Q1 bond market outlook for ETF investors

Carry, flexibility, and diversification in fixed income’s uncomfortably bullish market

- Central bank policy disparity has created diverse opportunities. Policy and fiscal easing support continued US growth, but we prefer the UK’s short end. Europe’s rate trough supports carry trades.

- Risks to the global economy and yield compression underpin diversification into emerging market debt and convertible bonds.

Approaching the neutral rate

- Central bank policy divergence has created diverse opportunities for fixed income investors. In the US, extending duration into the belly of the curve makes sense. We maintain a preference for the defensiveness of the short end in the UK.

In Q4 2025 we advocated for a modest increase in duration risk, targeting the belly of the curve. This approach remains appropriate as the rate cycle nears its conclusion.

Our latest Global Market Outlook anticipates three Federal Reserve (Fed) 25 basis point (bps) cuts in 2026, driven by labour market weakness and an improving inflation picture. This is more than current market pricing — 60bps — and would take the Fed funds rate down to around 3%. This is close to estimates of the US economy’s neutral rate. This will likely mark the bottom of the interest rate cycle.

US: It’s better to travel than to arrive

Bond markets’ best returns historically have come during policy easing cycles. The likelihood of only a limited number of additional cuts should heighten the emphasis on duration exposure. A steepening curve in reaction to higher inflation and higher issuance concerns made duration management tricky in 2025. However, there are several advantages to moving slightly longer:

- Enhanced return potential: Price gains from slightly longer duration strategies can enhance returns. For example, moving from the 3-7 year into the 7-10 year Treasury maturity bucket increases duration by 65%. This increases risks of negative returns if yields rise, but the recent drop in market volatility1 should reduce fears of a sudden yield spike.

- Yield profile: The steep US Treasury curve implies that longer maturity exposures could improve the yield profile. Again, switching from the 3-7 year into the 7-10 year Treasury bucket increases yield to worst by 35bp.2

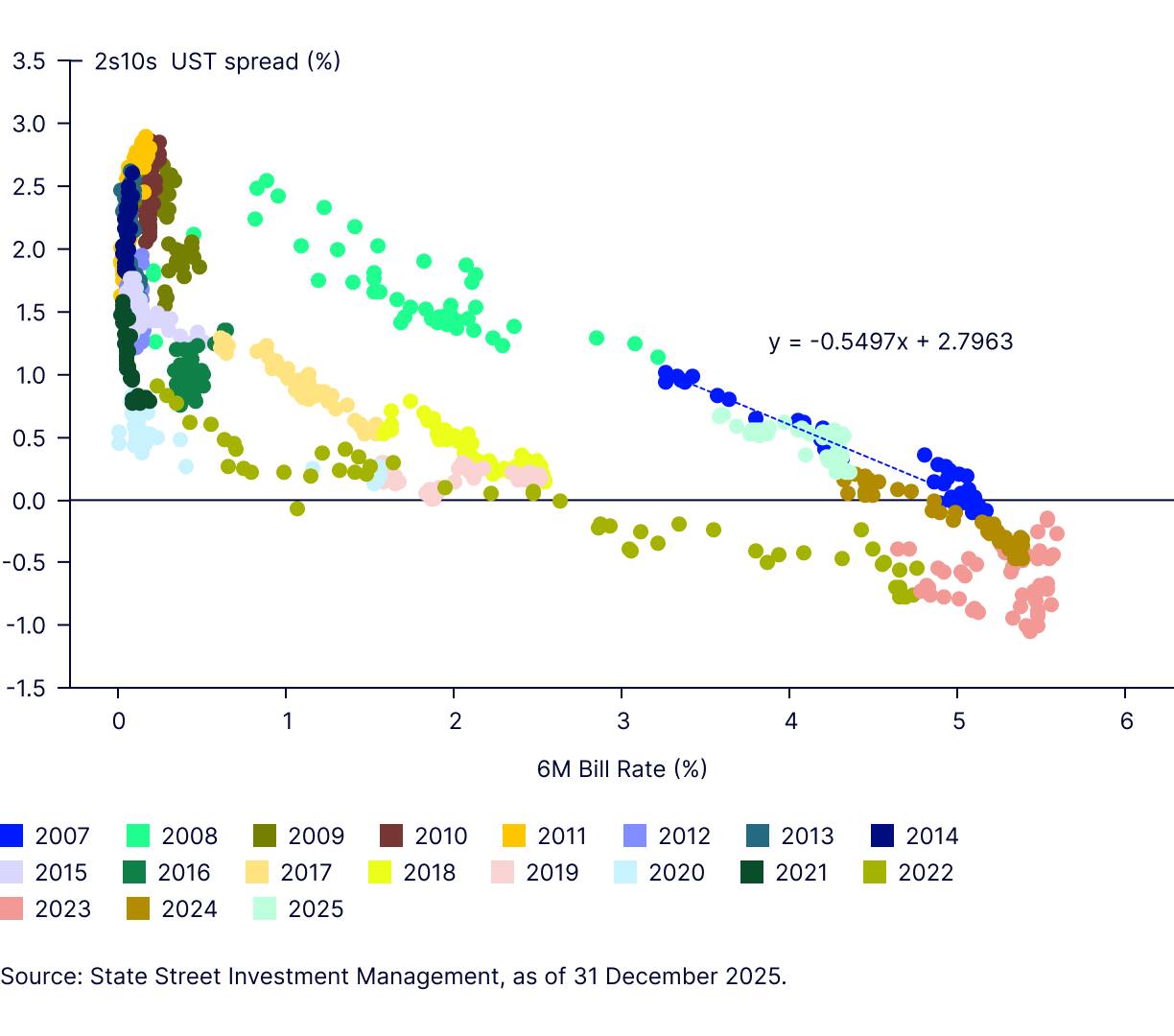

- A more stable curve: There is less reason to fear curve steepening in 2026, because the curve — particularly the belly — is already relatively steep. The 2–10 year spread relative to the 6 month bill rate already has returned to levels consistent with pre Global Financial Crisis norms, indicating that much of the term premium rebuild out to 10 years has already occurred (Figure 1). This is also reflected in the 5 year forward 5 year Treasury yield, which incorporates both yield levels and curve steepness. By the end of 2025, it stood above 4.75%, and history suggests it rarely sustains moves above 5% for long.3

- Inflation expected to edge lower: This reduces one argument for a rise in term premium. Issuance remains a concern but would be more likely to impact the long end of the curve rather than the belly.

Figure 1: The 2-10 year slope versus the 6M bill rate

UK: Destination unknown

The outlook for the UK is unclear. The Bank of England (BoE) cut rates in December as growth slowed and inflation undershot expectations. CPI remains well above the BoE’s 2% target and should decline in 2026 — but that’s not a given. The market expects only about 40 bps of cuts. The implied 3.3% would be above the neutral rate of interest for the UK economy.

Given this uncertainty, maintaining front-end allocations is prudent. The Bloomberg 1-5 Year Gilt Index yields 3.77% and ranged 3.7 to 4% since Liberation Day. It won’t be swayed by supply concerns, unlike longer maturities, and offers a strong yield per unit of duration of 145 bps, compared to arounds 50 bps for the broader Bloomberg Sterling Gilt Index.4

Seek Diversification

- Macro risks may weigh on traditional core markets, as a result diversifying sources of return may help add resilience. Convertible bonds may continue to perform in a risk-on market backdrop. Emerging market debt can reduce sensitivity to moves in the US Treasury market.

The resilience of the US economy has slowed the Federal Reserve’s (Fed’s) rate cuts. State Street Investment Management expects 2026 will see growth strengthen assisted by the tailwinds of previous rate cuts and supportive fiscal policy. But a K-shaped economy — a top half growing strongly, a struggling lower half — implies a wider dispersion of potential outcomes. Diversifying from traditional core holdings of government bonds and credit to satellite holdings may be prudent.

If the upper leg of the K-shaped economy continues to dominate, growth will likely remain strong, driven by tech and AI growth, and the investment environment will continue to look a lot like 2025, with convertible bonds performing strongly. The high exposure to technology (23.2%) and Telecoms (6.1%) helped deliver a 25.5% return for the FTSE Qualified Global Convertible Index in 2025.5

There are risks as the equities rally looks extended. The FTSE Qualified Global Convertible index delta — sensitivity to equites — reached 55.6 at the end of 2025, compared with 45.3 at the end of 2024. This creates risks if equites decline. Tight credit spreads suggest that corporate bond holdings would also suffer.

On a calendar-year basis there appears to be a returns asymmetry (Figure 1). Convertible bonds tend to move directionally in line with the global aggregate index, but they have significantly outperformed in positive years. Years with negative return have delivered a more mixed performance.

The FTSE Qualified Global Convertible index has a crossover rating profile, meaning returns should be higher but more volatile than investment-grade bonds over the long term. However, if investors expect the favourable equity backdrop to persist in the early part of 2026 and that bonds will remain relatively stable, then convertibles can continue to offer strong return potential.

EM debt offers geographical diversification

Downside risks to US growth emanate from the lower leg of the K-shaped economy hampering growth, which would widen credit spreads. Exposure to this risk can be lessened through geographical diversification through Emerging market (EM) debt.

The Bloomberg EM Local Currency Liquid Government Index returned 16.65% in 20256, and many supportive factors persist:

- US currency weakness: The dollar depreciated substantially in H1 2025, with more stability in the second half. State Street Investment Management’s fair value model still implies an 8% overvaluation versus the currencies that make up the Bloomberg EM Local Currency Liquid Government Index. US growth weakness would herald more easing by the Federal Reserve, and further undermine the USD.

- Bond return potential: Coupon returns may remain strong (5.3% in 2025). There is also scope for EM central banks to cut rates further. Real interest rates (the central bank rate minus local CPI) remain relatively high at close to 2.9% versus just over 1% in the US.7 High real rates signal that policy is restrictive.

- Low Treasury correlations: The fate of local currency bonds is often tied to the actions of the Federal Reserve and moves in the US dollar: the most recent trend has been for decoupling. Figure 2 shows the correlation between the returns of the Bloomberg EM Local Currency Liquid Government Index and the Bloomberg US Treasury Index. Correlations trended lower during 2024 and into 2025.

Implementation Ideas: