Canada Snapshot

Canadians are slightly more optimistic about retirement than two years ago, but their confidence lags the global average. In this snapshot, explore the reasons why — and how more education and resources may help.

Canadians are looking forward to retirement — whether that takes the shape of a simpler lifestyle, traveling, or taking up new hobbies. But they have concerns about being able to realize those hopes and are looking for help to achieve the financial security necessary to get there. Our Global Retirement Reality Report (GR3 ) provides insight into the factors shaping retirement savers' confidence and suggests actionable steps plan sponsors can take to help members turn their retirement hopes into reality.

Optimism Holds Steady But Remains Low

We first included Canada in our Global Retirement Reality Report (GR3) survey in July 2023 to gain insights into Canadian worker sentiment on retirement, including their confidence levels, preparedness, and the factors that shape their outlook.

Conducted in April 2025, our most recent survey finds optimism about financial readiness to retire increased two percent from July 2023, with 21% of those surveyed saying they feel very or extremely optimistic that they'll be prepared for retirement, while 35% feel somewhat optimistic. Of all countries surveyed, only UK repondents are less optimistic, with just 20% saying they are very or extremely optimistic.

Digging deeper, stark differences emerge by age cohort and gender. Continuing a trend, women expressed lower optimism than men, with nearly half indicating they're not at all or only slightly optimistic about their retirement prospects.

Figure 1: The Gender Confidence Gap

Globally, the most optimistic age group is the youngest surveyed, perhaps because retirement feels more distant and they presume they'll have the time needed to save. But optimism increases significantly for those closest to retirement in Canada.

Interestingly, for those aged 65+ optimism was greater among those with access to financial advice. Older retirement savers were more likely to rank ‘confidence in their retirement savings plan being invested wisely’ (61% versus 35% overall) and ‘having a financial advisor’ (39% versus 15% among all respondents) as top reasons for their optimism.

Given the fact that [I] will reach retirement age in many decades and that the world is fast evolving, it's difficult to envision any specific scenario…the version of retirement for my generation will be different from that of our parents or grandparents.

Figure 2: Positive Sentiment Highest Among 65+

Inflation Erodes Confidence, While Low Debt Boosts It

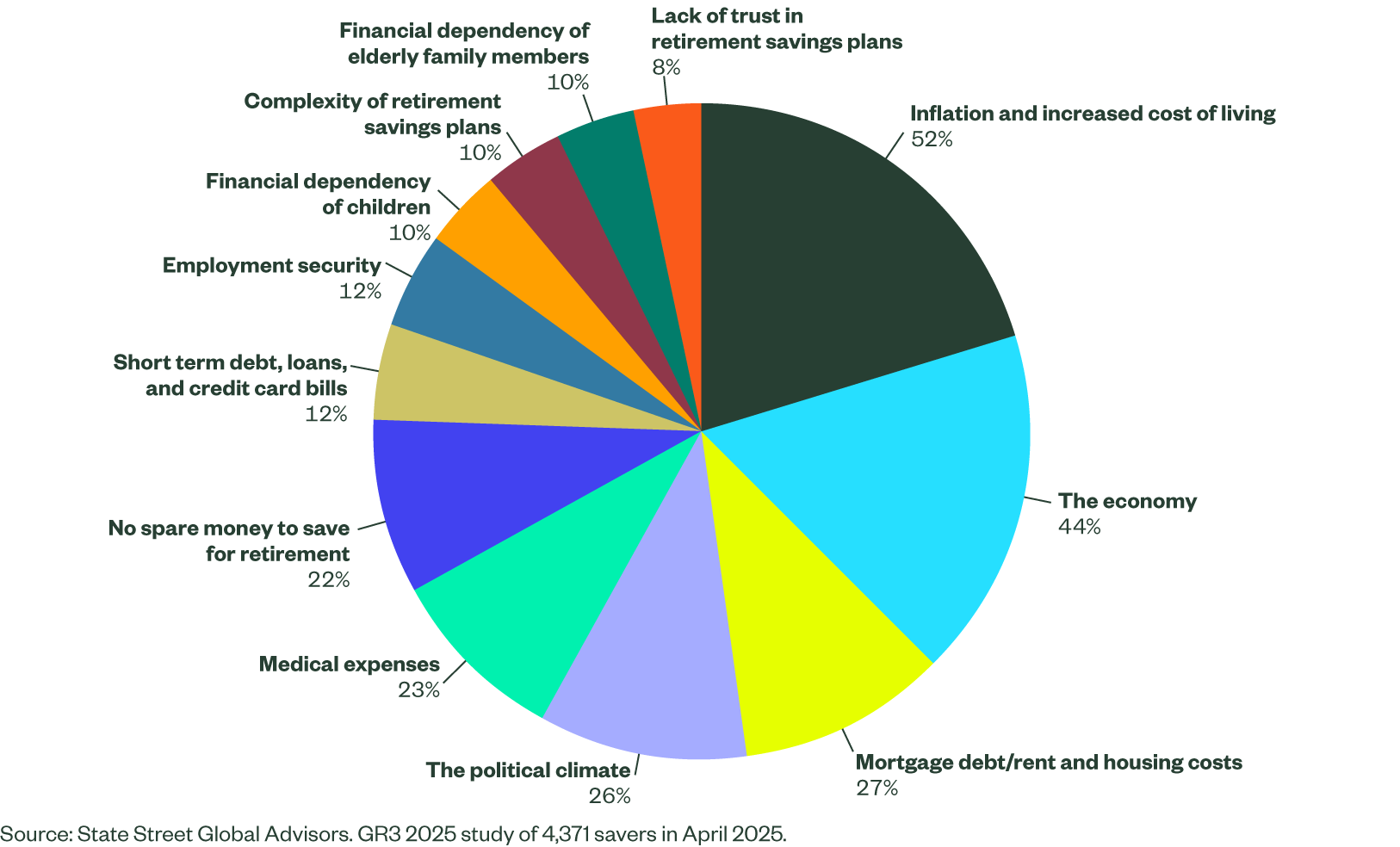

As the world navigates market volatility and the implications of tariff policy implementation, over half of respondents point to inflation and the increased cost of living as a principal factor negatively influencing their retirement confidence. Uncertainity about the economy ranks high as well and resonates globally. Mortgage or housing costs, and lacking extra money to save for retirement, were also frequently cited.

I am currently in a defined contribution pension through my employer. It is imperative for me to have my house paid off and as little debt as possible, but also for the stock market to be in an upswing when I retire. I am hoping to switch to a defined benefit plan which will allow me to plan better.

Figure 3: Barriers to Retirement Confidence

In line with global trends, Canadians cite having little to no short-term debt as the highest ranked factor boosting their retirement confidence, followed by the ability to save for retirement. Over a third cited having confidence that their retirement plan is invested wisely as another positive influence. Factors positively influencing confidence were mostly consistent across all age groups, but having a financial advisor doubled for respondents aged 65+.

Canadians' Retirement Plans Are Shifting

Of the countries surveyed, Canada has the lowest average expected retirement age at 64, with nearly half (49%) planning to retire before age 65. However, nearly half lack confidence in being able to retire when planned.

This wariness may be well-founded as the number of those 65 and older still working has increased almost 5% from 2020 to 2024,1 with the average retirement age increasing from 64.3 to 65.3 over the same timeframe.2 This could be due to a number of factors: lack of knowledge about how to plan for retirement income, the rising costs in Canada’s housing market, stock market volatility, and other economic influences.

Figure 4: What Age Do You Expect to Retire?

Still, more than half (54%) expect to eventually retire, with about a third expecting to partially retire, a figure that increases with age. While reasons for this may vary — wanting to remain active, pursuing a new career, or financial necessity — it reinforces that members need education earlier in their savings journey to better understand what it takes to be financially prepared to achieve the lifestyle they want.

I envision myself taking in a hobby that generates income as well as living off of my RRSPS and old age pension. I don't currently have a plan in how to get there.

Unsurprisingly, income also plays a role. Only 9% of workers earning less than $40,000 per year believe they will have enough savings to retire and 42% expect to continue working past retirement age.

Figure 5: The Critical Role of Income

While Canadian workers rank their RRSP as the top source of income in retirement, they also heavily rely on their own personal savings and public pension to sustain their retirement.

Figure 6: How Do You Plan to Take Income in Retirement?

Decumulation strategies play a critical role in supporting workers’ retirement readiness. When it comes time to access their retirement savings, 35% aren't sure what to do with their savings, even as they approach retirement (30% of those aged 55-64). However, 43% were at least somewhat likely to keep their money in their retirement plan if it provided income.

The Knowledge Gap

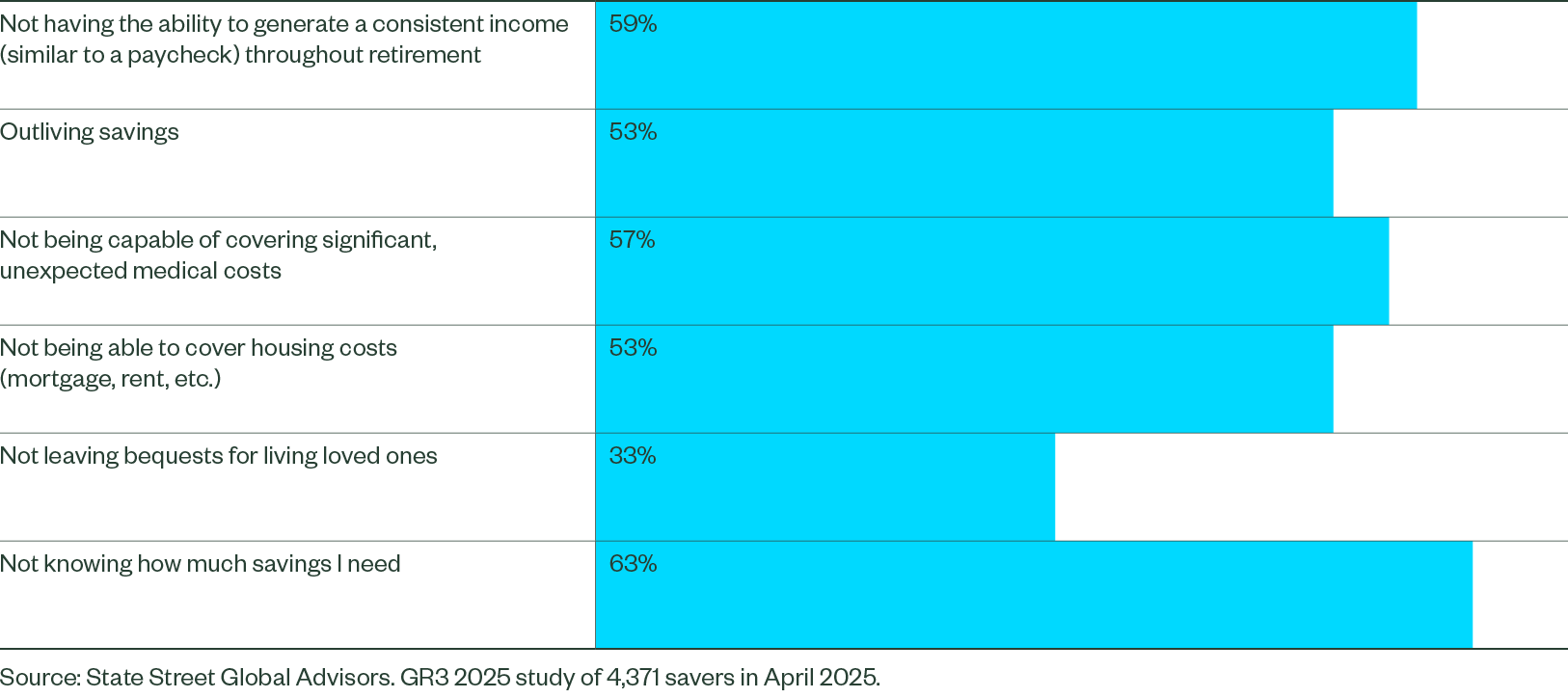

In addition to the broader economic and political environment, workers struggle with concerns closer to home that are within their control. While most anticipate needing over half of their current income annually in retirement, they don’t know how much total savings they’ll need to accumulate to be able to retire. Understandably, they’re also worried about outliving their savings and not being able to generate a consistent income throughout retirement.

Figure 7: Most Respondents Say They Will Need Half Their Current Income

Figure 8: Concerns About Retirement Income

These concerns may be exacerbated by a lack of financial knowledge. About half rate their financial knowledge as basic, or as having none at all. But of the countries surveyed, Canada has the highest percentage of those investing outside of their retirement plan (63%). Of these, nearly 4 in 10 work with a financial advisor, and the same number make their own investment decisions.

They're most interested in retirement planning and investment advice, but also seek guidance on tax planning, debt management, estate planning, and help financing their children’s and/or grandchildren’s education. Personalized service is the top factor in selecting an advisor, but specialization, being a trusted brand, and recommendations also rank high.

I expect to live comfortably when I retire and plan to travel and hopefully the advice I am receiving will help me to achieve this.

Moving From Confidence to Readiness

In our 2023 survey, respondents clearly indicated that they bear primary responsibility for their retirement, but our data shows that they need — and want — help. Employers and their trusted partners play a vital role in closing gaps through education and sustainable retirement income strategies.

The Guidelines for Capital Accumulation Plans (CAP Guidelines), updated in September 2024, aim to improve retirement readiness by introducing a more robust framework for plan sponsors in administering defined contribution plans, including a greater emphasis on educating members on plan features and investment options.

As employers develop communications and resources, they should be tailored to the specific concerns of different life stages. Individuals who are five years away from retirement have different worries than those 20 years away. The top concern for those aged 55-64 is outliving their savings, while for those aged 18-34, it's not being able to cover housing costs for them, immediate needs top saving for retirement.

Women face unique challenges as well, including earnings disparities, career gaps, and a tendency to rate themselves as less knowledgeable about financial matters. Additionally, women have a longer life expectancy and are more concerned than men about inflation and the increased cost of living. (56% vs. 47%) and the economy (47% vs. 41%). They're also less likely to know what to do with their RRSP at retirement (42% vs. 29%).

Interestingly, 19% of respondents are open to AI-generated advice, with an additional 23% open to it if overseen by a real person. Younger generations are particularly more receptive to AI-generated advice, presenting an opportunity to provide advice at scale.

By understanding and addressing these diverse needs, employers and their partners can provide more effective support and guidance, ensuring that all members are better prepared for their retirement.

We work together with DC plans and providers to design strategies that align with evolving member needs by focusing on value, flexibility, and confidence-building solutions. Please get in touch to discuss how we can help. Working together, we can help people turn their retirement hopes into retirement reality.

Bridge the Retirement Confidence Gap

Don’t miss our global retirement study of more than 4,000 savers worldwide. Uncover the forces shaping sentiment, savings behaviors, and income expectations — and the ways institutions can play a vital role now in helping people turn their retirement hopes into reality.

About This Survey

Our global online survey, conducted during April 2025 with international data analytics firm YouGov, engaged a total of 4,371 individuals participating in workplace-sponsored savings plans (or the market equivalent) in Canada, Australia, Ireland, the UK and the US. Surveyed countries represent a range of retirement systems. Gender, age, and regional quotas were balanced to reflect employed populations within each country.