demonstrated stock-picking skills. Company-specific risk drives performance, rather than market beta. |

| Attributes: | ||

| Return-driver | Alpha | Alpha |

| Principle sources of risk | Idiosyncratic as well as systematic risk | Idiosyncratic risk, with returns driven by the 30-40 companies selected for the portfolio |

| Decision-making | Quantitative/ rules-based | Qualitatively based Confidence Quotients (CQs) |

| Approach | Bottom-Up | Bottom-Up |

| Holdings | Broadly-diversified, around 500 securities | Concentrated, around 30-40 securities |

| Orientation | Forward looking ideas, back-tested using historical data | Forward-looking |

| ESG impact | ESG is recognized as an alpha attribute | ESG integrated in the stock-picking process |

| Expected Return | Benchmark outperformance of 0.75%-1.5% per annum over 5-7 years | Average 3% alpha over a market cycle of 3-5 years |

| Tracking Error | 0.25%-2.00% over 3–5-year period | 4%-8% |

Source: State Street Investment Management. *For illustrative purposes only.

The above targets are estimates based on certain assumptions and analysis made by State Street Investment Management. There is no guarantee that the estimates will be achieved.

Case study outcome

To summarize, we observe:

- The Enhanced Strategy has a low TE versus the benchmark

- Enhanced is a very different strategy in terms of style compared to GES, demonstrated by its low excess correlation with GES

- The total Core-Satellite blended portfolio TE can be adjusted by adjusting the exposure to GES (the Satellite)

- The Core-Satellite version with 75% Enhanced and 25% GES demonstrates robust excess performance with a low TE versus the benchmark, and with a similar TE to the standalone Enhanced strategy