The Role of Bank Regulations in Repo Market Disfunction

The supply-demand mismatch in money markets garnered considerable attention this past September. We view the volatility having more to do with a lack of willingness or ability from banks to intermediate than a lack of cash in the system.

A temporary supply-demand mismatch for cash in money markets garnered considerable attention this past September. While the accompanying volatility was severe with repurchase agreement (repo) rates spiking to nearly 10% during intraday trading (Figure 1), it had more to do with a lack of willingness or ability of banks to intermediate than a lack of cash in the system. Simply put, banks were reluctant to reallocate into the repo market from reserves, due to liquidity regulations or to borrow from wholesale markets to lend into the repo market, due to capital regulations. Regardless of potential changes to monetary policy, we believe ensuring banks will be quicker to use their balance sheets and mitigate future funding mismatches will require changes to regulations. Improving repo market efficiency can be accomplished without compromising the resiliency of the banking sector.

Much Different Than 2008

September’s intraday repo market volatility drew similar headlines to 2008, yet the underlying circumstances could not have been more different. Rather than pervasive concerns around collateral values and counterparty credit risk, as was the case in 2008, September’s price action was driven by a handful of foreseeable and temporary factors impacting the supply and demand of cash. Though these episodes are similar in that banks hoarded liquid assets, the primary concern this fall was remaining in compliance with the myriad of post-crisis regulations and not lending to the wrong counterparty. This hindered intermediation in even the most liquid short-term funding markets, but the happenings were far from a Lehman Brothers moment.

Why Didn’t Banks Jump In?

If short-term cash markets had been efficient and rational in September, banks holding $1.45 trillion in reserves at the Federal Reserve (Fed)1 would have jumped at the opportunity to reallocate into a liquid, low-risk, substitute such as repo backed by Treasury collateral. Not doing so indicates that bank reserves, which are not scarce in the context of pre-crisis monetary policy (variance of only $25 billion relative to pre-crisis levels), have become scarce in the context of post-crisis liquidity regulations. While this volatility is not particularly new, as money market investors have seen regulatory-induced dislocation on display at critical quarter- and year-end time periods for some time, reserves reaching their lowest comfort level have exacerbated these challenges.

Challenge 1 — Liquidity Rules

Why Banks Did Not Re-Allocate out of Reserves?

Investors have familiarized themselves with public liquidity regulations under Basel rules including the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR), yet these ratios did not appear to be binding in limiting banks from participating in repo markets. LCR presented no hurdle for substitution, as both reserves and Treasuries are treated equivalently in the numerator as high-quality liquid assets (HQLA), while the NSFR has yet to be adopted or proposed in the United States2. Rather, it appears non-public liquidity requirements were more binding, including:

- Non-Public Stress Testing The Fed’s Comprehensive Liquidity Analysis and Review (CLAR) is used to assess bank liquidity adequacy. CLAR evaluates liquidity through a range of metrics and through analyzing of firms’ internal stress tests.3 This process happens behind closed doors is very much a “black box” for investors. An important consideration of CLAR is intra-day or “day 1” liquidity needs under an internal stress test, which some estimate to be at least $800–$900 billion4. Regulators appear bias towards reserves as a liquidity source to meet non-public stress testing.

- Resolution Planning Large US banks are required to file resolution plans which must describe the company’s strategy for rapid, orderly resolution in the event of material financial distress or failure. The plan contains both public and confidential sections.5 As part of these plans, the banks must pre-position high quality liquid assets at various subsidiaries to withstand a severe stress event, known as Resolution Liquidity Adequacy and Positioning (RLAP). They must also account for the estimated liquidity needed post-bankruptcy to support the surviving or wind-down subsidiaries, known as Resolution Liquidity Execution Need (RLEN). Once again, reserves appear to be the preferred liquidity source of regulators.

Key Takeaway Anecdotally, evidence suggests that regulators assign a higher monetization assumption on reserves relative to Treasuries for internal stress testing and resolution planning purposes, forcing banks to maintain higher balances.6 While treating reserves differently than Treasuries runs counter to the way these assets are viewed under the LCR, regulators likely prefer reserves since they can be used to make payments of unlimited size instantly as opposed to converting a large amount of Treasuries into cash which this takes time, may not be doable intra-day and can have a market impact7.

Challenge 2 — Capital Rules

Why Banks Would Not Borrow to Intermediate?

New capital regulations have coincided with changes to binding capital constraints, making capital more expensive and scarcer. Under post-crisis rules, banks seek to use all capital that is always available to optimize returns. Negatively, capital cannot be as efficiently deployed if a dislocation hits.8 As it relates to repo markets, some of the most impactful changes post-crisis include:

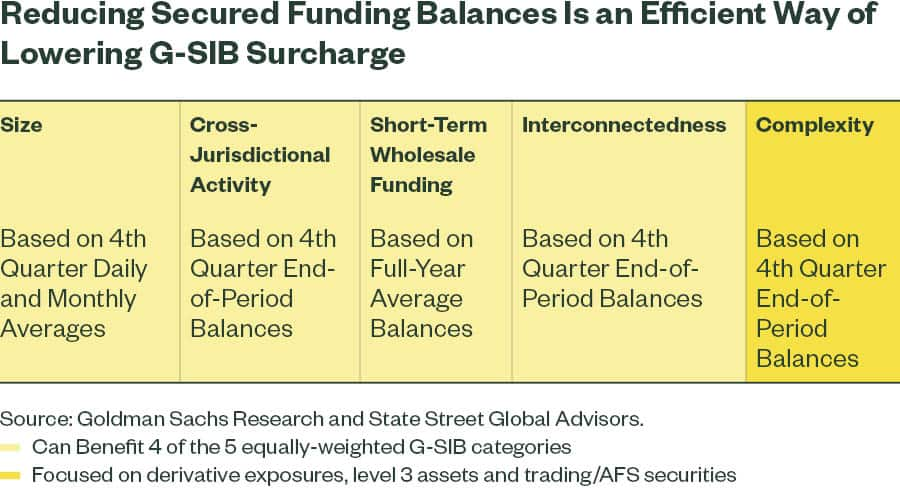

- G-SIB Buffer Global Systemically Important Banks (G-SIBs) are assigned an annual surcharge based on systemic importance. Under gold-plated US rules, the surcharge ranges from 1% to 5.5% in 50 basis point increments and is derived formulaically from five equally-weighted categories, the majority of which use fourth quarter- or year-end data. To achieve a lower capital surcharge, the only option is to reduce the balance sheet constituents that derive each category score. For repo markets, since four of the five categories can potentially benefit by reducing secured funding balances, this has become one of the most effective ways to manage the score given several other avenues (i.e. reducing derivatives and selling non-core assets) have been exhausted.9

- Leveraged Capital Requirements Measuring capital adequacy on a leveraged basis, introduced post-crisis as a compliment to risk-based requirements, is done by treating all assets the same, regardless of risk. The US gold-plated leverage ratio, known as the Supplementary Leverage Ratio (SLR), requires that 5% capital must be maintained against all leveraged exposure. As a result, the SLR disproportionally penalizes a bank for holding low-risk, low-margin assets such as reverse repo backed by treasuries, which hurts ROE, or for growing its balance sheet.

Key Takeaway Post-crisis regulations incentivize banks to be smaller, particularly around quarter- and year-end. Doing so by reducing or de-emphasizing secured funding is efficient from both a G-SIB score and leverage ratio perspective. In September, if banks had decided to borrow in wholesale funding markets to finance repo lending opportunities, it would have resulted in a larger balance sheet with a corresponding negative implication on G-SIB score and returns.

Conclusion

Post-crisis bank regulations have created a more resilient banking system but a less efficient and less liquid financial market. With reserves having met their lowest comfortable level, the appetite of banks to intermediate in repo markets will depend on how bank rules and regulations evolve.

While changes to monetary policy could help the repo market, the Fed becoming a more regular market participant via a standing repo facility (SRF) is fraught with its own shortcomings. An SRF would not change regulatory-driven constraints in the banking sector, would present moral hazard and would be ironic given the focus of post-crisis regulations on preventing bank bail-outs, especially given the current stigma associated with the Fed’s Discount Window. 10

Unless changed, there are four important bank regulatory constraints impacting repo markets. Two relating to capital (leveraged capital ratios, G-SIB surcharge) and two relating to liquidity (resolution planning, intra-day stress test). While leveraged capital requirements currently have some momentum for potential modification by the Fed, the other constraints would still apply. 11, 12 We suggest two changes to post-crisis bank regulations that authorities can pursue to improve the resiliency of the repo market while maintaining the strength of the US banking sector:

- Place less emphasis on fourth quarter and year-end data to recalibrate the Fed’s G-SIB score, removing the incentive for banks to shrink their balance sheets.

- Address non-public liquidity requirements to treat the monetization assumptions of reserves as equivalent to Treasuries, consistent with LCR. Even if regulators are convinced that a certain level of cash is required to meet intraday liquidity needs or to have a successful resolution, supplementing these changes with the creation of an SRF — provided it was open until the close of Fedwire — could make reserves and Treasuries nearly perfect substitutes, at least in terms of liquidity.13