Scaling advice without compromise: How ETF model portfolios are reshaping practice efficiency

In today’s evolving financial landscape, advisers are under increasing pressure to deliver more value to clients, to be faster, smarter, and with greater consistency. The challenge for many advisers is balancing the provision on personalised advice with operational efficiency. As client expectations evolve, advisers must find scalable solutions that maintain high standards of investment management.

This is where managed accounts, in particular ETF model portfolios, have emerged as a transformative force. Over the past decade, these portfolios have revolutionised how advice is delivered across Australia, offering a compelling blend of efficiency, transparency, and strategic flexibility.

The rise of managed accounts

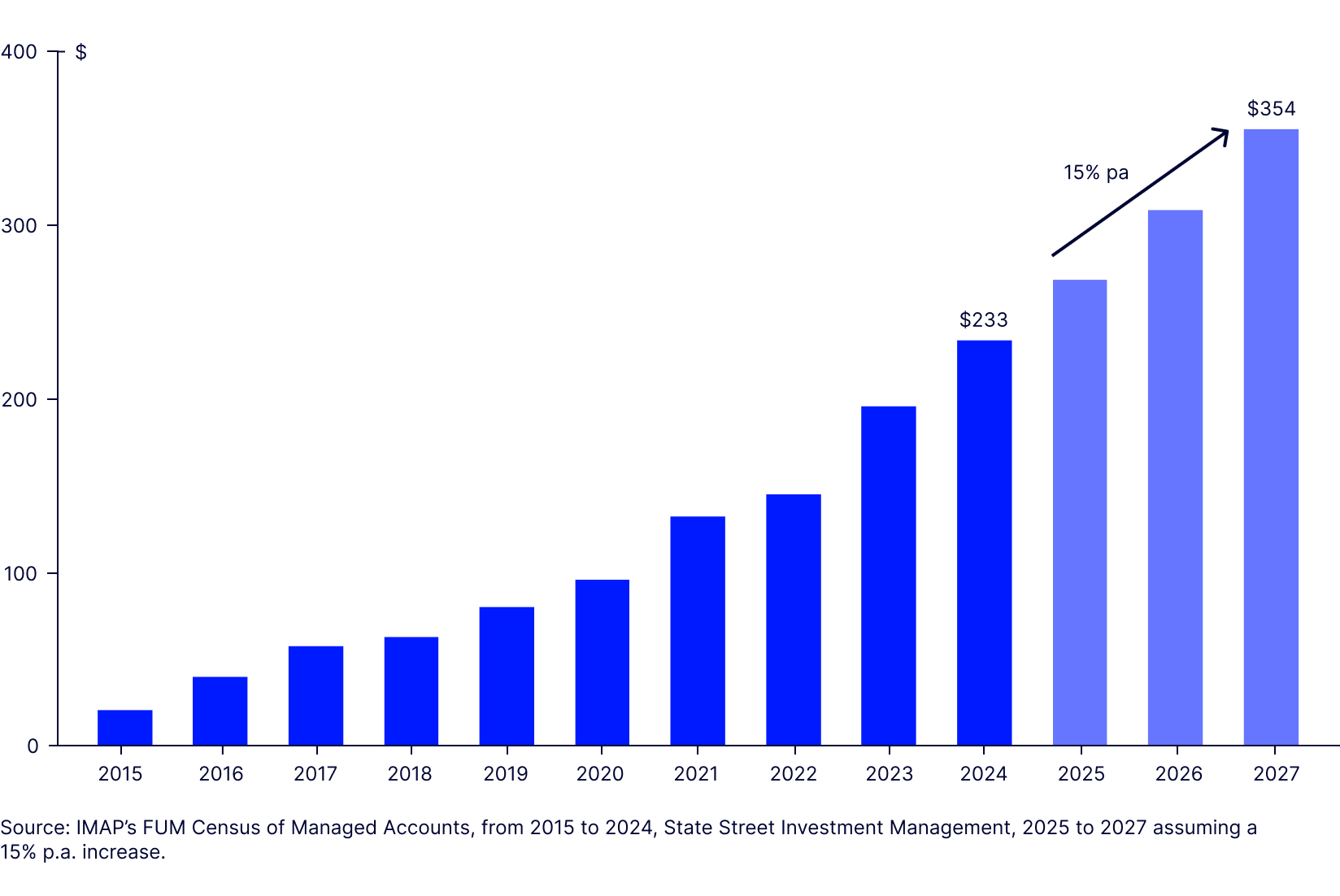

The managed account market in Australia has experienced extraordinary growth. As of December 2024, Funds Under Management (FUM) reached $232.77 billion, up from $188.85 billion the previous year, a 23.2% annual increase and 20% 5 year CAGR.1 Applying continued growth at 15% p.a. will have managed accounts at over $350 billion by 2027.

Figure 1: Managed accounts FUM

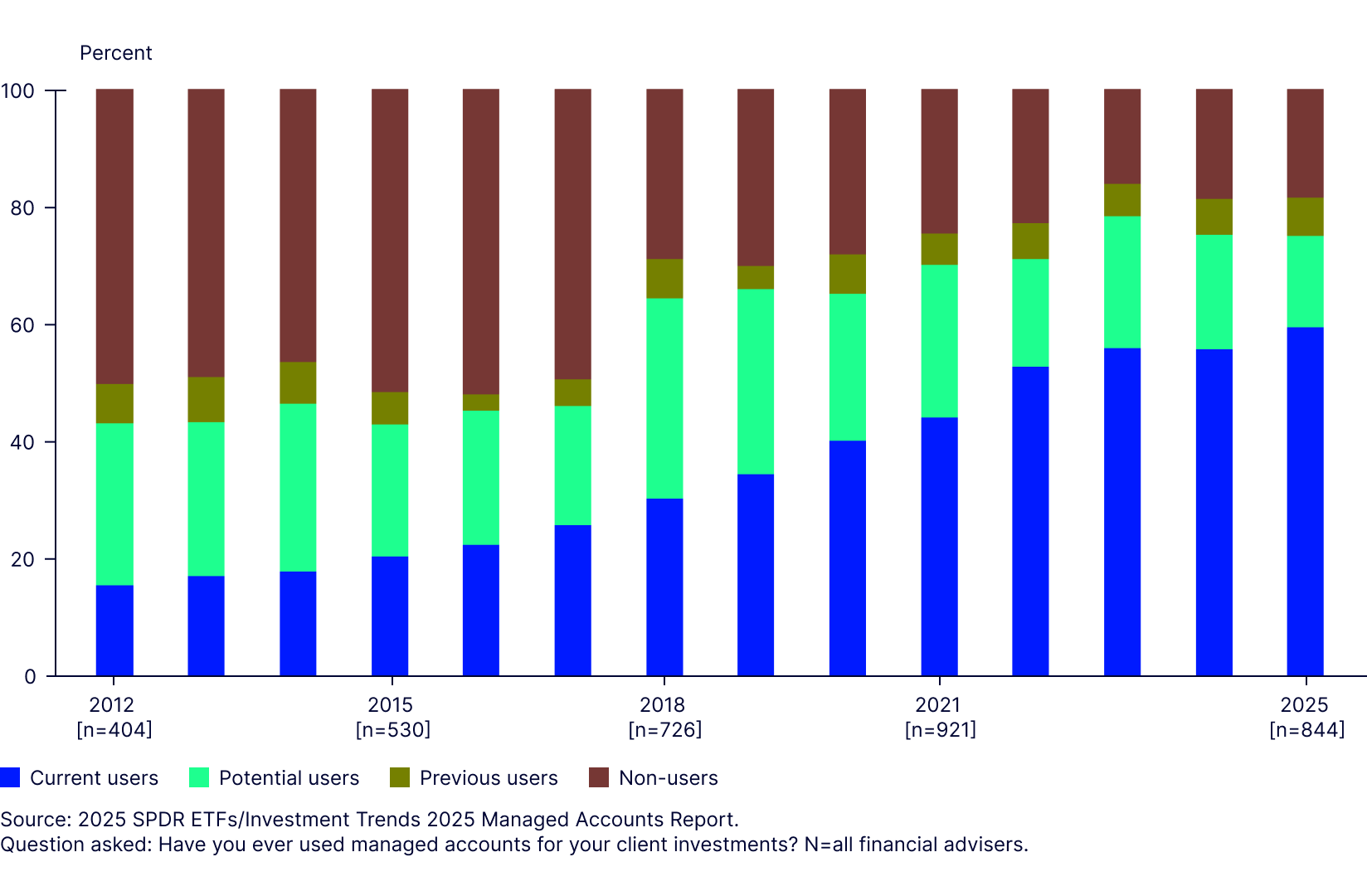

This surge reflects a broader shift in adviser behaviour: nearly 60% of Australian advisers now use managed accounts, up from just 20% in 2015. And the momentum isn’t slowing, with an additional 16% of advisers expected to adopt managed accounts in the next 12 months.2 This adoption curve signals a fundamental change in how advice is structured and delivered.

The increasing popularity of managed accounts is not just a trend—it’s a strategic evolution. Advisers are recognising the value of outsourcing investment management to focus on client relationships, strategic planning, and business growth.

Figure 2: Managed accounts adoption continues to increase

Managed accounts a driver of ETF adoption

The growth of managed accounts in Australia is closely tied to the rise of ETFs. With over $250 billion in assets under management, 3 the Australian ETF market now spans all major asset classes; from equities and fixed income to infrastructure, emerging markets, and sustainable investing themes.

Within managed accounts, multi-asset class ETF model portfolios have become the dominant strategy, representing 68% of recommendations over the past year. Investment managers favour ETFs for their cost efficiency, liquidity, and transparency, making them ideal for scalable, professionally managed portfolios.

State Street’s ETF model portfolios exemplify this approach, using diversified Australian-listed ETFs to tailor allocations across moderate to high growth profiles, positioning ETFs as strategic enablers of practice efficiency. These portfolios are designed to meet a wide range of client needs while maintaining consistency and control.

ETF model portfolios offer advisers a way to deliver robust investment solutions without the administrative burden of managing individual securities. This allows for more consistent outcomes and better alignment with client goals.

Efficiency without sacrificing quality

One of the most compelling reasons advisers are using State Street ETF Model Portfolios is the ability to scale efficiently without compromising on quality. The Investment Trends report highlights that advisers cite full asset allocation (46%) and streamlined portfolio management as key drivers of adoption. Advisers using managed accounts allocate, on average, 71% of their clients’ total assets into these vehicles. Further and among existing users, nearly 50% of new client inflows are directed to managed accounts.

Some of the benefits advisers we work with have explained that in using /outsourcing investment management to State Street, they can:

- Deliver consistent, research-backed investment outcomes

- Reduce time spent on portfolio construction and rebalancing

- Focus more on client engagement and strategic planning

Freeing up time for what matters most

Perhaps the most transformative benefit of ETF model portfolios is the time they give back to advisers. The 2025 Investment Trends report found that advisers save an average of 23.9 hours per week using managed accounts. Many use this time to acquire new clients (26%) or enhance client experience (25%).

With less time spent on investment administration, advisers can deepen client relationships, scale their practice, and focus on delivering holistic advice.

As the managed account market matures, the message is clear: scaling advice doesn’t have to mean compromising on quality.

The benefits are transcending to improved client satisfaction

Our 2024 survey of investors’ views towards working with financial advisers4, found that 74% of Australian investors want more personalised advice from their adviser that covers a comprehensive view of their financial priorities. Our survey further revealed that as ETF model portfolios become more embedded in advisory practices, investor awareness is rising from 47 percent in 2019 to 67 percent in 2024. This increased familiarity is also translating into stronger client satisfaction. Australian investors who know their assets are in model portfolios highlight low fees, improved portfolio monitoring, and more of their advisor’s time as some of the benefits.

When clients understand the strategy behind their portfolios, trust deepens and so does their confidence in the adviser relationship. Moreover, we found resistance to model portfolios is low. Only 5% of investors say they “wouldn’t like it” if their adviser moved their assets into models. Roughly half are either indifferent or simply want more information. This openness presents a clear opportunity for advisers to educate clients and position model portfolios as a strategic advantage.

A strategic shift in adviser mindset

The adoption of ETF model portfolios reflects a broader shift in adviser mindset. Rather than viewing investment management as a core differentiator, many advisers now see it as a function that can be efficiently outsourced to trusted partners. This allows them to focus on areas where they add the most value; client engagement, financial planning, and strategic advice.

Moreover, the scalability of ETF model portfolios makes them ideal for practices looking to grow. These solutions are being used across the spectrum of client wealth, advisers can tailor solutions that are both cost-effective and high-quality.

Looking ahead: The future of scalable advice

As the managed account market continues to grow , the message is clear: scaling advice doesn’t have to mean compromising on quality. ETF model portfolios offer a powerful solution for advisers seeking to grow their practice while maintaining high standards of investment management.

At State Street, we remain committed to supporting advisers with innovative, research-driven portfolio solutions that empower them to deliver exceptional outcomes. As we look to the future, we see ETF model portfolios playing an even greater role in reshaping the advisory landscape in Australia.

The journey toward scalable, high-quality advice is well underway. With ETF model portfolios, advisers have the tools they need to thrive in a complex, fast-moving financial world.