Real assets insights: Q4 2025 Inflation, risk appetite, macro, and structural tailwinds support real assets

The real assets strategy maintained its momentum during the fourth quarter, benefiting from stronger risk appetite, stubborn inflation, and further easing in monetary policy. These same forces, alongside powerful secular tailwinds, should continue to support real assets going forward.

Despite concerns over trade tariffs, a cooling labor market, the US government shutdown, and elevated technology valuations, 2025 proved to be an exceptionally strong year for risk assets, supported by robust earnings growth, AI-driven optimism, and central bank rate cuts. Investors rotated toward financials and cyclicals, supported by the Federal Reserve’s three rate cuts in September, October, and December, which lowered the federal funds target range to 3.50%–3.75%. This pivot toward monetary easing reinforced expectations of a soft landing and boosted sentiment across rate-sensitive sectors such as financials, real estate, and consumer discretionary.

Inflation data trended lower but remained above target, prompting a cautious tone in the Fed’s December meeting minutes. Global equity markets posted moderate gains in Q4 2025. Treasuries posted modest gains in Q4 and solid returns for the year, driven by rate cuts and resilient economic conditions. The US dollar index edged up 0.5% in Q4 but finished the year lower. Commodities advanced broadly, led by gold, which surged more than 12% in the quarter, bringing its annual gain to over 62%.

Quarter in review

Real assets started the quarter facing headwinds from the US government shutdown, labor market uncertainties, and persistent geopolitical risks. While overall inflation was contained, shelter and food prices were stickier. Real assets were up for the quarter, supported by a strong US corporate earnings season, reduced trade-related uncertainty, sustained momentum in AI-driven technology stocks, and additional rate cuts by the Federal Reserve.

The real assets strategy (strategy) advanced for all three months of the quarter, adding to earlier gains and bringing the year-to-date return to 19.9%. The strategy closed the quarter with a gain of 3.5%, just behind its composite benchmark by 2 basis points. The longer-term returns remain solid and since its inception in 2005, the strategy continues to maintain its lead over the composite benchmark by over 22 basis points annually and has provided an annualized return of 4.7%.

Commodities, as tracked by the Bloomberg Enhanced Roll Yield Total Return Index, rose 5.1% in Q4, driven largely by strong performance in precious metals and industrial metals. However, energy was a drag on returns, offsetting some of the overall upside. For the full year, the index posted a positive return of 18.7%, despite weaker oil demand weighing on performance. Precious metals and industrial metals were the primary contributors to this growth. While precious metals led the rally, agriculture and energy sectors recorded negative returns.

Global natural resource equities delivered the strongest performance among real asset classes this quarter, driven primarily by metals and mining companies. Every subsector had positive returns, the highest going to companies involved with aluminum, copper and silver. Companies in the forest products sector had the smallest increase. Natural resource equities were up 7.4% for the quarter and 37.1% for the year. Infrastructure equities also had a positive quarter, with a strong month in November. The industrial companies involved in airport, highways, and marine port services saw the highest returns and contributed the most to the positive performance. Energy companies within the infrastructure complex were a drag on the performance. Infrastructure equities were up 2.2% for the quarter and 21.5% for the year.

REITs, an interest rate-sensitive asset class, advanced over the year as declining rates provided support, though they experienced modest declines in the fourth quarter. The Dow Jones U.S. Select REIT Index declined 0.8%, but for the full year it gained 3.7%. Within property sectors, industrial and mixed industrial/office led performance during the quarter, while specialty and office lagged. For the full year, healthcare REITs posted the strongest gains, followed by mixed industrial/office and diversified. Conversely, data centers and self-storage REITs lagged the most in 2025.

In Q4 2025, TIPS underperformed comparator Treasuries by -0.87% for the period. The full TIPS Index (Barclays Series-B) returned 0.09% and the 1-10 year returned 0.3%, while comparator Treasury indices returned 0.96% and 1.16%, respectively. For the year, 1–10-year TIPS returned 7.4%. The US annual inflation rate came in at 2.7% in November, well below market expectations of 3.1% and 3% reported for September. Core inflation, which excludes food and energy, came in at 2.6%, below market expectations of 3%.

Investment outlook

Energy fundamentals are not exceptionally bullish, as supply is expected to remain high in the near term and expectations continue to point to a potential surplus. However, inventories have grown less than anticipated, suggesting the market is not as loose as forecasts imply. Looking ahead, oil demand is expected to rebound in both the US and China in 2026, which should place upward pressure on prices, particularly if economic growth surprises to the upside and demand estimates are revised higher. On the supply side, OPEC+ has paused production increases to assess global oil dynamics, and they should keep a floor under prices, especially as most spare capacity has already been deployed, cushioning downside risk. At the same time, US production growth could stall as rig counts decline, further reducing supply flexibility. Venezuela is unlikely to materially impact prices in the near term, as any production increase would take time and remain small relative to global demand growth, while ongoing political instability raises the risk of prolonged US sanctions, limited investment, and even potential supply losses in a worst case scenario. Broader geopolitical risks add to upside asymmetry, as sanctions on Russia could further restrict supply and political instability in Iran presents tail risks to production. While these risks may not immediately remove barrels from the market, they introduce meaningful uncertainty and warrant a geopolitical risk premium. Taken together, the combination of improving demand into 2026, limited spare capacity, potential stalling in non-OPEC supply growth, and elevated geopolitical risks suggests oil prices may be near the bottom of the cycle even as the short-term outlook is not overly bullish.

Gold remains well supported as multiple structural and cyclical forces continue to underpin demand. Investor interest is strong, driven by elevated geopolitical and policy uncertainty, including concerns around Federal Reserve independence, ongoing conflicts involving Russia and Ukraine, instability in Iran and Venezuela, and broader geopolitical tensions. Persistent worries over rising fiscal deficits further reinforce gold’s appeal, particularly if court rulings or policy shifts were to weaken tariff frameworks and exacerbate budget pressures. Central bank demand should remain a key pillar of support as monetary authorities continue diversifying reserves away from the US dollar. From a cyclical perspective, the prospect of additional Federal Reserve rate cuts, a weaker US dollar, and the need for portfolio hedges amid equity markets at record highs all point to continued support for prices, reinforcing gold’s role as both a defensive asset and a hedge against macro and policy risks. Silver’s outlook remains constructive, with momentum supported by a mix of macro, financial, and structural drivers. Increasing geopolitical risks and elevated equity valuations are encouraging investor inflows. Industrial demand is an important tailwind, with rising usage in solar energy, electric vehicles, and semiconductors reinforcing longer term demand growth. Physical silver markets remain tight, particularly outside the US, and retail investor inflows have been strong. Adding to near term tightness is uncertainty around potential US Section 232 critical minerals tariffs related to national defense and security policy—silver’s recent inclusion on the list has prompted precautionary stockpiling and constrained available supply. Taken together, tight physical conditions, growing industrial applications, and supportive investor demand suggest silver can continue to outperform in periods of both risk aversion and improving growth sentiment.

The outlook for industrial metals remains favorable despite several near term risks, as the broader backdrop continues to support demand. While global manufacturing PMIs remain sluggish, base metal consumption is becoming less cyclical and increasingly structural, driven by powerful thematic tailwinds tied to artificial intelligence (AI), electrification, the green energy transition, the rapid buildout of data centers and related infrastructure, and electric vehicle adoption. From a macro perspective, expectations for solid economic growth, additional Federal Reserve rate cuts, and a weaker US dollar are supportive for the industrial metals complex and broadly align with consensus market views. Policy initiatives such as the One Big Beautiful Bill Act (OBBBA) should further bolster household demand and capital investment, reinforcing infrastructure and construction activity that is metal intensive. Easing trade policies also contribute to a more constructive environment. Supply dynamics add to the favorable outlook. Copper markets are expected to remain in deficit, while aluminum supply is more balanced but still tight enough that any disruptions or upside demand surprises could quickly push the market into deficit. These constrained supply conditions amplify the impact of structurally strong demand growth and increase price sensitivity to even modest shocks. That said, risks remain. Speculative positioning across industrial metals is elevated, leaving prices vulnerable to pullbacks if AI related optimism fades or if growth concerns re emerge. Elevated price levels themselves may also dampen sentiment in the short term, particularly amid ongoing geopolitical tensions that can introduce volatility and episodic risk off behavior. Even so, taken together, strong structural demand drivers, supportive macro and policy conditions, a weaker dollar, and constrained supply argue for a constructive outlook for industrial metals, with copper standing out as a key beneficiary of these trends.

The outlook for global natural resource markets is constructive, underpinned by powerful secular demand trends and constrained supply conditions. Accelerating electrification, large scale grid expansion, rapid data center build outs, and ongoing reshoring of industrial capacity are collectively driving a sustained surge in global electricity consumption. These dynamics are translating into rising demand for a broad range of minerals and metals—particularly copper, aluminum, and other critical inputs—creating a favorable backdrop for both energy and materials sectors. At the same time, supply remains structurally tight across many key metals, which has kept prices high and can enhance the earnings potential for well positioned natural resource producers. Within this environment, precious metals stand out as especially compelling.

The prospects for gold and silver remain strong, supported by persistent inflation pressures, central bank demand, and their role as portfolio diversifiers amid macro uncertainty. These dynamics should continue to benefit mining companies. Looking ahead, an improving global growth backdrop in 2026, coupled with additional Federal Reserve rate cuts, should further support demand for natural resources. Inflation is likely to remain sticky and above the Fed’s long term target, reinforcing the appeal of real assets as inflation hedges. Moreover, a solid risk appetite among investors, combined with the ability of many resource companies to generate positive cash flow enhances the sector’s overall investment appeal. Collectively, these factors suggest a favorable outlook for global natural resources as both a cyclical and structural opportunity.

Figure 3: Short and medium-term directional outlooks

.png)

Global infrastructure equities appear well positioned as economic growth is expected to improve in 2026, particularly in the US where growth policies should support higher levels of investment and activity. This environment creates a supportive backdrop for infrastructure assets, which are closely linked to long term economic expansion while offering essential services that remain in demand across cycles. As growth improves, infrastructure companies stand to benefit from rising utilization and expanding revenues without the same sensitivity to economic volatility as more cyclical equity segments. Infrastructure equities also offer a compelling balance between structural growth exposure and defensive characteristics. Investors gain access to equities tied to durable secular tailwinds—such as decarbonization, AI, digitalization, and energy transition—while retaining elements of downside protection and hedging inflation. With inflation expected to remain sticky and above the Federal Reserve’s long term target, the regulated or contract based revenue structures common in infrastructure sectors can help preserve real returns through pricing mechanisms linked to inflation. Decarbonization efforts, alongside sustained capital expenditure for AI and data center development, are unlikely to subside in 2026 and should remain a key source of support for infrastructure equities, particularly within energy and utilities. Infrastructure plays a critical role in enabling the AI ecosystem by providing power generation, transmission, data networks, and connectivity required to support expanding computational demands. This creates long duration growth opportunities as electrification accelerates and digital infrastructure scales globally. Beyond energy and utilities, economically sensitive infrastructure segments such as airports, toll roads, and ports could benefit from improved economic activity and increased mobility, trade flows, and logistics demand. Additionally, potential tax reforms under the OBBBA could enhance capital efficiency and improve cash flows, bolstering earnings potential and reinforcing positive investor sentiment toward the asset class. Looking ahead, improving risk appetite alongside the prospect of Federal Reserve rate cuts should provide further support to infrastructure equity valuations. While key risks include a slowdown in AI driven demand or renewed upward pressure on interest rates, the combination of structural growth drivers, inflation resilience, and improving macro conditions suggests global infrastructure equities are well positioned to capitalize on favorable dynamics in 2026 and beyond.

REITs enter 2026 with a more constructive fundamental backdrop than market performance alone might suggest. Despite elevated interest rates throughout most of 2025, the sector delivered solid operational results, with funds from operations, net operating income, and dividends paid all increasing, according to Nareit. Balance sheet health also remains generally strong. Looking ahead, our base case of stronger economic growth and resilient consumer demand should support REITs in 2026. Monetary policy is likely to be an important incremental tailwind. With the Federal Reserve expected to cut rates again in 2026, lower financing costs could help stabilize or improve property valuations and ease pressure on capital structures. In this environment, investors may rotate back toward equity segments that offer durable income, particularly REITs, which have lagged traditional equities and continue to provide attractive dividend yields. Improving risk appetite could further support inflows into public real estate as investors reassess the relative value of income oriented assets. That said, risks remain. Yields could face renewed upside pressure due to ongoing federal deficit concerns, reduced reliance on US Treasuries by global investors, and persistently sticky inflation. While REITs may ultimately outperform their 2025 returns in a more accommodative policy environment, we continue to view the asset class as less attractive on a relative basis compared to other equity opportunities.

Treasury Inflation Protected Securities (TIPS) enter 2026 with a moderately constructive but constrained outlook, shaped by persistent inflation pressures, attractive real yields, and a cautious Federal Reserve. While US inflation has eased from its recent peaks, it remains elevated and subject to upside risks that could re-accelerate price pressures or, at a minimum, keep inflation sticky. This environment continues to support the role of TIPS as an inflation hedge, particularly for investors seeking protection against unexpected increases in realized inflation. Real yields in the roughly 1.25%–2.0% range offer compelling inflation adjusted income by historical standards. Combined with inflation hovering near or above 2% and expectations for a gradual policy easing path toward a federal funds rate near 3%, this backdrop is supportive of the belly of the TIPS curve. A modest decline in real yields would further benefit TIPS performance, and additional Fed rate cuts could act as a near term catalyst. However, the Fed has signaled a cautious, data dependent approach rather than committing to a full easing cycle, which limits the potential for a more pronounced rally. At the same time, breakeven inflation rates have risen entering 2026 and now sit near the upper end of their range over the past four years, while also elevated relative to most of the past decade outside the COVID era spike. Although inflation remains sticky and upside risks persist, these elevated break evens already reflect much of that risk, capping the scope for further upside in TIPS valuations. The combination of solid economic growth, persistent inflation pressures, and incremental Fed cuts is likely to limit how far real yields can decline, reducing the potential for strong price appreciation. Overall, while TIPS remain supported by attractive real yields and ongoing inflation risks, return potential appears more limited in the current macro environment. As a result, we view TIPS as a useful portfolio stabilizer and inflation hedge but currently favor other segments of real assets that offer greater upside potential and stronger total return prospects.

Inflation and real assets

Inflation dynamics have turned more nuanced in recent months, with price pressures unexpectedly cooling as core services inflation continues to soften and core goods prices stabilize, showing fewer tariff related price increases than many had anticipated. A combination of lower rent inflation and diminishing pass through from tariffs should help keep overall inflation pressures manageable and drifting modestly lower, though still sticky. That said, as we have emphasized previously, the disinflationary path is unlikely to be linear, and a range of upside risks continues to hang over the inflation outlook.

Several conventional indicators suggest that inflation may not decelerate as uniformly as headline metrics imply. Core CPI ended 2025 at 2.6%, and Barclays expects a modest re-acceleration toward 2.9% in 2026 as base effects turn less favorable and services prices remain firm. Our internal forecast is broadly aligned, with core inflation stabilizing around 2.7% in 2026—only a modest improvement from last year. As we noted previously, inflationary tailwinds tied to the US’s 250th anniversary, the FIFA World Cup, fiscal stimulus under the OBBBA, and positive wealth effects from equity market gains could continue to support demand and labor markets. These dynamics remain in place, alongside additional emerging areas of concern. December saw the sharpest increase in grocery prices since late 2022, highlighting persistent pressure in essential consumption categories. At the same time, US M2 expanded by roughly $1.65 trillion in 2025, the fastest annual pace since 2021, driven by rising bank deposits and money market inflows. This renewed monetary expansion, following the contraction of 2022–2023, introduces an additional layer of persistence into the inflation outlook, even before incorporating structural forces that lie outside the traditional cycle.

Among those forces, the acceleration of AI is particularly consequential. The physical footprint of AI is scaling at a velocity that departs from historical precedent. These developments do not refute the disinflationary baseline, but they complicate it. They widen the distribution of plausible outcomes, increase exposure to supply-side shocks, and elevate the potential for inflation surprises that stem from structural investment rather than conventional demand pressures.

Inflation surprise risk—signals from sentiment spreads

Figure 4 plots the Conference Board’s Consumer Confidence Index against its expectations sub index from 1985–2025. The gap between the two—the confidence–expectations spread—has repeatedly functioned as an early warning indicator of macro inflections. When the spread widens materially (confidence resilient while expectations deteriorate), the forward distribution of outcomes tends to skew toward regime change and policy recalibration.

Historical regimes.

- 1989–1991: A marked deterioration in expectations alongside still elevated confidence preceded the early 1990s downturn and a decisive disinflationary reset, as growth slowed and policy eased.

- 2000–2002: A renewed divergence emerged into the dot com unwind; the spread flagged fragility masked by headline sentiment and foreshadowed volatility in growth and pricing dynamics.

- 2007–2009: Expectations collapsed well before the nadir in confidence, signaling impending stress and an abrupt repricing of inflation risk and term premia.

- 2018–2020: Confidence remained firm relative to expectations on the eve of the pandemic shock, with the spread again highlighting sensitivity to non-traditional shocks.

The spread has been widening: headline confidence remains comparatively resilient, while expectations are anchored near multi decade lows. This configuration tends to compress risk premia and lower implied volatility until a catalyst surfaces, at which point the adjustment can be sharp. In inflation terms, it implies asymmetric tail risk: disinflation may persist on baseline metrics, yet sentiment is primed to amplify any supply side or cost push impulse—particularly those emanating from outside the usual consumption labor channel.

In a setting where consensus anticipates continued moderation in inflation, the confidence/expectations gap indicates that non-traditional cost drivers can still surprise on the upside. The accelerating buildout of compute, power, and network capacity associated with AI adoption is precisely such a driver. This is not a forecast of persistent inflation but a statement about skew and convexity—small shocks transmitted through energy, semiconductor supply, and infrastructure bottlenecks can produce outsized price effects when expectations are fragile.

AI-driven stimulus

Fiscal policy is also turning more supportive heading into 2026, adding upside risk to the otherwise moderating inflation outlook. The World Bank’s January 2026 Global Economic Prospects report notes that easing global financial conditions and fiscal expansion in several large economies is expected to help offset softening trade, contributing to a global growth forecast of 2.6% in 2026, an upward revision driven largely by stronger than expected US activity. In Europe, growth prospects are improving in part due to Germany’s more expansionary fiscal stance, which is expected to bolster domestic demand despite broader structural headwinds. Meanwhile, Japan continues to deploy targeted stimulus aimed at supporting household consumption and business investment as it navigates disinflationary pressures. Together with the AI driven capex cycle accelerating across advanced economies, these fiscal impulses are poised to refuel global growth in 2026 and complicate the path back to target inflation.

Data center electricity consumption

Figure 5 captures a structural shift unfolding faster than traditional infrastructure cycles can accommodate. A sector that once expanded at a measured and predictable pace is now behaving like an accelerated industrial expansion, as hyperscalers compress years of capacity growth into a single buildout phase. The inflation implication is less about any single project and more about timing: demand is materializing well ahead of the generation and grid reinforcement needed to serve it. Even as headline inflation eases, this AI driven load establishes a durable floor under power costs, creating the potential for supply side pressure to re-emerge when conditions tighten.

AI training costs

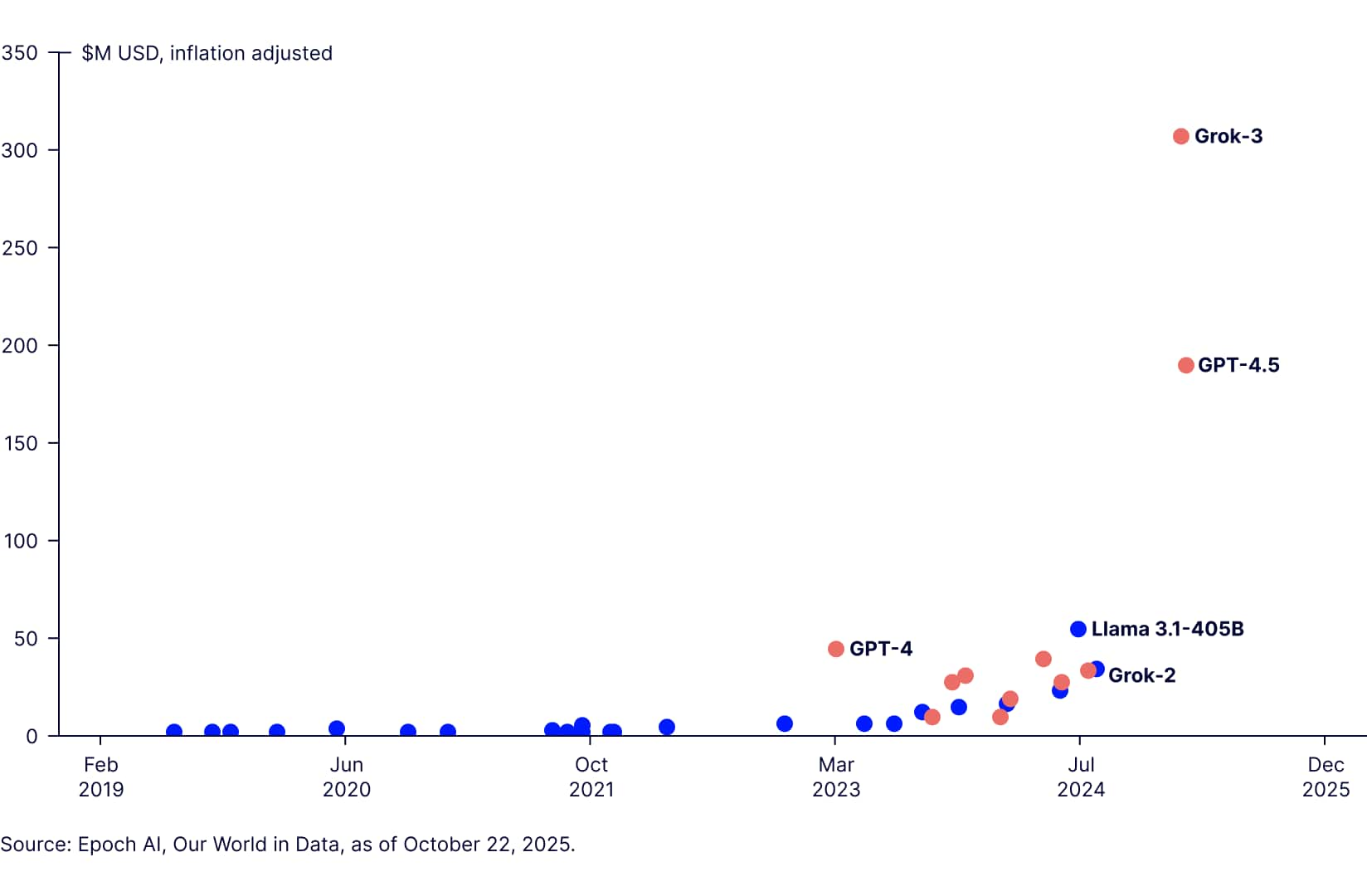

Figure 6 illustrates the sharp escalation in hardware and energy costs to train frontier AI models, from under $5 million in 2019 to over $50 million for leading systems in 2025. This surge reflects intense demand for high-performance semiconductors, energy, and data infrastructure, creating potential second-order inflationary pressures through energy markets, specialized hardware supply chains, and capital-intensive buildouts, areas closely linked to real assets. For institutional investors, this underscores the importance of maintaining exposure to sectors that benefit from persistent infrastructure and energy demand, even in a disinflationary environment.

Figure 7 underscores a more profound inflection point: the emergence of multimodal AI architecture. Unlike conventional large language models, these systems integrate text, vision, audio, and increasingly video, driving an exponential increase in computational intensity and energy throughput. The cost curve is steepening dramatically—recent benchmarks such as Grok-3 have eclipsed $300 million in training expenditure, far surpassing prior-generation LLMs. This paradigm shift signals a structural acceleration in demand for advanced semiconductors, hyperscale data centers, and grid capacity, with potential spillovers into commodity markets and infrastructure pricing. As multimodal AI scales, these dynamics could catalyze latent inflationary impulses, even as headline measures trend lower, reinforcing the strategic rationale for allocations to real assets as a hedge against technology-driven cost shocks.

Figure 7: AI training costs—large language model vs. multimodal

The nascency of AI introduces a distinct layer of uncertainty into the inflationary outlook. Cost dynamics emerging from hyperscale data center construction, grid reinforcement to support unprecedented energy loads, and semiconductor supply constraints have little historical precedent. These structural pressures can re-price critical inputs across the economy, creating inflationary impulses in sectors traditionally viewed as stable or disinflationary. Such effects may materialize asymmetrically and with limited visibility, presenting upside risk even as headline inflation moderates.

These dynamics underscore a broader reality: inflation risk is evolving beyond traditional drivers. As AI adoption accelerates, the scale of infrastructure and energy investment required introduces cost pressures that markets have yet to fully price, spanning rising electricity loads, sustained semiconductor demand, and the rapid expansion of data center capacity. In this context, real assets are not simply defensive; they are strategically aligned with the structural shifts reshaping the global economy. They offer exposure to the very investment cycles that AI is amplifying, while providing resilience should these emerging pressures translate into renewed inflation surprises.

Real assets strategy

At State Street Investment Management, we have a seasoned, diversified multi-asset strategy that combines exposure to a broad array of liquid real asset securities that are expected to perform during periods of rising or elevated inflation.

The asset allocation is strategic and utilizes indexed underlying funds. It is being used by a variety of clients as a core real asset holding or as a liquidity vehicle in conjunction with private real asset exposures. The strategy is meant to be a complement to traditional equity and bond assets, providing further diversification, attractive returns, and a meaningful source of income in the current environment.