Three Reasons Why The RBA Should Frontload Cuts

Regular readers will recall that we have been advocating for rate cuts in Australia since last year. While the Reserve Bank of Australia (RBA) have begun measured easing, we continue to advocate that further and faster cuts are required to prop up a flagging economy.

As we saw with the disappointing Q1 growth figures, timing of these cuts is of the essence. We are encouraged by the dovish pivot the RBA made in May but, with the cash rate currently at 3.85%, we believe there’s more work for the RBA to do. We have been advocating a 3.10% terminal rate this year since April and our latest macroeconomic outlook sees slower growth and rangebound inflation. However, we believe these rate cuts should be frontloaded, starting in July, for three reasons.

Reason #1: Inflation

Australian markets and consumers are finally getting to see lower inflation broadly, and with that relief comes some confidence that it will remain controlled. We expect CPI to average 2.3% and 2.6% in 2025 and 2026 respectively. Recent EOFY sales, lower food and fuel prices, steady disinflation in other areas and most importantly, energy subsidies, all played crucial roles in bringing overall inflation comfortably into target.

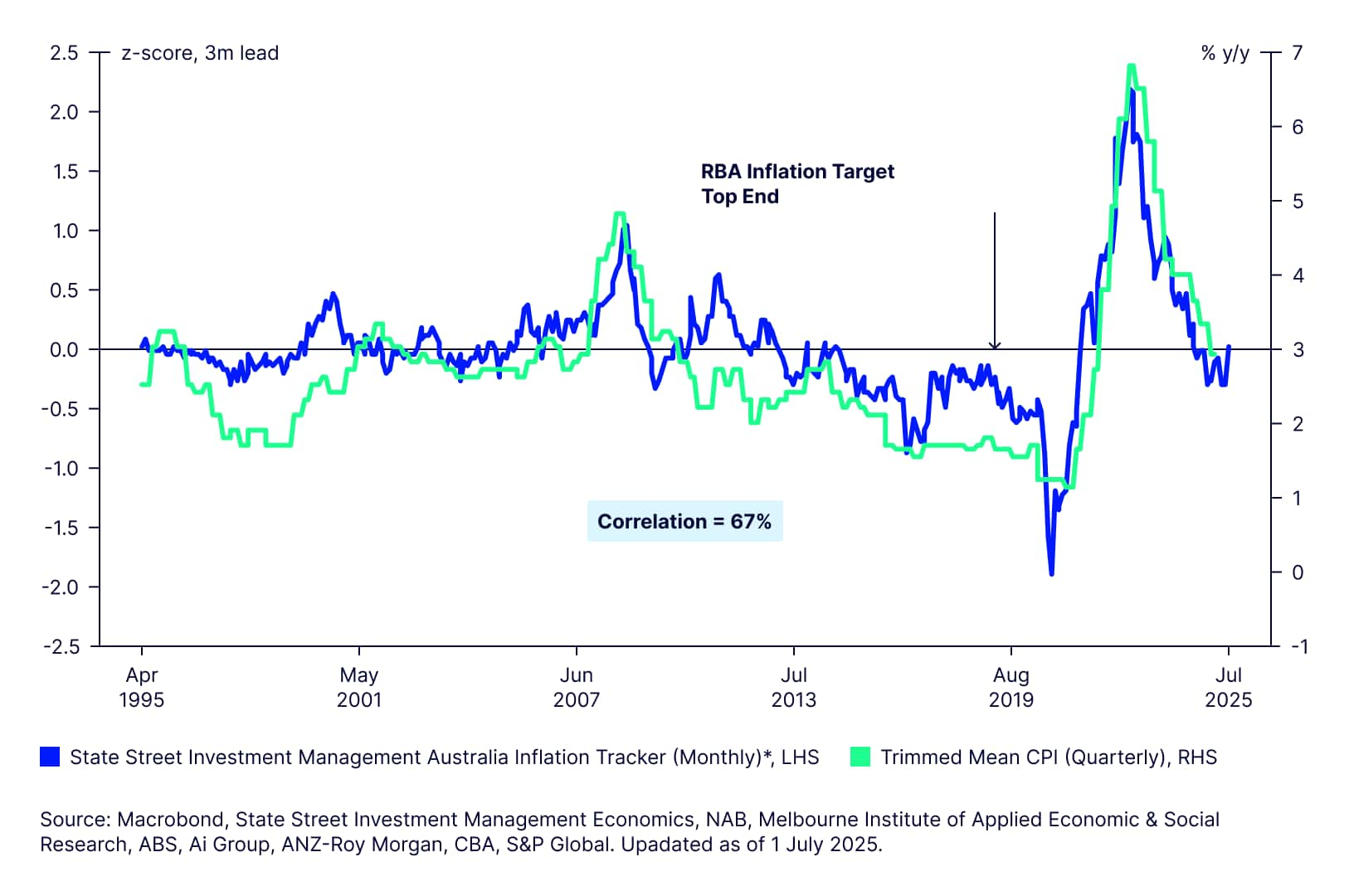

Moreover, despite the initial worries around the impact of tariffs, we are not observing any upside risks to inflation. Our proprietary Australia Inflation Tracker, which aggregates eight leading indicators of inflation, suggests that it is likely to stay in the target range in the near-term (Figure 1). Furthermore, recent inflation data has surprised to the downside. This should be the top reason for the RBA to frontload rate cuts.

Figure 1: AU Trimmed Mean CPI: Comfortable Enough

Reason #2: Downside risks to growth

Figure 2: No Tailwinds for GDP Growth in Q2

While it is conceivable that other sectors could pick up the slack from fading federal government spending, the potential for this is limited in our view. The state governments are already quite constrained fiscally. This puts the onus of driving the economy on the private sector, which has been largely sluggish since the pandemic. However, our recent forecast revisions do not envision that takeover to be smooth or rapid, highlighting the need for policy support.

Reason #3: Vulnerable Australian consumers

The most understated risk currently is the average Australian consumer. For a long time we have been of the opinion that despite the strong labour market, Australian consumer spending is vulnerable to high debt and the costs associated with it (i.e. mortgages).

Household debt is the highest in Australia among peers at 110% of GDP as of 2023, according to the IMF. In addition, the debt service ratio is also the highest among peers at 17.4%, according to the BIS. This means that not only do Australian households already have the highest debt compared with their peers, but also that they also pay high interest rates. This unique combination puts consumption at immediate risk; as such, consumer sentiment has not improved as much despite two rate cuts.

Figure 3: Australian Households Are Vulnerable

Household consumption in Australia has been weak for a couple of years due to the cost of living pressures that have been dominating the headlines. With inflationary pressures easing, the other main driver of cost pressures, interest rates, could be lowered to potentially drive a consumption recovery. This makes the timing of any RBA rate relief crucial before excessive consumer caution sets in.

The RBA did well to make a dovish pivot in May, but that needs to be followed up with further rate cuts accordingly. With Q1 GDP having disappointed and the outlook looking lacklustre, the RBA’s support will be vital for any economic recovery. While markets are now fully pricing a July rate cut (our forecast since April), there is less confidence in the path forward.

Hence, we are calling for frontloaded, back-to-back cuts from the RBA in July and August, while holding off a cut till Q4 to see how the economy rebounds, if at all. If the RBA chooses to wait for Q2 growth data, there is a risk of falling materially behind the curve, with growth continuing to stagnate. Our cash rate forecast for the end of this year remains 3.10%.

Investment Implications

With the less than rosy outlook for Australian growth, absent further policy support, it would follow that investors should seek investment opportunities in global markets. Despite the extreme levels of geopolitical and trade policy uncertainty, global markets have shown great resilience and recovered pretty much all the “Liberation Day” losses to now be setting new highs. However, with the US tariff pause due to end in July, the global economy could facing another period of uncertainty and market volatility while new trade deals or tariffs are announced.

We continue to recommend maintaining a medium to longer term timeframe when setting investment strategy and focussing on diversification and defensiveness in the portfolio. Within equities, investors should look to tilt portfolios towards quality and low volatility factor exposures – that is companies with strong profitability and balance sheets. Other asset classes that would be attractive in the current environment would be Australian fixed income, both government and corporate bonds, with interest rates likely to fall with a lower inflation and growth outlook. Gold is another asset class that currently warrants attention and, together with fixed income, will help investors weather the potential volatility ahead.