A Fundamental Approach to Climate Risk Assessment

The adoption of the Paris Agreement in 2015 has, by far, been the most ambitious intention expressed at a global level to combat climate change. A key element of the Agreement is the global stocktake, a process that evaluates the progress made toward the climate targets.

A major finding of the synthesis report of September 20231 highlights that current levels of global emissions are not in line with the global mitigation pathways consistent with the temperature goal of the Paris Agreement.

The Important Effects of Climate Risk on Companies’ Operational Health

Climate change may pose great financial risks to the ability of companies to operate, let alone create stakeholder value.. Investors have begun to assess climate-related physical and transition risks to the companies they invest in. Companies, on the other hand, are gradually realizing the importance of assessing the kind of financial burden these climate events may have on their balance sheets in the future. This is illustrated by Figure 1, which shows the rise in the global number of companies setting climate targets.

Climate-related risks, when left unassessed, can lead to unexpected value erosion for shareholders. Physical risks can cause disruptions in a company’s value chain and direct damage to a company’s assets (acute risks). They can also impair the financial performance of a company through changes in water and raw material availability and extreme temperature changes impacting operations (chronic risks). It is equally important to consider the transition risks. For example, companies with products that do not comply with various environmental regulations or companies that make false claims of offering “green” products can face lawsuits. In one of such cases, the Massachusetts Attorney General brought action against Exxon Mobil for various alleged violations based on the company's marketing communication regarding the role of fossil fuels in climate change.2 The lawsuit alleged Exxon Mobil systematically misled investors about climate driven risks to its business and deceived drivers and other consumers about the role fossil fuels products play in causing climate change. This type of lawsuitnot only may have a negative impact on a company’s financials, but also leads to reputational damage that may impact future revenue as well. The global climate transition3 has also, in certain cases, forced companies to make large-scale capital expenditure investments in products and technologies to avoid becoming obsolete in the market in terms of the products and services they offer, and also to be relevant in meeting the requirements of regulators.4

Addressing Climate in Fundamental Analysis

The Active Fundamental Equity (AFE) team at State Street Global Advisors considers the impact of climate risks in its assessment of the quality of companies. The AFE team uses a proprietary research framework, the Confidence Quotient (CQ), to assess the quality of companies. The team believes companies that consider the impact of climate change-related risks on their business operations are better placed to take strategic actions to overcome those risks.

For example, a company that has taken into consideration a carbon tax being imposed in the jurisdiction of its operations as well as an internal carbon price in its investment decisions will either make investments in technologies to comply with the allowed emissions levels or will factor the carbon tax into its capital budgeting decisions. Similarly, a company that sees a need for products that aid consumers in adapting to changing climatic conditions will make future investments in developing such product streams and generate newer revenue sources. In the first example, the financial condition component of the CQ framework will reflect the impact of the heavy carbon tax that could be paid by the company in the future. In the second example, the market position and fundamental momentum components of the CQ framework will reflect the company’s adeptness in assessing climate risks.

The AFE team also developed specific climate scorecards to look at the impact of physical and transition risks on a company’s operations and to identify the enablers of low-carbon products and services. In our assessment, companies are paying close attention to the risk that climate change can have on their business operations and ultimately their financial performance.

Company Case Studies

Here are two case studies of companies with proactive strategies and actions plans on climate change.

1. A Risk Mitigation Approach to Climate Change: Nestlé’s Response to Physical Risks

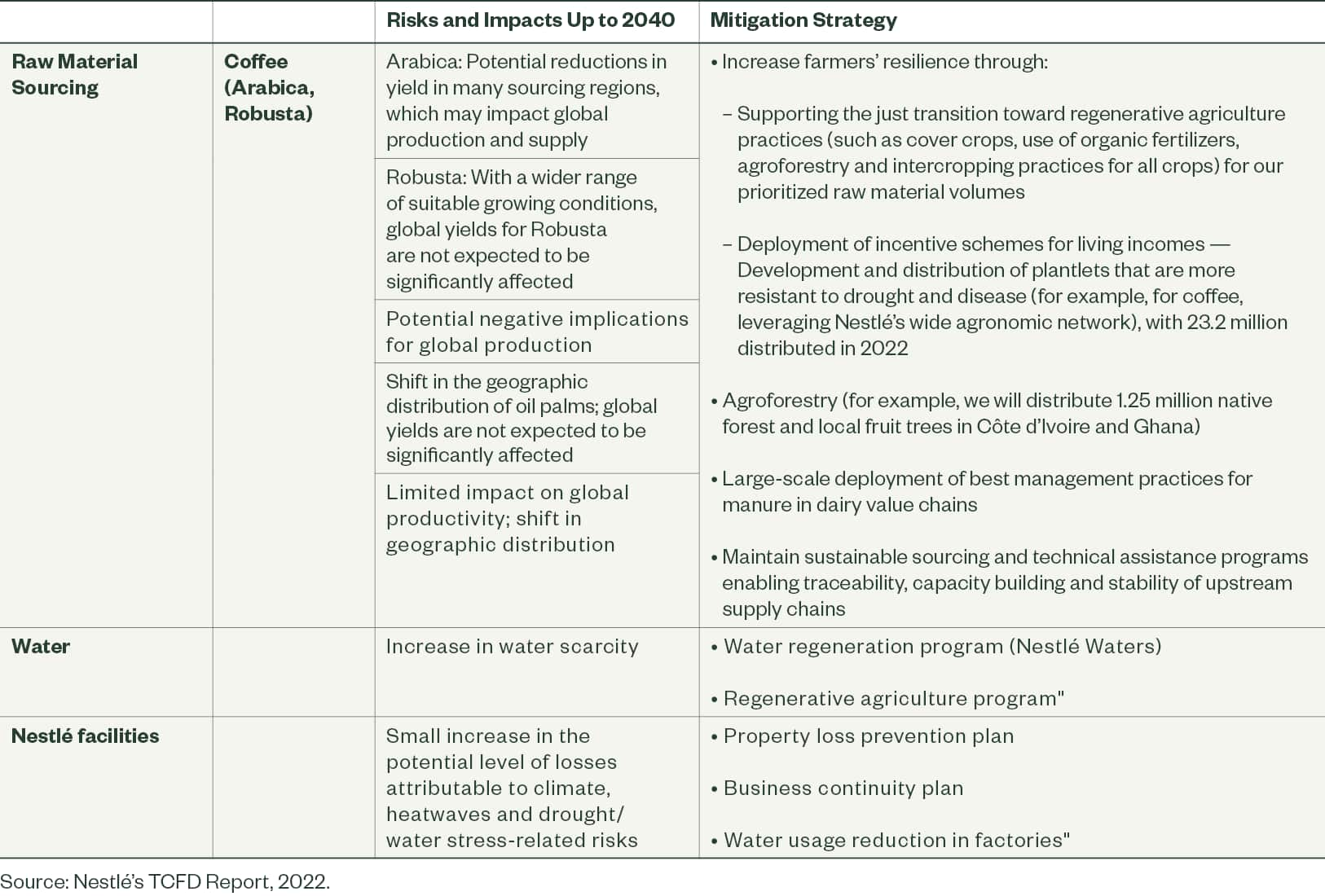

Nestlé assesses how climate-related risks such as heat waves, droughts, and water stress can impact its business operations in the form of raw material availability, lower quality raw materials, and lower yield and greater yield variability in its raw material sources. The company has mapped sourcing locations and volumes for key commodities representing 90% of its total spend. These commodities were selected based on the materiality to the business as well as vulnerability to climate change. The company uses a 1.5 degree scenario by 2040 to model the evolution of climate across the globe to quantify physical risks related to sourcing raw materials. As a result of this assessment, the company is able to predict how the sourcing of its raw materials will be impacted in the near- and long-term future. One of the proactive measures taken by Nestlé involves working with the farming community for development and distribution of plantlets that are more resistant to droughts and diseases (Figure 2).

This information should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

Figure 2: Nestlé Has Established a Mitigation Strategy Across Business Lines

2. A Climate Change as an Opportunity Approach: Applied Materials’ Strategy to Drive Industry-Wide Innovation

Applied Materials provides manufacturing equipment, services, and software to the semiconductor, display, and related industries. Through its diverse technology capabilities, it delivers products and services that improve device performance, power yield, and cost. Manufacturers of semiconductor chips form a large segment of the customers that Applied Materials caters to. Semiconductor chips are used in a lot of technologies aimed at decarbonization — for example, their use in electric vehicles such as development of powerful batteries, efficient power management systems, and advanced driver management systems. On average, electric vehicles require up to three times more semiconductor content than conventional vehicles. As the rollout of electric vehicles speeds up across the globe, there will be a growing demand for semiconductor chips. Applied Materials has come up with innovative technologies for its semiconductor chip manufacturing customers. Its innovative patterning system can reduce per-wafer manufacturing costs, water use, and carbon emissions compared to existing processes. Such innovative products will see a rising demand as semiconductor chip manufacturers are subjected to greater chip demand as well as the need to keep their emissions, water, and energy footprints in line with environmental targets and commitments. This will drive positive momentum for Applied Materials in terms of additional revenues from the novel technologies it has developed.

The Bottom Line

When performing its fundamental bottom-up research, the AFE team looks for all material risks that can detract from a company’s quality, earnings power, and long-term growth rate. If climate risks and opportunities are deemed to be material, then it has to be considered in the investment thesis of the company. The AFE team has developed a set of proprietary climate scorecards that assess a company’s climate transition plans, the impact of climate change on a company’s financial performance, and the potential benefits for a company with enabling products and services to reduce carbon emissions. These climate scores help inform our overall confidence level in a company and allow us to compare and contrast company climate exposures across industries to identify the most preferred candidates for investment.