Q3 2023 Credit Research Outlook Curb Your Enthusiasm

The increased usage of fixed rate debt across developed market economies between 2020 and 2022 has shielded corporates and consumers from the impact of higher rates. But for how long?

The state of interest rates 2–3 years from now will be a critical factor for corporate credit markets as the maturity schedule for lower-quality corporate credit becomes far more significant in 2025.

In evaluating global central bank performance in fighting inflation so far – while keeping the prospect of a “soft” economic landing alive – I would quote the great Larry David: “Pretty … pretty … pretty good.”

However, as noted in our Q2 2023 Outlook, central bankers cannot claim victory yet. The full impact of the massive interest rate hikes will continue to work its way through global economies in a lagged manner, and there is the risk of increased pressure on credit markets and economies if interest rates remain high for longer.

While financial and lending conditions have tightened across global economies, they have not been overly restrictive. This is an outcome consistent with central bank mandates to fight inflation, as well as avoid causing a recession.

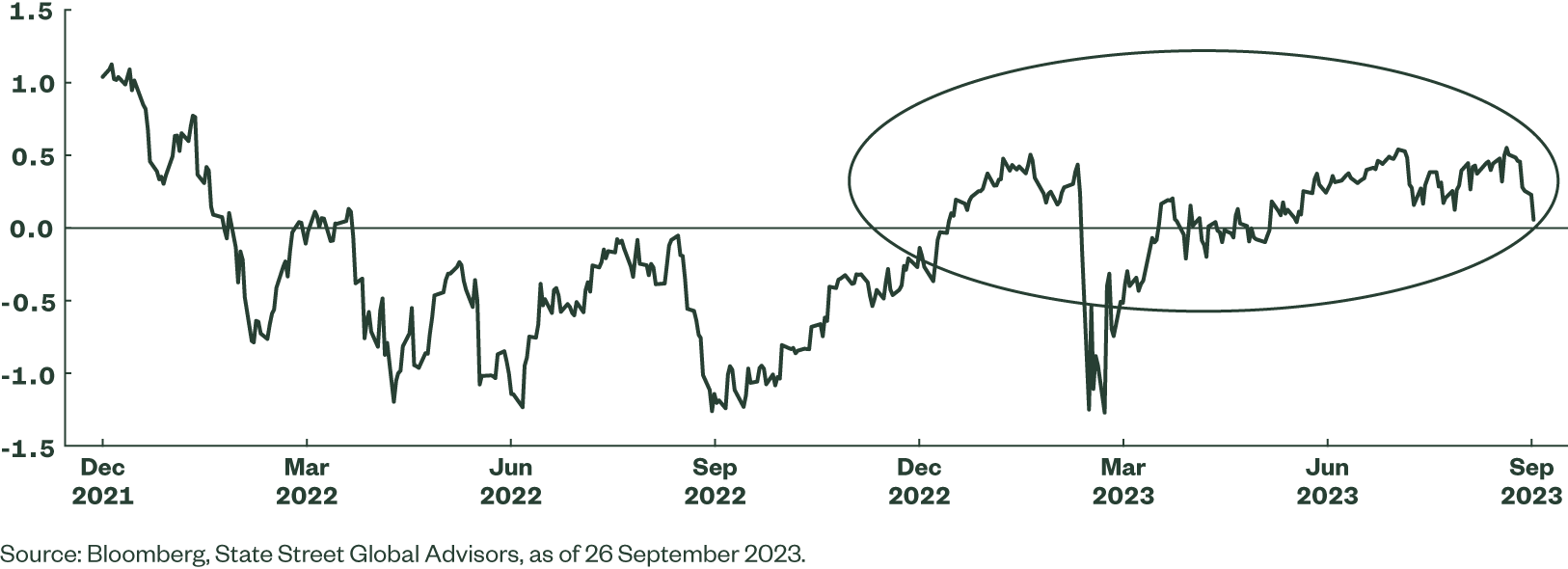

The Bloomberg US Financial Conditions Index (Figure 1) demonstrates that conditions are still slightly above the neutral level (the significant tightening earlier in 2023 was a temporary, idiosyncratic episode related to the US regional bank stress).

Figure 1: Bloomberg US Financial Conditions Index (31 December 2021–26 September 2023)

The latest global bank lending surveys tell us that credit conditions are still tightening, even if modestly. The G-4 Senior Loan Officer Opinion Survey proxy points to a continued negative credit impulse in coming quarters despite modest positive credit growth.1

Even without further tightening in lending conditions, the accumulated credit constraints are expected to hinder economic activity in the next few quarters. Lenders are likely to remain cautious, and there is risk that banks’ willingness to extend credit tightens even further.

Fortunately, consumer, bank and corporate balance sheets in developed market economies have remained healthy despite the rapid interest rate hikes. This resilience can be attributed to the ability of these constituents to issue and refinance debt at very low interest rates following the COVID-19 shock.

The increased usage of fixed rate debt across developed market economies between 2020 and 2022 (both corporate and consumer) has helped mitigate the impact that higher rates have had on debt servicing costs for consumers and businesses. This has been especially beneficial to the US economy, where the mortgage markets are heavily skewed toward the 30-year debt duration.

Indeed, after the refinancing boom of 2020–21, the average effective interest rate on mortgage debt has barely budged since the US Federal Reserve (Fed) started hiking, and remains near a record low.

Bankruptcy data also suggests that consumers and businesses are coping well with higher interest rates. Non-business bankruptcies have barely risen, while business bankruptcies have increased – though they are still below their pre-pandemic level.

All this is consistent with the idea that the increased prevalence of fixed-rate debt is shielding borrowers from high interest rates.2

Despite the economic resilience we have seen so far, over time, higher rates are still likely to take further toll on consumption and business investment as more debt needs to be refinanced.

Such expectations will also continue to dampen demand for new loans. In the global corporate debt sector, greater reliance on fixed-rate financing during 2020–22 is unlikely to provide a lasting shield from central bank tightening as the maturity schedule – starting in 2025 – becomes more significant.3

For investment-grade-rated corporates, materially higher interest rate expense costs will negatively impact profits, and could deter capital expenditure and hiring plans. However, for lower-rated, and more highly levered corporations (high-yield-rated corporates and leveraged loan borrowers), any need to refinance debt at significantly higher rates is more likely to threaten solvency.

The maturity schedule for lower-quality corporate credit becomes far more significant in 2025, and the years beyond, so the state of interest rates two or three years from now will be a critical factor for corporate credit markets, particularly outside of the investment grade universe.

Developed market central banks are signaling the need for sustained higher policy rate, driven by concerns that economic resilience could lead to persistent inflation. Such policies may compress profit margins, slowly erode balance sheets, and bring an end to the economic expansion.

Whether or not a technical recession occurs, we believe that subpar growth will cause a re-examination of the lower-end of the credit spectrum. As such, our credit research team is vigilant in limiting exposure to credit profiles that could be negatively impacted by the more leveraged parts of global economy.