Q2 Investment Outlook

The first quarter of 2024 was a challenging one for fixed income as the market unwound the over-exuberance seen at the close of 2023. Short duration, higher yielding strategies were typically the best performers and, given the ongoing resilience in the US economy, it may make sense to consider the following exposures:

- High yield and convertible bonds, which have performed well so far this year

- Barbelling risk in European markets for a potentially higher yield than straight government exposure

- Emerging market hard currency, which has been more resilient than local currency, as we wait for the US easing cycle to begin

Q2 2024

Supportive Risk Appetite Benefits High Yield and Convertibles

- The bond market struggled in Q1 with duration weighing on returns. If growth remains firm and inflation slow to decline, opt for strategies that performed well in Q1 such as high-yield and convertible bonds.

The Q1 Bond Compass noted risks to bond markets in the early part of 2024 given the extremely strong performance seen at the end of 2023. But it has been a tough start to the year for bond investors, with the Bloomberg US Treasury Index returning -0.96% and Euro governments returning -0.65% year to date. The rather sticky path for US inflation and the seemingly continual upgrades to growth have been a tricky backdrop for fixed income investors to navigate. Market sentiment has now shifted substantially with the Fed Funds Futures now pricing just three 25 basis point (bp) cuts from the Federal Reserve (Fed) in 2024, in line with the messaging from the Federal Open Market Committee (FOMC).

This more moderate policy easing does make for a better risk-reward profile for bonds in Q2, but risks remain that growth will hold up. This creates a more favourable backdrop for risk assets, most notably equities. But for fixed income, two strategies have managed to perform well in 2024: high-yield and convertible bonds.

Resilient High Yield

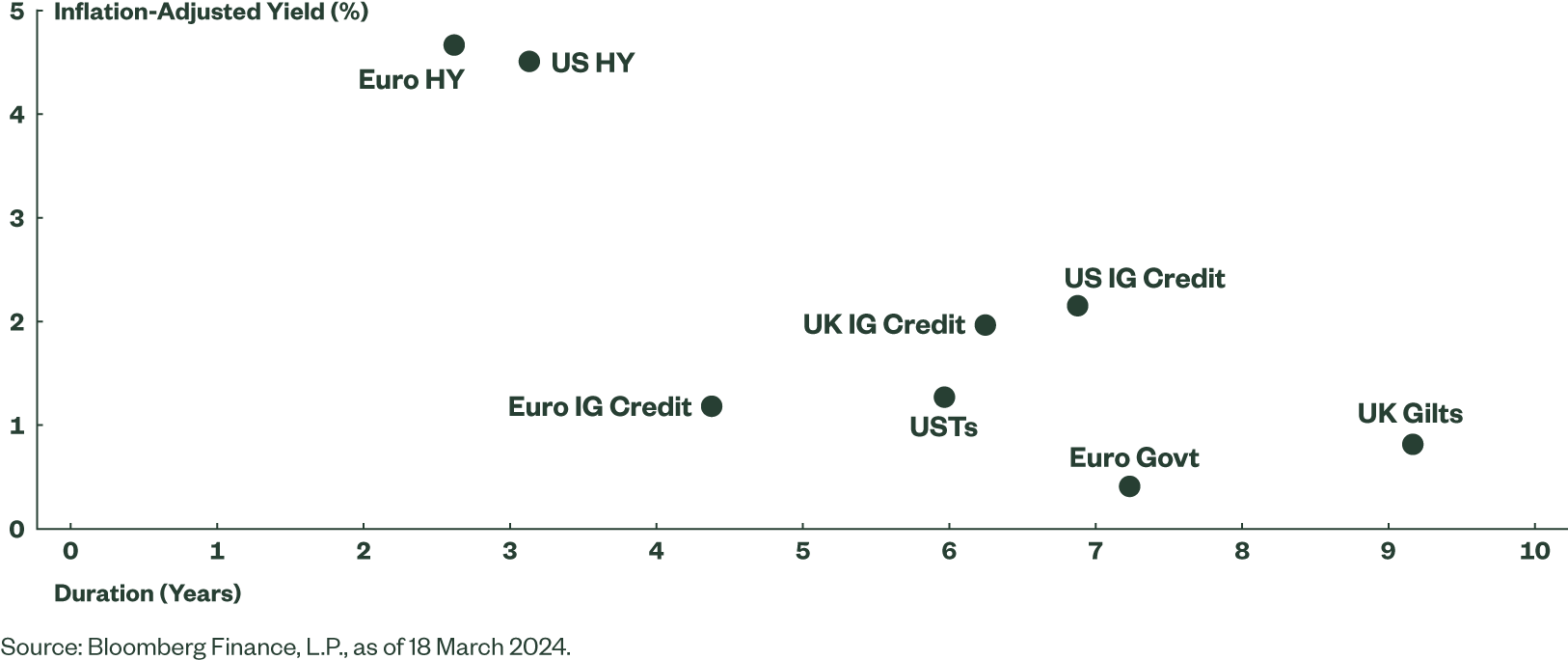

The performance of high-yield strategies has been driven by a combination of the high yield on offer coupled with generally short durations, making them less sensitive to rising market rates. Figure 1 shows the real yield-to-duration trade-off1 for various Bloomberg bond indices. By this measure, high yield is by far the most interesting.

Figure 1: Yield Versus Duration in Fixed Income Markets

Investors may be particularly interested in the defensiveness of the strategy. Dividing the yield by the duration provides an approximate breakeven rate for the indices, i.e., it gives some indication as to how high yields would need to rise for the price losses on the index to wipe out the index yield. These are at 270 bps for Euro high yield, an all-time high, and 245 bps for US. Markets would have to sell off significantly from current levels for the strategy to lose money.

The high coupon yield and relative price insensitivity of the underlying index have offset much of the impact of the rise in underlying Treasuries, and should remain supportive if growth and inflation do not fall quickly enough to open the door to central bank easing.

Convertibles Capture the Risk-on Mood

Year-to-date equity performance has left bonds in the shade, however convertibles have allowed bond investors to partially participate in this equity rally. The short duration profile of convertibles has provided some defence in the face of rising yields, but returns have been driven by the equity ‘option’ embedded in the convertible bonds. The broadening of equity market gains out of large-cap stocks should provide ongoing support to the issuer base which, for convertibles, is more typically classed as small and mid cap. The sector breakdown for convertibles is also constructive, being biased towards technology and communications, which have been strong performers2.

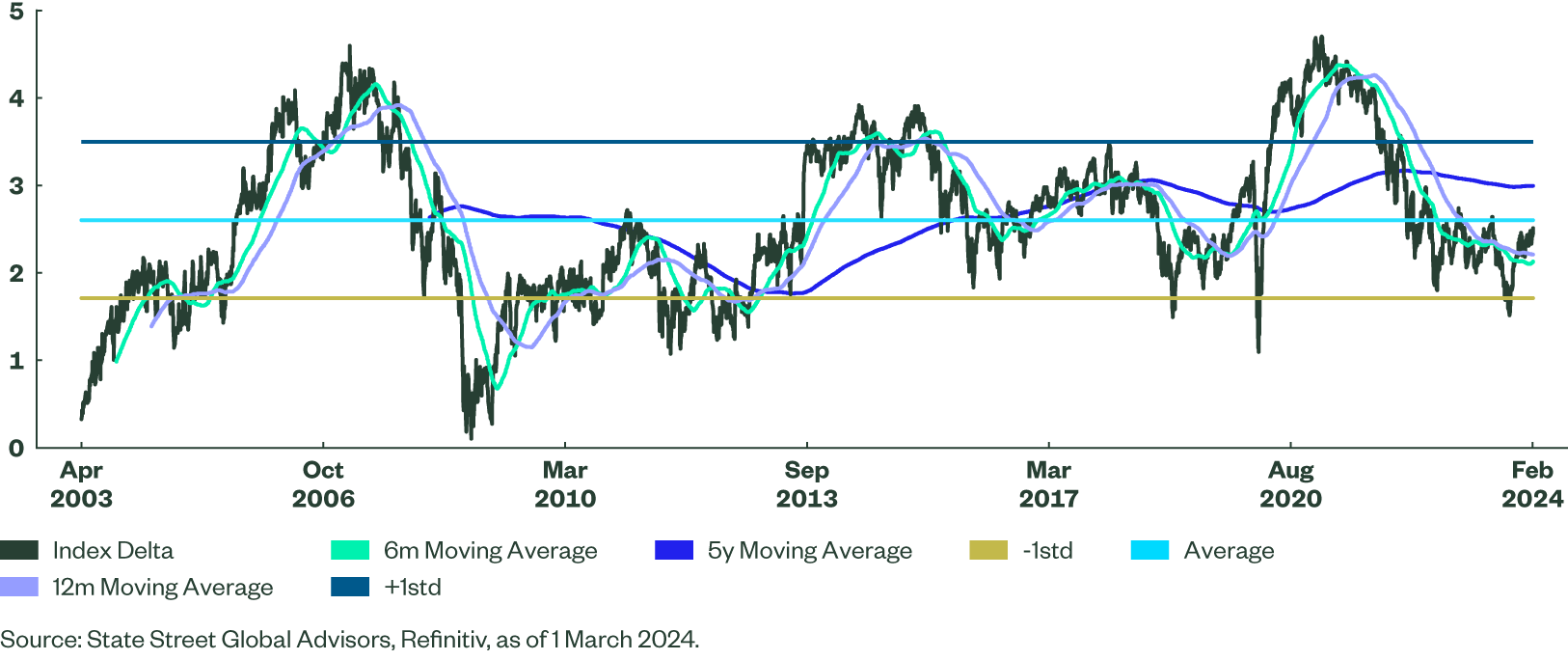

At around 45, the index delta (the price sensitivity of the index to the underlying equity) remains at low levels relative to its history. In the past, this level has been associated with strong positive performance in the following 12 months (Figure 2)3.

Figure 2: The Delta for the Refinitiv Qualified Global Convertible Index

Recession Concession

These two strategies could continue to perform better than either government or investment-grade (IG) funds if growth continues to outstrip expectations. However, they may be vulnerable if growth slows in a more material way. For high yield, credit spreads are currently quite tight and would likely widen. However, some of this would be due to falling government yields, as the market priced in more aggressive cuts from central banks. Given the historically high breakeven rates alluded to above, spreads would have to widen dramatically to push outright yields high enough to generate losses.

Convertibles, which consist of around 50% non-IG issuers, could also be vulnerable. The equity market reaction would be a key driver as more aggressive policy easing may be viewed favourably. Importantly, both strategies performed well in November and December, as falling inflation and a softening in growth saw central bank cuts come into view. However, the market moved to price a soft landing rather than a recession.

How to Play this Theme

Positioning for the ECB with the European Barbell

- Barbelling risk in European markets continues to appeal. It can provide a higher yield than just a straight government exposure for the same duration risk. There is also additional convexity, which can aid performance in the event that growth decelerates quickly.

The performance of both investment-grade (IG) corporate and government bonds was negative at the start of 2024. The correction from a rather rich looking market at the end of 2023 has been painful for bond investors, with government bonds in particular bearing the brunt of the re-pricing of central bank policy expectations. Narrowing credit spreads and higher coupons have provided some respite for those invested in IG exposures.

In our Q1 Bond Compass, we discussed barbelling risk for Europe: short-dated IG corporates provided yield coupled with long-dated government funds to add duration. Duration was aligned with the average duration of the underlying government bond markets, and performance has been better than for the all curve government strategies. In Euro, returns for Q1 2024 have been 62 basis points (bps) higher than for the all maturity government index. A similar barbell for the UK resulted in returns that were 73 bps higher. However, returns for both EUR and EK barbells have been lower that they were for an all curve credit exposure. A lot of this had to do with duration, as IG credit exposures typically have shorter durations then their government counterparts.

The question now is whether enough has changed to force a rethink of this positioning. Euro area growth remains weak and the Consumer Price Index (CPI) has fallen to 2.6% YoY, which has prompted the European Central Bank (ECB) to hint at potential rate cuts around mid-year. Around 25 bps of cuts are priced in for the June meeting and close to 90 bps for the remainder of 2024. With a cut potentially coming as soon as late Q2, it makes sense to stick to the barbell approach.

Government Bonds or IG Credit — Or Maybe Both

In the 2008-2009 easing cycle, government bonds clearly outperformed IG credit. Credit spreads blew out aggressively and positive returns did not materialise until the easing cycle had finished. Credit performed better in late 2011-2012, but even then, returns from European government bonds were marginally stronger. This may have resulted from the longer duration of the government strategy and the tendency for credit spreads to widen if a material slowdown is anticipated.

The downside of sticking to government exposures is giving up some yield. This can particularly hamper returns if the central bank is late to start the easing cycle. However, the short-dated IG exposure embedded in the barbell provides yield uplift of over 70 bps to government bonds. Couple this with a long-dated (10+ years) government exposure and you exclude the middle part of the curve, which is the low point for yields (around the 7-year maturity). When structured versus the Bloomberg Euro Aggregate Treasury Index, it provides an annual yield pick-up of 67 bps. This will support returns if the ECB holds off on rate cuts if, for instance, inflation does not fall back as projected.

Last, the long-end exposure adds in some convexity, with the barbell having over 25% more convexity than the all curve exposure. This may prove trivial for performance on market moves of a modest magnitude, but it buys protection in the event of a sharp slowing in the economy. The European economy is cruising close to stall speed, meaning any deterioration in growth momentum could force the ECB to act more forcefully. In this case, the additional convexity should support barbell returns.

Timing the Bank of England

Many of the same arguments above are applicable to the UK market. Growth has proved persistently weak, with the UK experiencing a technical recession in the second half of 2023. A more meaningful deterioration would significantly increase pressure on the Bank of England (BoE) to cut policy aggressively. Inflation has declined dramatically, with CPI undershooting expectations in February at 3.4% YoY. Even the BoE Monetary Policy Committee (MPC) is split on the timing of a cut, with one member already voting to cut rates. The market is less convinced of an imminent move and the first cut is not priced in until the August meeting.

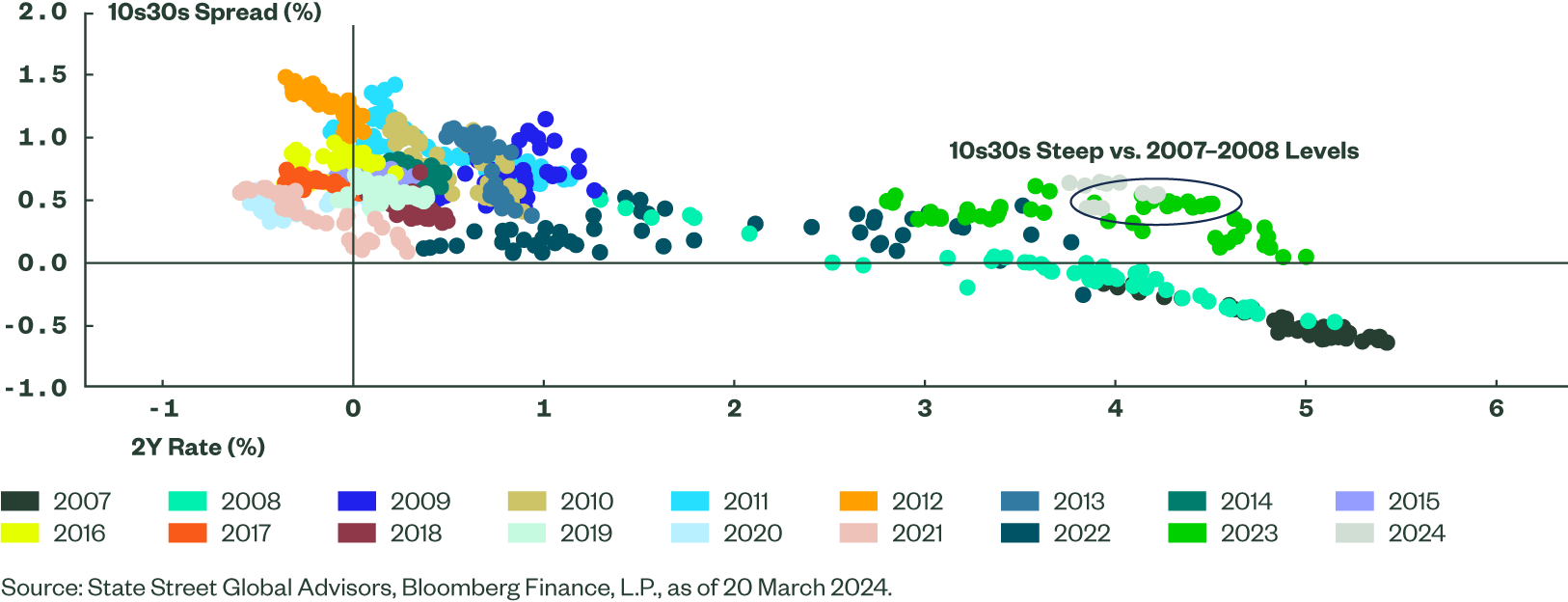

There is an additional reason to consider barbelling risk: there has been a material re-pricing of the long end of the UK curve. The 15-year forward gilt rate is close to 5%, near the top of its historical range. The absolute highs were at 5.36% in 2009, but it typically has not traded above 5% for any period of time. The term premium rebuild appears more advanced in UK markets, with the chart below showing how the 10-30-year spread is now far steeper than it was in 2007 and 2008, the last time that the 2-year gilt yield was at similar levels.

Figure 2: 10Y-30Y Gilt Spread Far Steeper in 2024 Relative to the 2Y Yield

How to Play this Theme

The Resilience of Emerging Markets Hard Currency

- Emerging market local currency debt has been buffeted by the strength of the US dollar and remains dependent on the path that the Federal Reserve takes. Hard currency has proved more resilient and, while spreads are tight, may continue to provide better returns until the US easing cycle is underway.

A theme in the Q1 Bond Compass was emerging market (EM) local currency exposure. But the strong performance seen in Q4 2023 did not continue, and EM local currency instead closed the first quarter with negative returns. Rising US interest rate expectations have had the double impact of pushing US Treasury yields higher and supporting the USD. While local currency bonds will primarily be influenced by domestic factors, they are less attractive if yields on US Treasuries are high. Attribution for the Bloomberg Emerging Markets Local Currency Liquid Government Bond Index over the first quarter shows that price returns were -0.5%, but the far bigger impact came from the USD with currency returns of -2.79%. This was partially offset by strong coupon returns of 1.2%4.

It is clear that the Federal Reserve (Fed) is very much in the driver’s seat when it comes to EM debt returns. The six-month correlation of returns between EM local currency and Treasuries is over 80%, which is historically high. While the USD remains over-valued on the State Street Global Advisors long-term measure of fair value, it seems unwise to assume a reversion to fairer levels given the resilience of the US economy.

Hard Currency Has the Edge

Expectations for the first 25 basis point (bp) cut by the Fed have shifted from March 2024 (as priced at the end of December 2023) to July 2024. Despite this substantial re-pricing, hard currency exposures proved resilient with the J.P. Morgan EMBI Global Diversified Index returning over 2% in the first quarter5. High coupon returns and spread tightening have supported performance; if the economic backdrop remains similar in Q2, opting for hard, rather than local, currency exposures may make sense.

The counterpoint is that spreads to Treasuries are historically very tight. This is the case for most spread products and hard currency bonds are no exception. To some extent, the risks from spread widening are mitigated by the high absolute yields on offer. This can certainly provide protection, especially if investors opt for shorter-duration exposures.

Figure 1 shows the breakeven spread for the ICE BofA 0-5 Year EM USD Government Bond ex-144a Index. The high yield on offer of over 5.6% coupled with the relatively short duration of 2.26 years means that yields would have to rise by around 250 bps for the price losses on the index to wipe out the annual yield. While it is possible that spreads could start to blow out if the US economy starts slowing, this should, in part, be driven by falling US Treasury yields as the market prices a more acute easing path from the Fed. Unless accompanied by a rise in market risk aversion, overall yields on hard currency bonds could still decline if underlying Treasury yields fall.