The total cost of ownership

Investors need to look beyond the ETF’s expense ratio to assess a fund’s total cost of ownership. Otherwise it could wind up costing more money in the long run. Because ETFs trade like stocks on exchanges, trading costs also contribute to the total cost of owning an ETF. And these costs can fluctuate significantly.

It is not surprising that in today’s environment, expenses are top of mind. Many investors focus on a fund’s expense ratio to determine if it is “low cost.” But when selecting an Exchange Traded Fund (ETF), investors need to look beyond the expense ratio to assess a fund’s total cost of ownership. Otherwise it could wind up costing you more money in the long run and erode a portfolio’s total return.

An expense ratio doesn’t capture the full ETF cost

The expense ratio reflects only what it costs to hold an ETF – which is just one important part of the total cost of ownership. It represents the portion of your investment that the fund charges on an annual basis for management fees. All else being equal, lower expense ratios are positive for investors.

Because ETFs trade like stocks on exchanges, a number of trading costs also contribute to the total cost of owning an ETF. And these costs can fluctuate significantly depending on everything from the individual fund’s trading volume to market volatility.

- Bid/ask spreads: This is the difference between the price a buyer is willing to pay for shares and the price at which a seller will sell. It is driven by several factors including the ETF’s trading volume and the liquidity profile of the underlying securities. For example, as an ETF’s trading volume increases, so does its profile in the market, attracting a broader range of investors, traders and liquidity providers. The increased competition leads to tighter bid/ask spreads, making trading more cost-effective.

- Commissions: Trading commissions have declined over time due to competitive forces. Some wealth management platforms now offer certain ETFs to trade for free. Investors should not choose an ETF solely for this reason, because a high expense ratio or a wide bid-ask spread can cost a lot more than what you save on commissions.

Figure 1: The total cost of ETF ownership

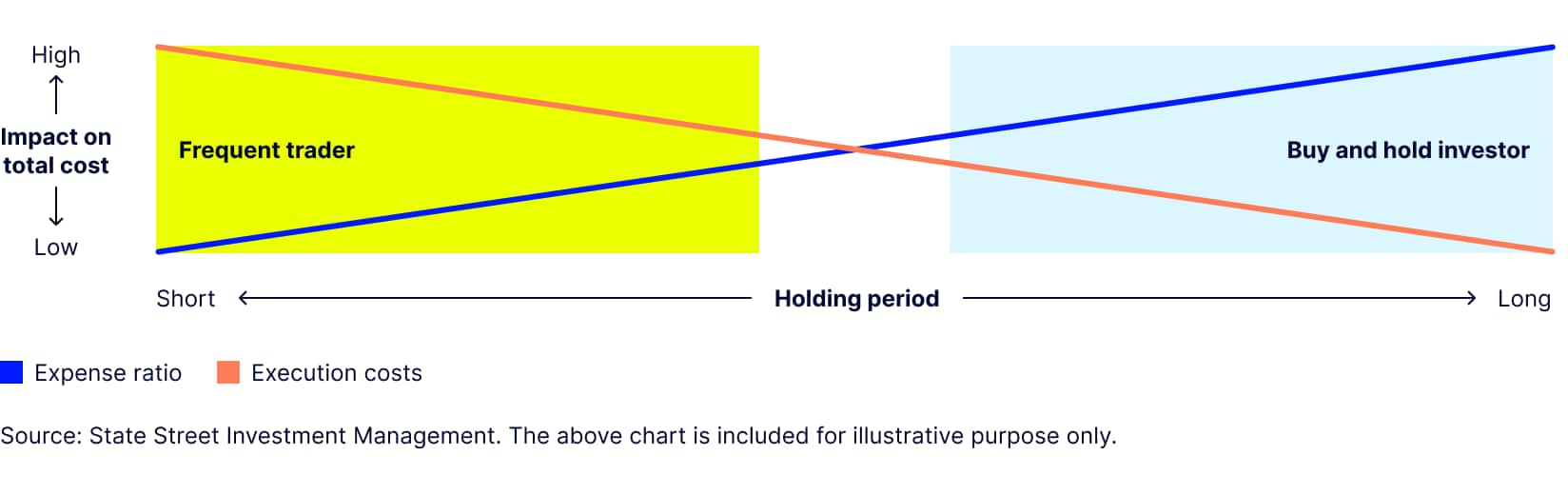

It’s important to consider your time horizon

One question to consider before selecting a fund is how you will be investing and using the ETF you are evaluating. The ETF that best meets your needs may depend on whether you intend to hold it for a short or long term.

If an investor expects to trade frequently to better manage exposures within a portfolio, execution costs such as spreads and commission may be the prevailing factor for total cost-of-ownership consideration. Alternatively, in instances where a buy-and-hold ETF strategy is being implemented, the annual management fee may be the prevailing factor for total-cost-of-ownership consideration.

Figure 2: The total cost of ownership through a holding period lens

Striking the right balance

There is no one-size-fits-all approach to optimising for the total cost of ownership, and it helps to consider your circumstances more broadly. For example, if you rebalance your portfolio on a regular basis, the rebalancing frequency will have impact on trading costs – the more frequent the rebalancing, the higher the costs to trade. Additionally, if the amount of portfolio turnover is high, this will be reflected in the trading costs, and therefore the total cost of ownership.