US small-caps in focus

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

Macro Backdrop

While uncertainty remains, developments since the initial tariff announcement offer insight into how the situation may evolve. The Donald Trump administration has shown a willingness to disrupt the status quo for policy change, while also responding to market reactions. We believe peak uncertainty has passed and expect conditions to stabilize, with elevated—but manageable—tariff levels likely to persist.

US economic growth in Q2 is tracking well, with the Atlanta Fed’s gross domestic product (GDP) tracker estimating a 2.6% annualized rate. However, we continue to forecast a broader global slowdown due to persistent uncertainty and signs of consumer fatigue. Despite these headwinds, we do not expect a recession. US growth is projected to reaccelerate in 2026, supported by pro-growth policies and expected clarity on trade and fiscal matters in the second half of the year. We forecast US GDP growth to ease to 1.7% in 2025 from 2.8% in 2024, before improving to 2.3% in 2026.

The US economy continues to face headwinds. Business investment remains weak amid policy uncertainty, and labor market data points to a cooling trend. The ADP report was soft, and although non-farm payrolls beat expectations, gains were driven by government hiring, with private-sector growth lagging and prior months revised down. The unemployment rate dipped to 4.1%, but labor force participation also fell, and rising continued claims suggest job seekers are struggling to find work.

Consumers are feeling the strain. While household debt service remains historically low, rising delinquencies in credit cards, auto loans, and student debt points to mounting financial pressure. Broader economic activity, including manufacturing and services, also remains sluggish.

But there are signs of optimism as well. While the housing market remains weak, it could rebound as interest rates fall and pent-up demand releases. Business investment may also recover with greater clarity on trade and fiscal policy. The proposed tax bill includes provisions—such as immediate expensing of domestic R&D and accelerated depreciation—that aim to spur investment, particularly in areas such as AI and clean energy. These tailwinds could support a more constructive US economic outlook in 2026.

While the Federal Reserve is expected to take a cautious approach at its July meeting, we continue to believe three 25-basis-point rate cuts this year are justified to support a soft landing for the US economy. Some Fed officials have hinted at a possible cut, though the broader tone remains prudent as the Committee awaits more clarity on the inflationary impact of recent tariffs.

We expect those effects to be limited, with disinflation in shelter costs helping to offset upward pressure. Corporate pricing power is also weakening amid signs of consumer strain. Given the softening labor market and manageable inflation risks, we believe the Fed has sufficient grounds to begin easing policy.

While recent developments have provided some clarity on trade policy, notable uncertainties remain—particularly considering the latest tariff announcements. We will continue to closely monitor ongoing trade negotiations, their implications for the global economy, and the potential effects of the recently enacted reconciliation bill. As new information becomes available, we remain prepared to reassess our outlook and make adjustments as needed to reflect evolving conditions.

Directional Trades and Risk Positioning

Our quantitative framework continues to show encouraging signs, suggesting conditions for risk assets are improving, though potential headwinds remain.

Investor risk appetite has steadily improved in recent weeks, as shown by our Market Regime Indicator, which has trended upward since mid-April. While geopolitical tensions in the Middle East and unresolved trade negotiations persist, investor focus has shifted toward improving macroeconomic signals. Inflation continues to moderate, and the tariff impact has been milder than expected. The recent federal spending bill and a series of stable, though not exceptional, jobs reports have also helped to ease concerns, creating a more favorable environment for risk assets.

Our quantitative model points to a gradually improving outlook for investor risk appetite, with positive signals across several key factors. Equity trend evaluations have strengthened, and sentiment spread analysis has moderated from extreme risk aversion to a more neutral stance. Declining equity implied volatility and narrowing spreads in riskier debt markets also support rising risk appetite. However, not all indicators are aligned—measures of risk support and credit sentiment still reflect elevated caution. Overall, our Market Retime Indicator suggests a shift from pessimism toward a more balanced, neutral risk environment.

Our outlook for global equities has become increasingly constructive, supported by broad-based improvements across multiple factors within our model. The recent rally in equity markets has reinforced our price momentum signal, which has now turned positive. In addition, analysts' expectations for both sales and earnings have grown more supportive, and our assessment of corporate balance sheet health remains favorable. However, valuations continue to be the primary headwind, acting as a partial offset to the otherwise improving landscape. Taking all factors into account, we now hold a slightly positive view on global equities.

Our fixed income outlook reflects a nuanced view shaped by macro trends and investor behavior. The model anticipates a modest decline in interest rates, a slightly steeper yield curve, and a favorable credit environment. While improving risk appetite may pressure yields higher, mean reversion suggests a downward bias. Weaker economic momentum is largely offsetting persistent inflation, supporting modest curve steepening.

On credit, our positive stance is supported by stronger equity momentum, falling implied volatility, and improving risk appetite, pointing to tighter spreads and a supportive backdrop for credit markets.

We also forecast positive returns for commodities. Curve structure (carry) is modestly positive, and recent momentum, along with reduced anti-commodity bias, suggests a constructive setup for the broader complex.

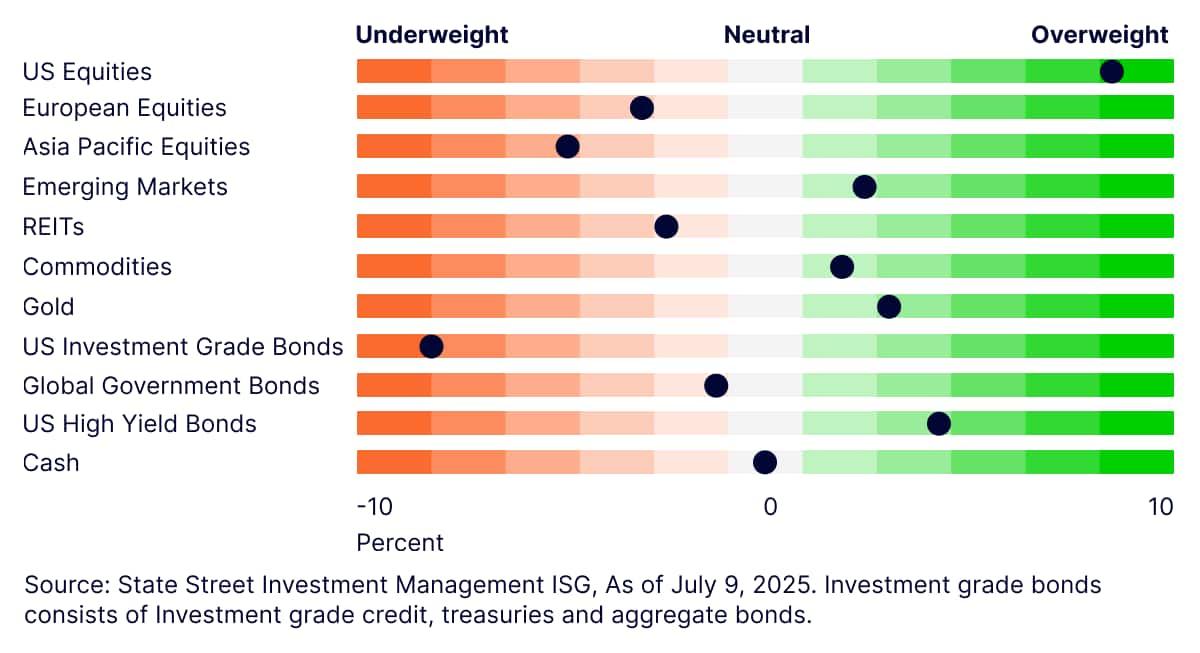

Given stronger risk-on signals, we have increased equity exposure to a small underweight and raised our commodity allocation. These moves were funded by trimming aggregate bonds and our tail-risk basket—cash, gold, and long-duration government bonds.

Relative Value Trades and Positioning

Within equities, we have continued to shift allocations toward the US, where our outlook remains strong. US equities benefit from improving price momentum, solid corporate balance sheets, and strong sentiment indicators, including positive sales and earnings expectations. Our focus is on small-cap stocks, which offer more attractive valuations than large caps.

In emerging markets, improved momentum and sentiment have led us to modestly increase our overweight. To fund these moves, we reduced exposure to REITs, returning to an underweight position, due to weakening momentum and deteriorating sentiment.

At the portfolio level, we now hold a significant overweight to US equities, across both large and small caps, and a modest overweight to emerging markets. We remain underweight in non-US developed equities and REITs.

On the fixed income side, our preference for credit led us to reduce aggregate bond exposure and increase our allocation to high-yield bonds. We now maintain a healthy allocation to both investment-grade and high-yield credit.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.