Making It Plain: Our Asset Stewardship Approach

Our Approach: Active Engagement with Our Portfolio Companies to Promote Long-term Value of Our Clients’ Investments

At State Street Global Advisors, we use a risk-based approach to identifying issues that we believe have the most material impact on the long-term value of our clients’ assets. We elevate outcome-oriented stewardship priorities each year based on factors such as market trends, financial materiality and portfolio impact.

As near-permanent holders of capital, it is our responsibility as fiduciaries to consider elements that may impact long-term value creation. Our asset stewardship program includes:

Corporate Engagement

- Engaging with companies on key challenges and opportunities pertinent to their region and industry

- Educating their boards and management on best practices

Proxy Voting

- Leveraging the exercise of our voting rights, which provides a meaningful shareholder tool that we believe protects and enhances the long-term economic value of the holdings in our client account

Corporate Engagement

We engage with companies to drive improved standards and disclosure around financially material risks and opportunities. Our experience in asset stewardship has provided us with important lessons on constructively engaging with companies.

Engagement versus Divestment

In our view as long-term holders of the companies in which we invest on behalf of our clients, divestment is not an adequate option for investors. Rather than divesting from companies, we believe that engaging with companies to optimize their operations and disclosures is the optimal strategy for mitigating risks posed to our clients’ investments, as well as capturing potential opportunities that may exist.

Our focus begins with governance, as we believe that strong, independent and effective boards of directors can better address the issues affecting long-term strategy. We use sustained, multi-year engagements to drive improved disclosure and standards and seek the long-term preservation of the value of the companies in which we invest.

We believe that our portfolio companies are best suited to understand what issues are most impactful for their business and, therefore, base our priorities for each portfolio company upon ongoing dialogue with company management and boards. Importantly, State Street Global Advisors does not maintain a firmwide divestment policy.

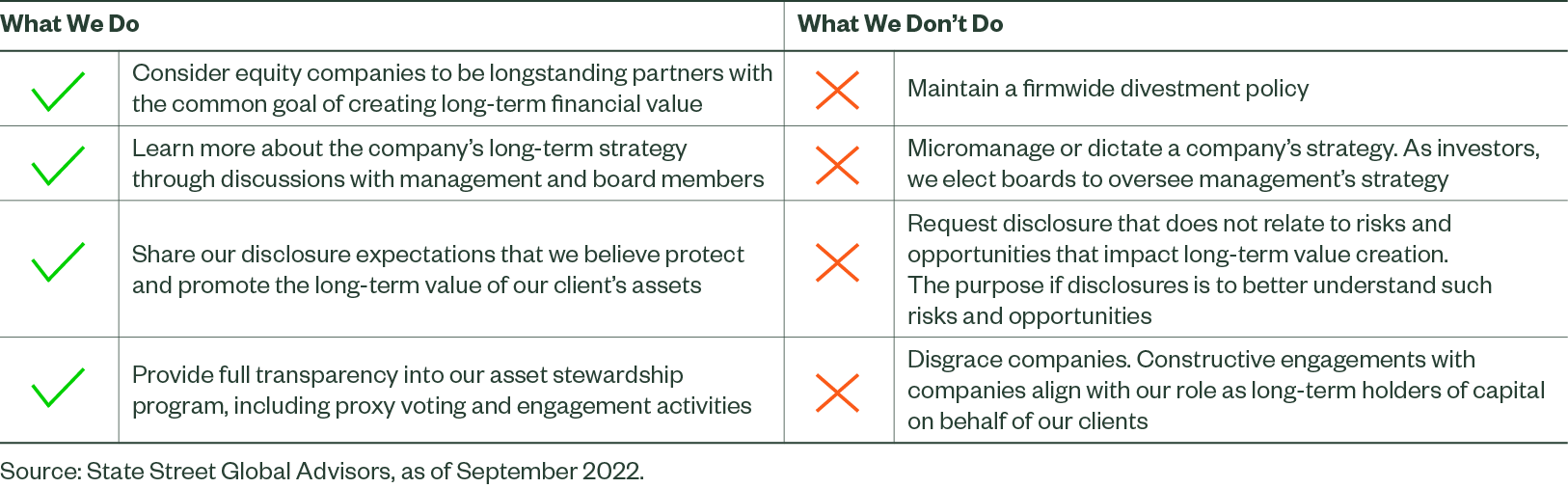

Figure 1 explains our approach to engagement.

Figure 1: Our Engagement Standards

Proxy Voting on Sustainability-Related Issues

As environmental, social and governance (ESG) factors have risen in importance to the broader market, State Street Global Advisors has seen a rise in shareholder proxy proposals related to sustainability issues. We consider sustainability-related shareholder proposals on a case-by-case basis and analyze many different factors to determine our approach. As such, we only vote in favor of sustainability-related shareholder proposals when we believe it is both reasonable and likely to maximize long-term value for our clients.

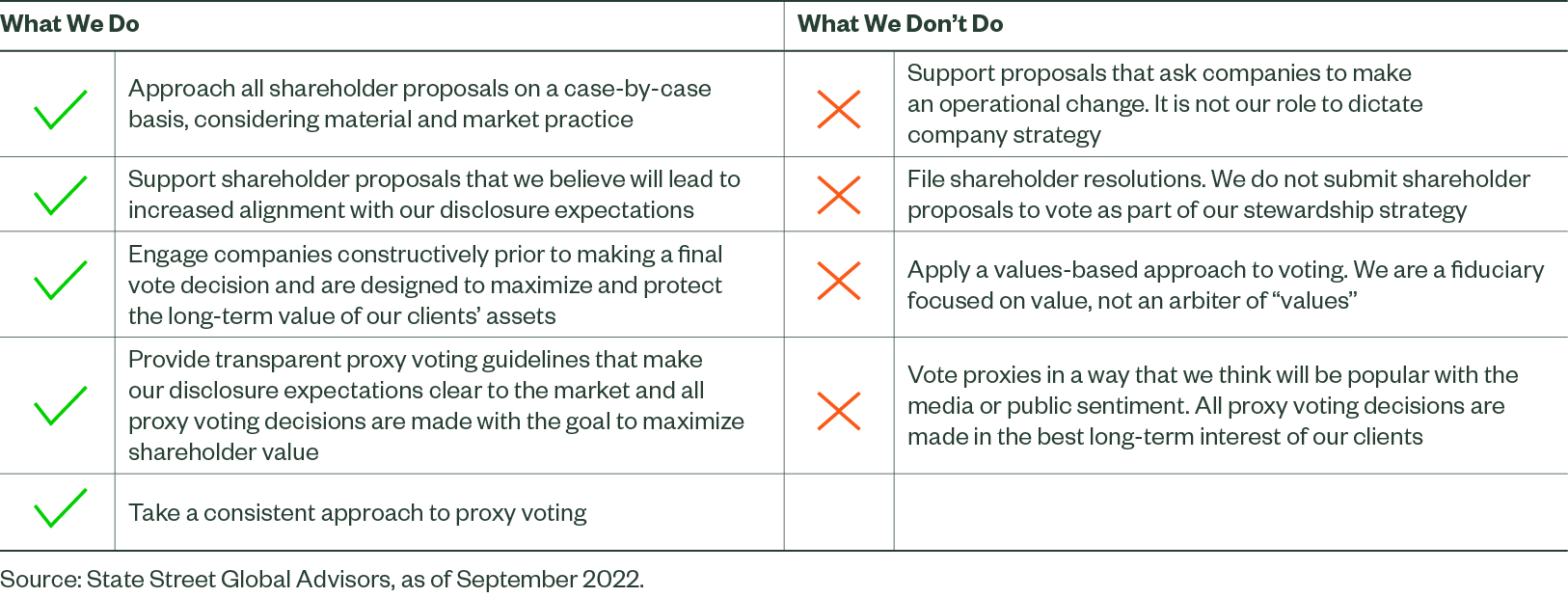

With this in mind, we will only consider supporting sustainability-focused shareholder proposals if they address an environmental or social topic we deem to be material to a particular sector. Figure 2 outlines our proxy voting approach, which is meant to help mitigate risks and promote long-term value creation.

Proxy Voting on Sustainability-Related Issues

As environmental, social and governance (ESG) factors have risen in importance to the broader market, State Street Global Advisors has seen a rise in shareholder proxy proposals related to sustainability issues. We consider sustainability-related shareholder proposals on a case-by-case basis and analyze many different factors to determine our approach. As such, we only vote in favor of sustainability-related shareholder proposals when we believe it is reasonable and will maximize long-term shareholder value for our clients.

With this in mind, we will only consider supporting sustainability-focused shareholder proposals if they address an environmental or social topic deemed to be financially material to a particular sector. Figure 2 outlines our proxy voting approach, which is meant to help mitigate risks and support business practices that create long-term value. Also see our CEO’s letter on our 2022 Proxy Voting Agenda.

Figure 2: Our Proxy Voting Standards

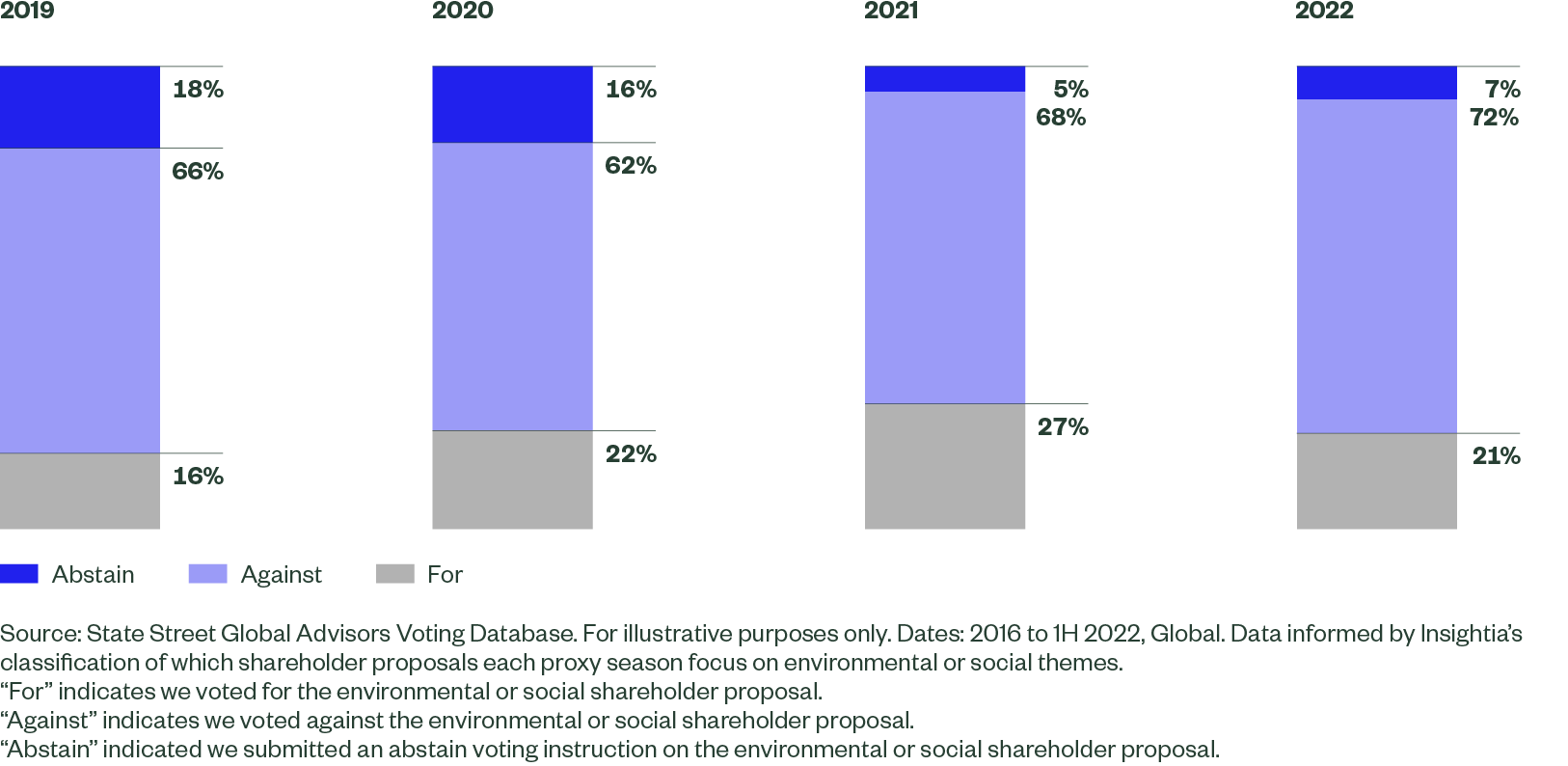

With respect to sustainability-related proposals, see our voting record in Figure 3. For environmental and social proposals, we consider the materiality of the environmental and social factors to the company’s business and sector, the content and intent of the proposal and a company's responsiveness to engagement, among other criteria.

Figure 3: State Street Global Advisors' Record on Environmental and Shareholder Proposals

Investor Choice

We are supportive of giving our clients greater choice around how their shares are voted. Today, clients invested through our separately managed account structures have the option to retain proxy voting authority over the securities held in their accounts that we manage for them.

State Street Global Advisors has made proxy voting choices (i.e., the proxy voting program) available to clients invested in certain commingled funds in the US and the UK, in which case a pro rata portion of shares held by the fund attributable to clients who choose to participate in the proxy voting program would be voted consistent with the third-party proxy voting policies selected by the client.

We are continuing to explore the possibility of providing investor choice to more products and client types.

Our Goal: To Be Constructive Partners With a Pragmatic Approach

As a long-term shareholder, we will continue to serve as a consistent voice to portfolio company boards and management teams. While we do believe there are benefits in boards considering the voices of long-term shareholders when weighing significant decisions relating to capital allocation and long-term strategy, it is the board’s role — and not investors’ — to determine that strategy.

For example, we believe it is appropriate for us as investors to share what metrics related to climate risk aid us in understanding companies’ exposure to climate transition risk. Conversely, we believe it is not productive for shareholders to micromanage strategy or dictate which assets should be divested. We have publicly shared our concerns of the unintended consequences of inappropriate investor pressure to divest fossil fuel assets.

Another example of how we approach our engagements with companies from a risk rather than an operational lens is our discussions with a pharmaceutical company that received a shareholder proposal asking it to suspend the manufacture of a specific product that was alleged to have carcinogenic properties. We did engage with the company to understand how it was managing the reputational, legal, and financial risks associated with this product. Ultimately, we did not support the proposal because we believe it is the responsibility of regulators — not investors — to determine what products are safe for human health and appropriate for consumer use.

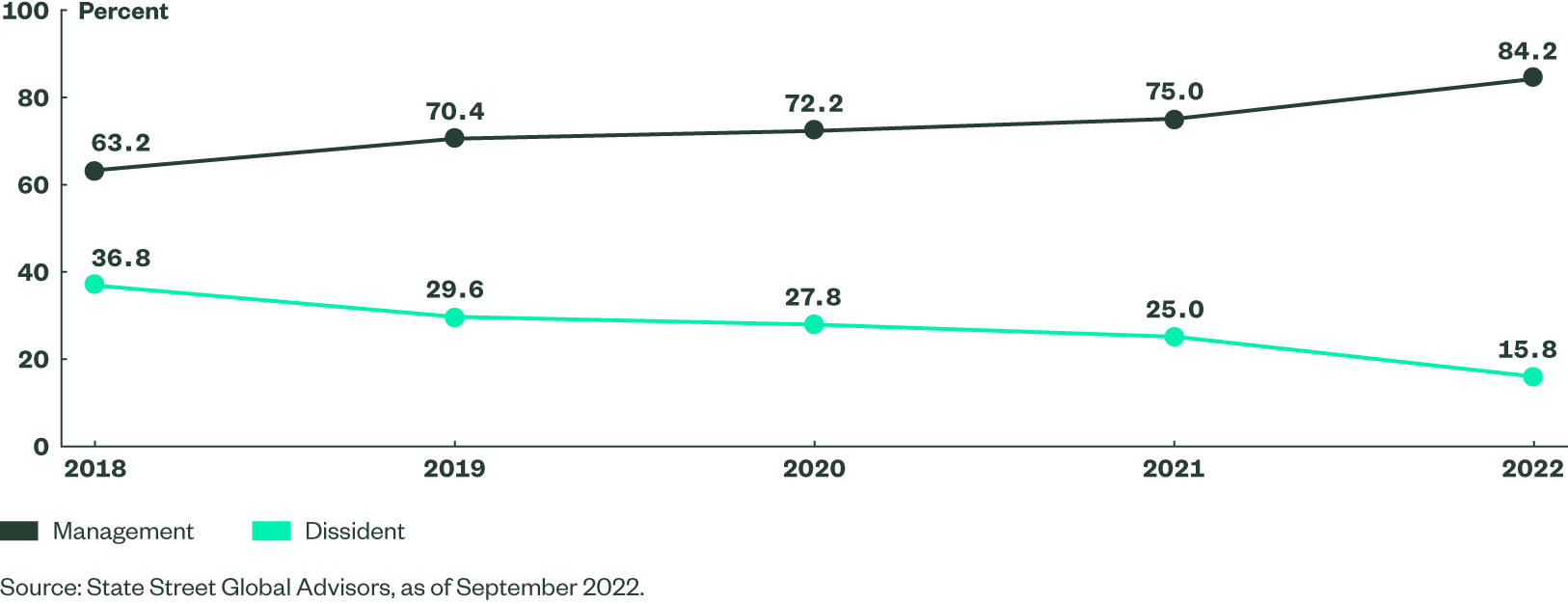

With many portfolio companies improving their shareholder engagement practices and approach to long-term material issues, our support for incumbent directors in contested elections has steadily increased over the last five years, reaching a new high in 2022, as seen in Figure 4. We will continue to foster constructive, long-term relationships with our portfolio companies and serve as a consistent voice to their boards and management teams.

Figure 4: Our Support for Incumbent Directors in Proxy Contests Has Risen

Our Support for Dissidents in Global Proxy Contests, 2017-2022

We are pleased to report that 2022 was a significant year for our corporate engagement activities, including 956 comprehensive engagements across 31 countries. For further information on our 2023 stewardship activities, see our website.

We look forward to continuing to advocate for our clients and to advise and engage with our portfolio companies on material issues that we believe can impact long-term value.