Guide to Using the Sector Momentum Map

The SPDR Sector Momentum Map provides investors with a quantitative approach for identifying how sectors are trending relative to their US, European and World benchmarks and sector peers. The Map serves to complement the fundamental and flows data featured in our quarterly Sector & Equity Compass.

Introduction to the Sector Momentum Map

The Sector Momentum Map (‘Map’) is powered by RRG® Research (as seen on Bloomberg Terminals). We are now in our second year of partnership with RRG to provide this sector rotation visualisation tool to SPDR clients.

The Map features relative strength and price momentum, which can indicate emerging opportunities and risks among sectors. Spotting the rotation of sectors in and out of favour can enable investors to anticipate money flowing from one sector to another and adjust portfolios accordingly. The benefit with this tool is seeing combinations across all sectors, neatly presented in one chart.

What the Map shows

The Map is built on two relative strength metrics:

- The JdK RS-Ratio measures trends in relative performance. This algorithm tries to find trends in the relative performance of each sector, comparing against the trends in relative performance of the other sectors in the universe. The comparison of relative trends across a universe is not always possible with traditional relative strength metrics.

- The JdK RS-Momentum measures the momentum of the relative trends detected by the RS-Ratio, again in a way that allows for comparison across a universe. Because rate of change is a leading indicator, it can serve as an early warning system for potential trend changes.

How to interpret the Map

The sectors generally rotate in a clockwise fashion around the centre (the market benchmark). Sectors in the top-right, or LEADING, quadrant are in a relative uptrend against the benchmark and that uptrend is being pushed higher by strong positive momentum. These sectors can be expected to outperform and could be relatively attractive for investors.

When a trend starts to deteriorate, this will be indicated by a loss of momentum, which will usually cause the sector to rotate into the WEAKENING quadrant. These sectors are still in a relative uptrend but their trends are losing momentum. This can be viewed by investors as a risk.

If that weakness continues, the sector will continue its rotation into the LAGGING quadrant. These sectors are in a relative downtrend against the benchmark and that downtrend is being pushed lower by negative momentum. These sectors can be expected to underperform the benchmark. The move that will signal change is an improvement in momentum, turning from negative to positive. That will cause the sector to rotate into IMPROVING. These sectors are still in a relative downtrend but are picking up positive momentum. Investors can interpret this as a relatively attractive opportunity.

If that improvement in momentum continues, the sector will usually rotate back into the LEADING quadrant.

Whereas the general pattern, as described, is a clockwise rotation, in strong up or down trends a rotation can complete on one side of the chart. Thus in the case of a very strong (and reliable) uptrend, rotations from LEADING into WEAKENING and then back into LEADING are possible. Conversely, strong (and reliable) downtrend rotations are possible from LAGGING into IMPROVING and then back into LAGGING.

Toggle the settings

Investors have several options for customising what they want to see on the Map:

- Universe: a choice of three regions is available – Europe, US, World/Developed Markets. SPDR offers sector ETFs in all three regions. A new “Overlay” option has been added, allowing the regional Maps to be viewed together.

- Frequency: the chosen timeframe can affect the RS-Ratio and result in different conclusions – a weekly setting captures the long-term trend, while daily captures a shorter trend.

- Securities: it is possible to view all or a selected number of sectors together to aid comparison of trends or to limit the scope for a clearer image.

- Settings: switching on Tails can allow the Map user to see where the security has moved.

A history of up to 12 months is available, which can be accessed by dragging the dark green bar toward the left.

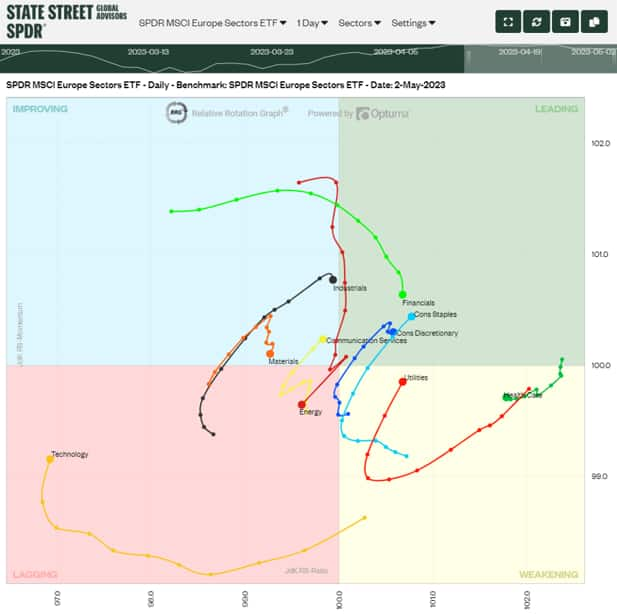

Example: Snapshot of European sectors across all 4 quadrants

Figure 1 shows sectors on the move on a day-to-day basis, with the Tails indicating the direction of travel over the previous 2 weeks. In this case, Technology is in an attractive position with improving relative strength and positive momentum, placing it in the LEADING quadrant, whereas Utilities is showing the opposite trend within the LAGGING quadrant.

Figure 1: Snapshot of European Sectors on Daily Basis over Two Weeks

Source: RRG. Snapshot taken on 3 April 2023. The chart is for illustrative purposes only.

Example: Rotation of US Consumer Discretionary & US Health Care

Figure 2 shows the path of two US sectors over a whole year from the start of April 2022, set on a weekly basis.

The chart of consumer discretionary depicts a full rotation. For the first 12 weeks, the sector was in the Lagging quadrant, which is not seen as a comfortable position. Improving Relative Strength Momentum and less negative Relative Strength took consumer discretionary into the Improving Quadrant in July 2022, acting as an early buying indicator for some investors.

The positive trends continued week by week into September 2022, taking the sector into Leading Quadrant, which would have been encouraging for long-only investors. Thereafter, there was a turnaround in momentum from positive to negative, with Relative Strength following, which may have unnerved sector fund holders. Following its quick move through Weakening in November 2022, the sector was back into Lagging. The cycle can be seen repeating itself since then.

While consumer discretionary is traditionally a cyclically sensitive sector, health care acts in a defensive fashion. As Figure 2 shows, the two sectors are often on opposite sides of the Map, reflecting how the stock market would treat the relative merits of these sectors.in different times.

Figure 2: Snapshot of US Sectors on Weekly Basis over 1 Year

Source: RRG. Snapshot taken on 3 April 2023. The chart is for illustrative purposes only.

To use the Sector Momentum Map, please click here .

To learn more about our broader sector ETF capabilities, please click here .

For up-to-date comments on sector positioning on the Map and how that fits with our fundamental views, please request to join the mailing list for Sector Talk by contact your local sales representative.