Monthly Fund Commentary State Street Floating Rate Fund

In December, the State Street Floating Rate Fund returned 0.36% (net), outperforming the benchmark by 0.03%1.

Australian short-dated yields continued their upward trend through December, extending the repricing that began in late October. The move reflected a decisive shift toward a “higher for longer” stance as markets digested resilient domestic data and the RBA’s commitment to keeping policy restrictive until inflation returns to target. While November headline CPI surprised slightly to the downside (+3.4% y/y vs ~3.6% expected), inflation remained well above the 2–3% band, and the market steadily priced out any residual easing expectations.

Early in the month, sentiment was cautious, but stronger household spending quickly reinforced the hawkish tone, with traders starting to factor in the possibility of a February hike and more tightening through 2025. Positioning around key futures expiries added momentum, and the short end stayed under pressure into year-end as the risk skew tilted toward additional RBA tightening rather than cuts. Overall, the tone was one of bear flattening and persistent upward pressure, reflecting confidence that policy would remain restrictive for longer. The market is anticipating a busy start to 2026 for issuances and the fund is well positioned to take advantage of these opportunities. The outlook for spreads remains constructive with the current senior unsecured discount curve still looking very attractive given the prevailing interest rate outlook. The fund continues to deliver strong performance and attract consistent inflows.

The State Street Floating Rate Fund has outperformed its benchmark over all time periods net of fees, delivering +0.97% of alpha over the past 12-months, +1.23% p.a. over the past 3-years and +0.87% p.a. since inception.

Looking ahead

Market update and outlook

December saw Australian fixed income endure a second consecutive challenging month to close out the year. The Bloomberg AusBond Treasury 0+ Yr Index declined -0.76%, while the broader AusBond Composite Index fell -0.68%. The selloff was driven by a renewed hawkish repricing of RBA policy expectations, following sticky inflation signals and resilient domestic demand.

As expected, the Reserve Bank of Australia left the cash rate unchanged at 3.60% at its December meeting. The statement was brief but carried a distinctly hawkish tone, removing earlier references to downside risks and emphasizing the Board’s growing discomfort with inflationary pressures. Minutes released later in the month revealed that members debated whether financial conditions were sufficiently restrictive and acknowledged that the economy was still operating with a positive output gap. The Board highlighted three key considerations: excess demand relative to supply, the trajectory of labour market strength, and uncertainty around the new monthly CPI series. While the RBA judged it premature to draw firm conclusions from volatile monthly data, it placed significant weight on the upcoming Q4 CPI release ahead of the February meeting. Governor Bullock reiterated that interest rate cuts are not on the horizon, and while a hike was not explicitly discussed, scenarios that could warrant further tightening in 2026 were debated should inflation prove more persistent.

As we enter 2026, we think the near-term trajectory for Australian rates remains skewed to the upside as persistent inflation and the RBA’s hawkish bias keep easing expectations firmly off the table. While the December meeting reinforced a “higher-for-longer” stance, the Board’s emphasis on data dependency means upcoming CPI prints and labour market trends will be pivotal in shaping the path forward. Household spending is emerging as a critical swing factor. The RBA expects demand to remain resilient, supported by strong employment and housing activity, which would reinforce excess demand and heighten inflation risks. Any signs of moderation could ease pressure on the Board, but for now, risks remain tilted toward further tightening rather than cuts.

Bottom line

“In the middle of every difficulty lies opportunity.” — Albert Einstein

Albert Einstein, one of history’s most influential physicists, was renowned for his ability to see simplicity and possibility in complex systems. His insight applies as much to markets as to science: challenges often create the conditions for advantage.

Rather than fear volatility or policy uncertainty, investors can use these dynamics to uncover opportunity. Elevated rates and persistent inflation risks may feel like headwinds, but they also create a landscape where floating rate instruments thrive. By focusing on flexibility, short duration, liquidity, and instruments that reprice with policy – portfolios can turn difficulty into strength. In practice, that means leaning into structures that benefit from higher reference rates, maintaining optionality to capture new issuance, and staying nimble as data surprises emerge. The goal isn’t just to withstand uncertainty; it’s to position portfolios so that the very forces creating difficulty become drivers of return.

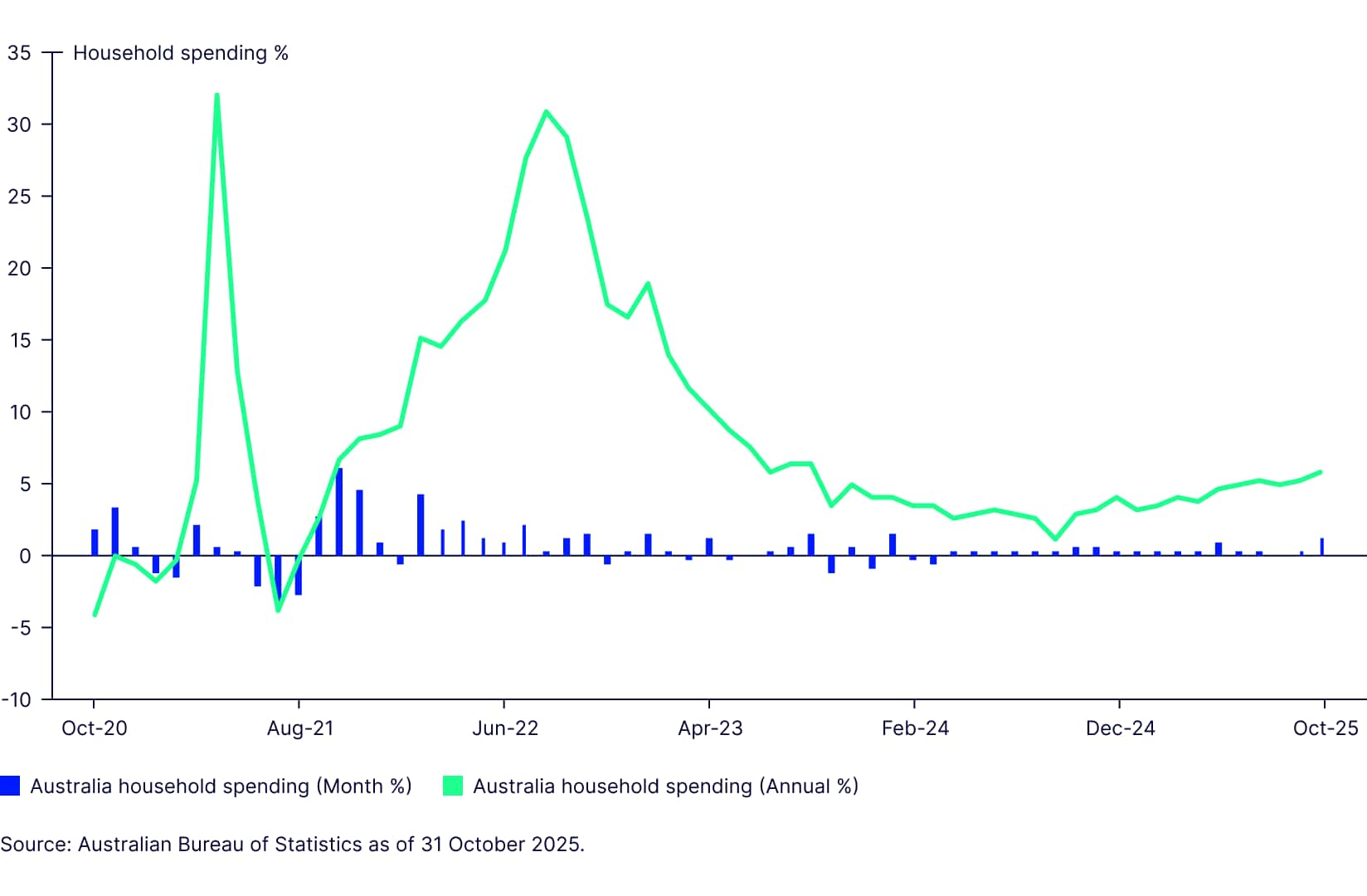

Australian front-end pricing has shifted meaningfully higher, reflecting a market that now embeds a non-trivial risk of additional hikes in 2026. Recent Australian Bureau of Statistics (ABS) data highlighted in Figure 1 shows household spending rose 1.3% in October – the biggest increase since January 2024 and more than double the consensus forecast of 0.6%. Year-on-year, spending is up 5.6%, driven by strong discretionary demand despite restrictive policy, supported by robust employment and housing activity. The household saving ratio (see Figure 2) remains elevated at 6.4%, providing an added cushion. This resilience reinforces the RBA’s hawkish bias and keeps inflation risks elevated, making a “higher-for-longer” stance the base case. With the implied overnight rate curve showing persistent strength through 2026, portfolios should expect elevated reference rates to endure and position accordingly.

This backdrop creates a constructive environment for the FRN market. Coupons reset off BBSW, so income steps up automatically as reference rates rise without adding duration risk – a key advantage when yields are trending higher. Liquidity remains deep, with major bank issuance accounting for nearly half the market, and we expect robust supply early in the year as issuers take advantage of strong demand. For investors, this means clear entry points, tactical flexibility, and the ability to harvest elevated rates efficiently while maintaining high credit quality and low volatility.

Figure 1: Australian household spending

The table above displays the current price, seasonally adjusted estimate.