Light at the end of the tunnel…but not yet

Macroeconomic Outlook

It appears that the light at the end of the tunnel is further away than initially anticipated. The macro uncertainty from elevated inflation and the central bank efforts to stem this now seems destined to continue. The markets are now embracing the “higher for longer” narrative and pushing out expectations for rate cuts.

In recent months, the Fed, BoE, and Reserve Bank of Australia (RBA) left interest rates unchanged. The primary theme in all the commentaries for the pause was quite hawkish indicating caution against letting inflation get out of hand and warning that interest rates could stay elevated for a longer period of time. The surge in oil prices over the last quarter, and now, potentially, the breakout of war in the Middle East, has maintained the significance of the said concerns.

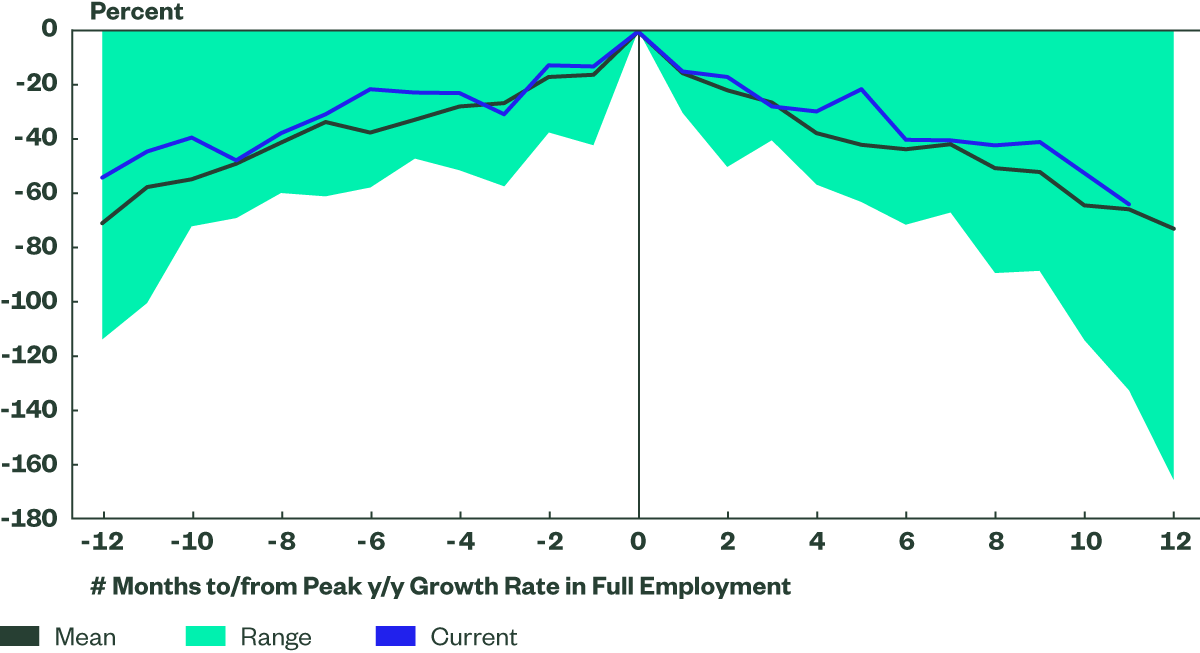

The thorn in the side for global central banks has been the strong labour markets. It is as if the policy tightening is set to quell the inflationary flames, only for the skewed labour supply to stoke them. In the US, payroll gains and jobless claims have exhibited positive momentum in recent months. Although the consensus view is that the Australian labour market is strong, we believe that it is cooling. In Australia, the September rise in employment came in below than consensus, as the economy added just 6,660 jobs against expectations of 20,000. Nearly 958,000 people are working multiple jobs, over 200,000 more than before the pandemic. Additionally, about 90% of the 63,300 jobs added in August were part-time and the growth in part-time employment offset the fall in full-time employment in September (+46,500 vs -39,900). This is consistent with the countercyclical nature of part-time employment, rising while full-time employment cools during slowdowns. Furthermore, the annual growth of employment in the current cycle peaked in October 2022; by September 2023, the growth rate slowed to below the half of the peak level, this is also consistent with the historic cycles.

Figure 1 – Full Time Employment Is Cooling In Australia

Source: State Street Global Advisors Macro Research Team, Australian Bureau of Statistics (ABS), and Macrobond as of 30 September 2023.

Notwithstanding inflation, monetary tightening has had its effect on the rest of the economy. Recent economic readings in the US have home sales down and consumer confidence down-trending. The domestic economy is showing a similarly mixed picture. The YoY inflation came in as expected at 5.2% but the MoM number ticked up. The Q2 GDP forecast met expectations at 2.1% YoY, although household consumption has shown only modest growth. The lockdown-induced savings, which up until now have been supporting household consumption, have witnessed a large drawdown. Retail sales continued to downtrend in August. However, within that, clothing and footwear, and cafes & restaurants rose. Exports have also provided support to the economy. Overall, the picture is not quite as gloomy compared to peers with Australia having a lower recession risks than many other developed economies. This is partly to the credit of the RBA.

The RBA has tended to approach rate hikes with greater restraint than other global central banks, only raising rates by a cumulative 400 bps versus 525 bps by the Fed (Figure 2). Instead, the RBA has opted for several hawkish pauses instead. The pause in October serves an example of this stance. A hike is still an option for November, when a new set of inflation data will be out, as well as more information on the potential supply side shock in oil markets from the Middle East conflict.

The uncertainty of the central bank tightening cycle has become evident in the bond markets. Bond yields rose across global markets over the last quarter. It is important to note here that the rise in yields has also been partly attributed to the increase in supply of treasuries. However, the markets seem to have accepted that it will be a while before central banks start unwinding the policy tightening. In the short term the expectations are for yields to continue their ascent, albeit at a slower pace and smaller magnitude. The break in this ascent is inevitable, but the timing is not. Our expectations are that over the next few months the tighter monetary conditions will show a material effect on economic growth. However without any decline in inflation, policy reversal is unlikely. Aside from an exogenous shock, like geopolitics, we believe that a sustained fall in yields is only possible with policy reversal. Investors are therefore recommended to exercise caution with fixed income. The decadal high yields are favorable for income return but further yield ascension can be costly for fixed income price returns.

We favour a diversified quality defensive equity approach in the present climate. Defensive equities are more equipped to endure economic uncertainty. They are characterized by short duration earnings, high margins, and stable operations which are less exposed to the high rate environment. These characteristics cushion portfolios against broad market drawdowns. Simultaneously, it is also important to geographically diversify equity exposure in this environment. A large exposure to the domestic market makes the portfolio vulnerable to idiosyncratic moves in the one market. The table below (Figure 3) highlights the sector differences between MSCI World and regional developed market indices. The Australian domestic market has large overweights to Financial (value) and Materials (cyclical) sectors and a large underweight to IT (growth and quality).

Figure 3 – Sector Tilt vs MSCI World Index

| S&P ASX 200 | S&P 500 | MSCI Japan | MSCI Europe | |

| Communication Services | -3.3 | 1.5 | -0.1 | -4.1 |

| Consumer Discretionary | -4.0 | -0.2 | 8.6 | -0.2 |

| Consumer Staples | -2.6 | -0.6 | -1.1 | 5.0 |

| Energy | 0.7 | -0.5 | -4.3 | 1.1 |

| Financials | 13.7 | -2.2 | -2.2 | 2.9 |

| Health Care | -3.8 | 0.5 | -4.3 | 3.4 |

| Industrials | -3.9 | -2.5 | 11.7 | 4.2 |

| Information Technology | -19.3 | 5.7 | -8.1 | -15.2 |

| Materials | 20.0 | -1.6 | 0.5 | 2.9 |

| Real Estate | 3.6 | 0.0 | 0.7 | -1.6 |

| Utilities | -1.1 | -0.2 | -1.4 | 1.5 |

Source: FactSet as of 30 Sep-2023. Past performance is not a reliable indicator of future performance. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable. All the index performance results referred to are provided exclusively for comparison purposes only. It should not be assumed that they represent the performance of any particular investment.

Additionally, the sector biases for defensive equities with exposure to the quality factor are found in healthcare, consumer stables, and communication services. The domestic market lacks opportunities in these sectors relative to other regions. The variance of sector bets is higher for Australian equities than it is for the other three regions. The standard deviation of the active bets is 10.2 for Australian equities compared to 2.2 for US Equities and 5.7 for Japan and European Equities. As a result, Australian investors, via their concentration in the domestic market, are more prone to sector specific drawdowns and therefore, diversification away to global markets could help reduce this risk.