Look Beyond the Headline Costs for Model Portfolios

- With 1100 unique model portfolios available in Australia investors should consider a range of factors, including cost.1

- Investors are encouraged to look beyond the headline investment management fee.

- Additional costs can vary, and can detract from investors returns.

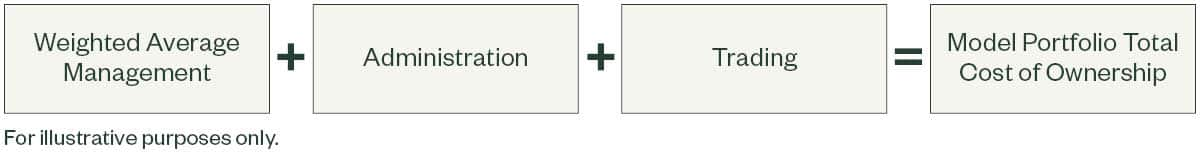

In an environment of ongoing fee compressions, model portfolio expenses are top of mind. Many investors focus on a model portfolios investment management fee relative to similar investment styles and approaches to determine if it is priced appropriately. This is a problem because it doesn’t incorporate the total costs associated with implementing a model portfolio. To better understand the cost of a model portfolio we break down the total cost of ownership.

What is the Investment Management Fee

The investment management fee can generally be broken down into two parts :

- Weighted Average Management Cost: is the weighted average costs of the underlying investments, such as ETFs and Managed Funds, included in the model portfolios. It is the investment managers responsibility to understand the fee’s associated with each vehicle included in the portfolio and to manage the weighted average management cost.

- Investment Management Fee: This is the fee an investment manager will charge for the ongoing investment management services related to the model portfolio. Services include rebalancing to target weights, and monitoring and responding to market changes. This additional fee is being compressed to zero, due to a global trend where investors are no longer willing to accept this fee when proprietary products are the underlying assets within the model portfolio.

Where the model portfolio is implemented as a non-unitised registered managed investment scheme, for example a separately managed account, a Responsible Entity manages the scheme. In most instances the Responsible Entity will charge a fee, and this may be described as, or be recouped from, the investment management fee. The Responsible Entity can also be the administrator, and may have limited involvement in the investment management of the model portfolio, delegating these duties to an investment manager.

It’s important to understand the party that benefits from the investment management fee. The product disclosure statement can provide details.

Look Beyond Headline Costs

Investment management fee’s is just one of the components of the total cost of ownership for a model portfolio. There is a range of other costs to consider beyond this headline. The model portfolio administration cost for different asset classes and trading cost are such examples. These costs can fluctuate significantly and can potentially reduce investors returns.

- Administration Fee: Typically, Australian investors can access model portfolios through a managed account. Managed accounts are available on investment management platforms. The platform will charge an administration fee to administer the investors’ managed account, often the fee is a percentage based fee of the model portfolios total assets. Investors are encouraged to understand the range of administration fees as different asset classes within a model portfolio have the potential to significantly impact the total cost to client.

- Trading Cost: Depending on your rebalancing size and frequency, trading costs can accumulate significantly and have a large impact on the total cost of ownership. Generally, a model portfolio with more underlying assets and frequent trading will have larger trading costs. Therefore, it’s important to determine if an underlying asset is a value add. Be sure to ask the question – what is the optimal number of underlying vehicles to enhance expected return? Often a lengthy list of underlying vehicles can be reduced to enhance returns and reduce trading cost. In this case less can be more! (Provided that the model portfolio remains sufficiently diversified.) The State Street ETF Model Portfolios have been crafted with trading cost in mind, incorporating vehicles that are additive to portfolios expected return. In addition to the number of underlying assets, an active strategy may result in more frequent trading, however, investors need to ascertain if the cost of frequent trading is adding value or reducing returns.

Figure 1: Model Portfolios the Total Cost of Ownership