Ireland Snapshot

While we are settling on a new normal after the COVID-19 pandemic, Defined Contribution (DC) savers are contending with more challenges than ever before: inflation, sharp cost of living increases, the impacts of the Russia-Ukraine War, and political instability. Our Global Retirement Reality Report looks at insights from 3,553 DC savers around the world to see if they are staying the course with their retirement savings strategies and which retirement systems globally are more robust to these headwinds. In this snapshot, we discuss the findings from Ireland and compare the results to our 2020 surveys.

Key Findings

In this year’s Global Retirement Reality Report, our Irish respondents showed a lack of confidence in their retirement prospects driven by inflation and the cost-of-living crisis. Despite this gloomy outlook, it was positive to see that the majority of savers had not made changes to their contribution rates.

In a post-COVID reality, flexibility when it comes to work and retirement is becoming more desirable. The abolishment of the mandatory retirement age in Ireland will be an important step to allow members to fulfill these expectations.1

Respondents showed an expectation for their investments to be sustainable but did not want to compromise returns or risk management.

Below, we share six key findings that can help further inform the automatic enrollment plans in Ireland.

Key Finding #1: Retirement Confidence is Falling with Almost Half of Irish Savers Not Optimistic About Retirement

Close to half (46%) of Irish savers surveyed reported they were not optimistic about being financially prepared for retirement. This is a slight deterioration in outlook since May 2020, when we asked the same question.

Against a backdrop of Brexit, the Russia-Ukraine War, political instability, and the fallout from COVID-19, it is not surprising that Irish savers are low-spirited about their futures. Digging further into the reasons behind the lack of confidence, most common answers were:

- Inflation and the cost-of-living crisis

- No spare money to save for retirement

Key Finding #2: Despite the Gloomy Outlook, Most Will Not Make Changes

Perhaps driven by market volatility, 29% of Irish savers reported to have checked their balances more regularly over the past six months. While it may be concerning to see a notoriously unengaged population of savers paying closer attention to short-term fluctuations in pension balances, it was positive to see that most (62%) had maintained their contribution rates over the past six months.

While only a minority (13%) of Irish savers had reduced their contributions over the last six months, this is notably higher than their UK counterparts who are already captured within an auto-enrollment system.

The data suggests that contribution rates are relatively unaffected by what happens in the economy in the short term, but greater automation could increase the commitment to contribution rates.

Key Finding #3: Flexibility is Needed to Facilitate the New Retirement

COVID-19 has changed the way that people work and view its balance with home life. After the peak of the pandemic, many changed jobs (or careers), joined the gig economy, left the workforce, or changed their working patterns. We asked if this shift, known as “the Great Resignation,” has changed outlooks on how and when people might retire.

We asked members if this trend had changed their retirement outlook and 29% of Irish savers stated it had. In addition, 27% said they only expected to partially retire, but continue doing some work.

We gave respondents the opportunity to provide more explanation on how they expect their working lives and retirement to change:

“During the pandemic, I revised my pension schedule with a view to early retirement.”

- Female, Ireland, Aged 45-54

“Life is too short after the pandemic. WFH really made me realize that. Leaving my full-time job this month to take time off before possibly looking for a part-time job in 2023.”

- Female, Ireland, Aged 45-54

Many predict that over time, the “traditional” retirement taking place as a cliff edge at some point in a member’s 60s will become less prevalent and a phased transition into retirement will become more common.2 When asked what supports would need to be in place to facilitate longer working lives, the most popular answers were:

- Offer flexible working arrangements (47%)

- Ability to phase to part-time hours (30%)

Up until recently, a phased retirement has not been available to many workers in Ireland due to the mandatory retirement age. We are pleased to see the Employment Equality Bill 2022,3 which looks to abolish the mandatory retirement age and expect this to help provide further opportunity for phased retirements.

Key Finding #4: The First Stage of Retirement is Causing the Most Worry

When asked about which stage of retirement people are most concerned about budgeting, survey results showed that the first stage of retirement (age 65-80) was front of mind.

Figure 3: At What Stage of Retirement Are You More Concerned About Budgeting to Ensure Your Savings Last a Lifetime?

This may be partly driven by the current cost-of-living crisis and larger than normal expenses (referenced in key finding #1). When asked what people were concerned about when it comes to planning for retirement, people were more concerned about significant expenses (41%) than outliving their savings (16%).

Key Finding #5: Time to Rethink Income in Retirement?

Looking to the future, once auto-enrollment gains traction and more savers enter retirement with sizeable DC pots, members may require more support in converting a lifetime of saving into an income in retirement. This is a trend that has been observed overseas in the US, Australia, and the UK, where retirement income solutions are increasing in popularity.

From our Irish sample:

- Close to one-third (29%) worry about not being able to generate a consistent income stream in retirement.

- 78% would value a source of regular income (e.g., an annuity) offered through their employer.

With annuity rates increasing in correlation with bond yields, could guaranteed income products increase in popularity and help members address their budgeting concerns? While nearly half of members don’t know what an annuity is, only 23% think they don’t represent good value for money and 28% think they have a bad reputation.

When asked about the use of guaranteed income in retirement, almost a third (32%) have preference for a stable retirement income that lasts a lifetime. However, the majority (40%) preferred a hybrid approach.

With a strong advisor presence in Ireland, many Irish savers (66%) said they would value a solution from their financial advisors that provides an income in retirement. The use of advice also allows opportunity for greater personalization of post retirement solutions.

Key Finding #6: ESG is Important, but Returns Are the Priority

The Climate Action Plan launched by the Irish government in 2021 plans to put Ireland on a more sustainable path, cutting emissions, creating a cleaner, greener economy and society protected from the devastating consequences of climate change.4 In order to help work toward these goals, pension schemes are beginning to adopt their own climate and carbon reduction goals for their investment portfolios. But do members also place importance on sustainability?

Over half (53%) of the Irish members surveyed said that sustainable investing in retirement savings was important and over half (51%) agreed that it should be incorporated into their pension schemes on their behalf as standard.

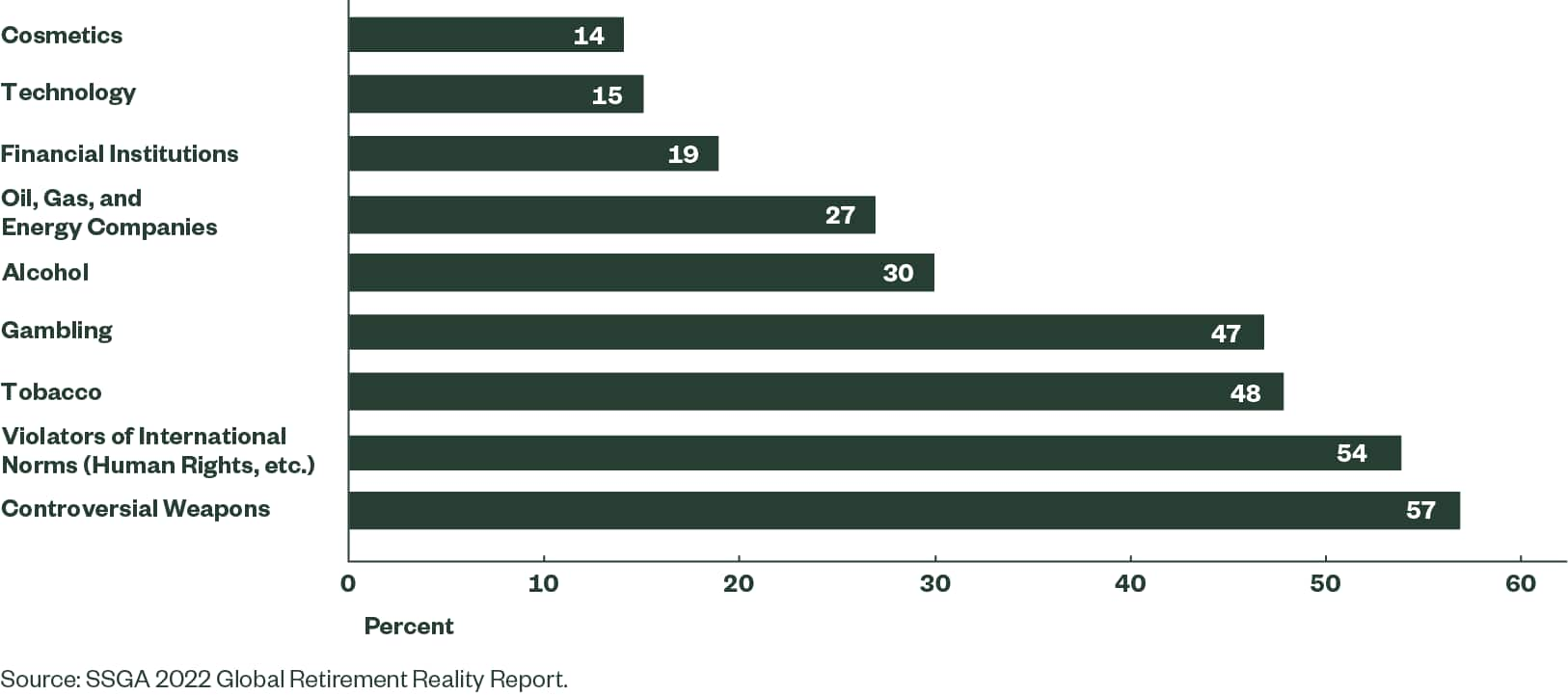

Forty-nine percent of Irish savers expressed a preference for picking investments based on the issues that matter most to them. While sustainable investing can be achieved through a variety of tools, front of mind for many savers is the exclusion of particular companies or sectors. When asked which areas they would not want their pension savings invested in, controversial weapons and violators of international norms were the most popular answers:

Figure 6: Which Sectors Would You Not Want Your Pension Savings Invested in? Please Select All That Apply

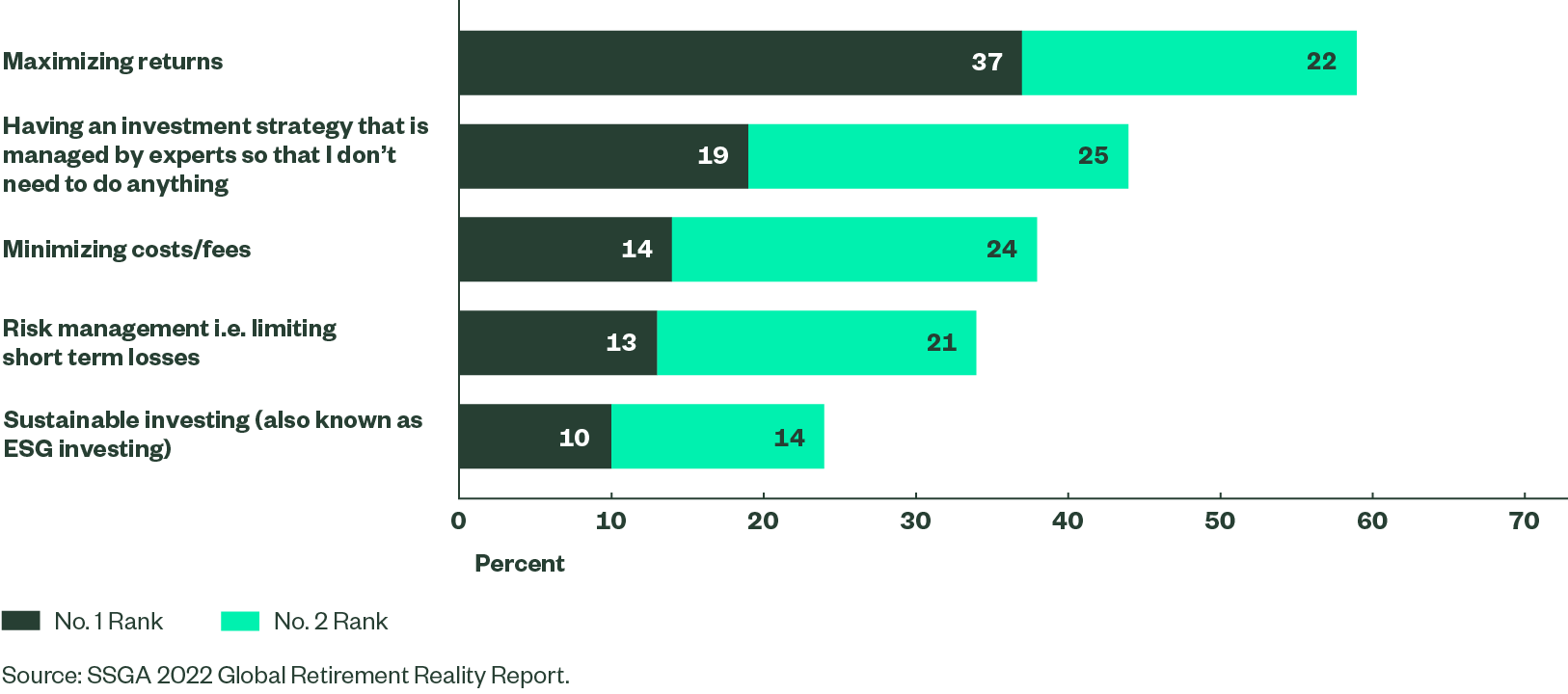

However, when asked to rank priorities for their investments, maximizing returns was most important to members. Trustees may therefore choose to look at how ESG investing can help manage risks and present these considerations in their member communications.

Figure 7: Please Rank the Following Priorities for Your Pension Investments

Closing Thoughts

With only 47% of Irish workers saving for their pensions,5 we are pleased to see the plans for the introduction of auto-enrollment moving forward. The results of our Global Retirement Reality Report provide some important learnings for the design of the new system:

- Member confidence is low, fueled by inflation and the cost-of-living crisis. While auto-enrollment is an important step to build confidence and retirement readiness of workers in Ireland, policymakers should be sensitive to the current economic situation and the fact that many individuals are facing much higher outgoings. In light of this, we support the proposed conservative starting contribution of 3% (1.5% employee and 1.5% employer) in the first three years of auto-enrollment.

- Most members surveyed who are already saving in a DC plan have not altered their contributions in response to recent global market events. Further comparison with the actions of UK members showcases inertia in action. Auto-enrollment will be an important step for getting more people consistently saving into a retirement plan.

- The removal of the mandatory retirement age will support greater flexibility in retirement (e.g., phased retirement, part-time work), which is not only desired by members, but will also support longer working lives, allowing members more time to build up savings for retirement.

- Solutions providing members with an income in retirement will become increasingly important as DC pots grow relative to other income sources. While many DC members currently have access to financial advisors who can help provide personalized retirement income strategies, there may be a need for solutions to be provided through the Central Processing Authority as DC coverage increases. These solutions could provide stability in retirement through the use of guaranteed income or annuities.

- Savers expect ESG to be incorporated within their investments on their behalf. Policymakers should consider the extent to which ESG can help manage risks within the investment options.

Survey Methodology

State Street Global Advisors commissioned global analytics firm YouGov to conduct an online survey across four countries, representing a range of retirement systems. The goal of the 2022 survey was to monitor retirement sentiment and compare trends across 2020, 2019, and 2018 datasets. YouGov surveyed 3,553 individual savers with access to employer-sponsored defined contribution plans between July 20 and August 22, 2022.

Region | Number Surveyed |

Australia | 618 |

Ireland | 607 |

United Kingdom | 1,180 |

United States | 1,148 |