India in 2025: A tale of contrasting risk perception?

Market responses to the April terrorist attack in India indicated a difference between geopolitical risk perception and actual market outcomes. An Indo-US trade deal is likely to help address this contradiction.

Financial markets rarely predict geopolitical events accurately, but they adjust rapidly to news—FX and commodities first, followed by equities, and finally bonds, which do this less consistently. We demonstrated this in a 2018 paper, which specifically examined select emerging markets (EM) that exhibit frequent exposure to geopolitical risks but also meet certain levels of liquidity and efficiency—India is one of them.

In May 2025, the Indo-Pak conflict escalated following a terrorist attack in Pahalgam. India initiated Operation Sindoor, targeting what it identified as terrorist infrastructure in Pakistan. Pakistan responded with military actions of its own. The confrontation lasted for a brief period until both sides agreed to a ceasefire brokered by the United States (US).

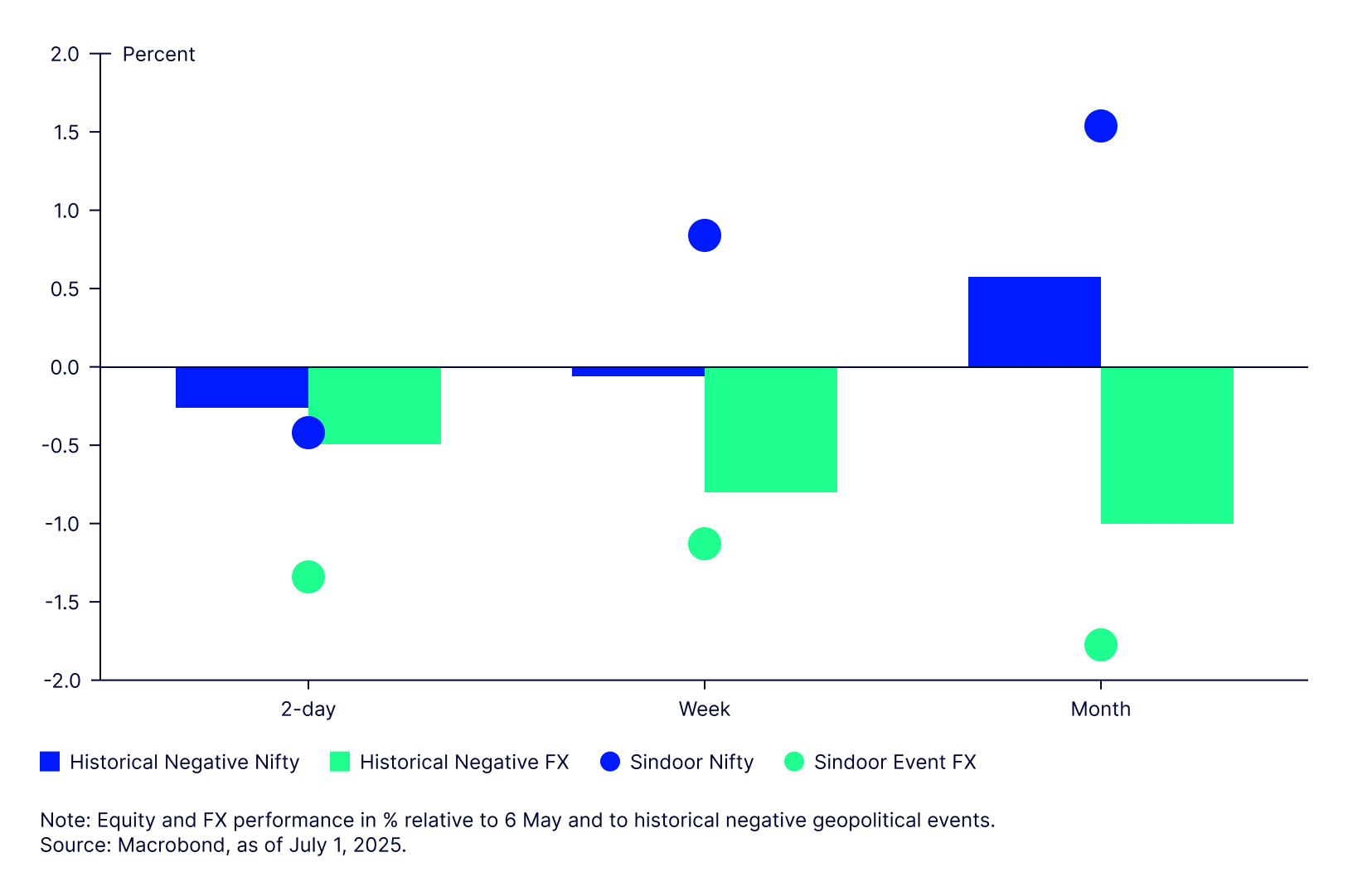

The military conflict between India and Pakistan serves as yet another case for analyzing how geopolitical events play out in financial markets such as India. Market responses to the Indo-Pak conflict offered a basis for comparison with similar such market responses in India over the past few decades. Figure 1 shows how India’s FX and equity markets responded to the event over a two-day, one-week, and one-month horizon compared with the historical average of identified negative events.

The initial two-day reaction shows how markets repriced Indian assets lower than what has been typical for negative geopolitical developments in the past. While the rupee sold off by 1.4% in the initial time period, nearly three times the usual depreciation in these circumstances, the negative performance of equities was slightly more than the historical average. In fairness, the situation did escalate beyond previous episodes, with India conducting nationwide military mock drills for the first time since 1971.

But following the ceasefire on 10 May, equities followed the normal pattern of returning to trend. In fact, within a week, equities managed to return to positive territory and exceeded historical averages, with the gap growing over the subsequent month. For context, the MSCI World returned 6% during the same period versus 1.5% for the Nifty, so global factors probably played an outsized role as well. In contrast, FX performance did not recover as per historical trends. In fact, the rupee lost nearly 2% versus the US dollar over the month, even though the US dollar was generally depreciating, with the US Dollar Index (DXY) down by about 0.7%.

All in all, this suggests that the India-Pakistan conflict of May 2025 had a more meaningful impact on investor perception than on actual market performance, with net portfolio flows, both for equity and debt, remaining positive for the month of May.

What could happen in the event of a positive geopolitical event?

By their very nature, favorable geopolitical events unfold over extended periods of time. And when they occur, the market outperformance tends to be significant. This is because an improved security or economic environment tends to materially de-risk or improve return prospects, and markets tend not to fully price in positive news until it is confirmed. This is in contrast to the geopolitical risk scenario that we illustrated above, where market performance and perception contrasted and a significant risk premium was attached in the context of the conflict.

For 2025, a positive geopolitical event could be India’s trade deal with the US, which may eliminate residual uncertainty on the trade front as well as confirm specific opportunities. India has already announced trade agreements with the United Kingdom and the European Free Trade Association. Similar agreements are in the works with the European Union, Qatar, and New Zealand, but markets’ attention has squarely been on the one anticipated with the US.

A trade deal could invite higher foreign investment once the trade policy becomes clear. A potential deal with the US has the caliber to reprice equities higher, depending on the quality of the outcome. While an average tariff rate close to 10% could be a positive surprise, a deal in itself has the potential to brighten the long-term economic outlook.

But clarity alone is not enough for equity performance. The deal’s substance would have to satisfy markets. Minimum requirements include better trade access for India compared with the median EM Asian country; lower trade barriers to India’s legacy sectors (e.g., agriculture); and support for emerging sectors (i.e., agreements on technological cooperation and free trade in key high-tech sectors).

Investment implications

The terror attack and the subsequent escalation in conflict imposed a significant risk premium on Indian assets. In contrast, a favorable US–India trade deal could help Indian equities outperform trend, support rupee stability, and ease geopolitical risk perception.

India’s medium-term economic prospects also look bright, with a consensus growth forecast of 6.4% and 6.7% YoY for FY 2026 and FY 2027, respectively. In May, inflation hit its lowest level (2.8%) since February 2019, which should help lower interest rates, rejuvenate consumption, and further aid growth. As such, inflation is expected to remain low, with consensus forecasts for FY 2026 indicating a range between 3.6% and 4.3% against a historical average of above 7%.