Defined Contribution

Target Date Funds

Since inception, the average State Street target date fund has outperformed 91% of our peers, while also experiencing lower volatility than 73% of the same peer group, due in large part to our broadly diversified set of underlying asset classes. i

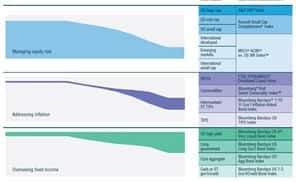

A Needs-Based Approach to Asset Allocation

Beyond deep diversification, we express our commitment to delivering better retirement outcomes by offering:

- Low-cost, all index lineups

- Thoughtfully constructed, “through” glidepath

- Securities lending capabilities, intended to enhance returns

- An array of investment vehicles, including collective investment trusts (CITs), custom separate accounts and mutual funds

Diversification

Innovation

Customization

J. Ryder TDF enhancements paper to come

Focus on the Long Run (PDF)

The Potential Diversification Benefits of Long Government Bonds in the Target Date Glidepath

Assessing fixed income in target retirement strategies.

Taking Target Date Fund Strategies Further

Gaining leading sponsors’ insights on how to uncover target date fund

value through key enhancements.

A. Rudin paper to come

To learn more about our target date fund approach, including developing customized glidepaths, contact DCInvestmentStrategy@ssga.com.