Good Things Don’t Always Come To Those Who Wait

While most developed countries expect a policy U-turn in early 2024. Australia is expected to have a longer route to policy normalization.

Macroeconomic Outlook

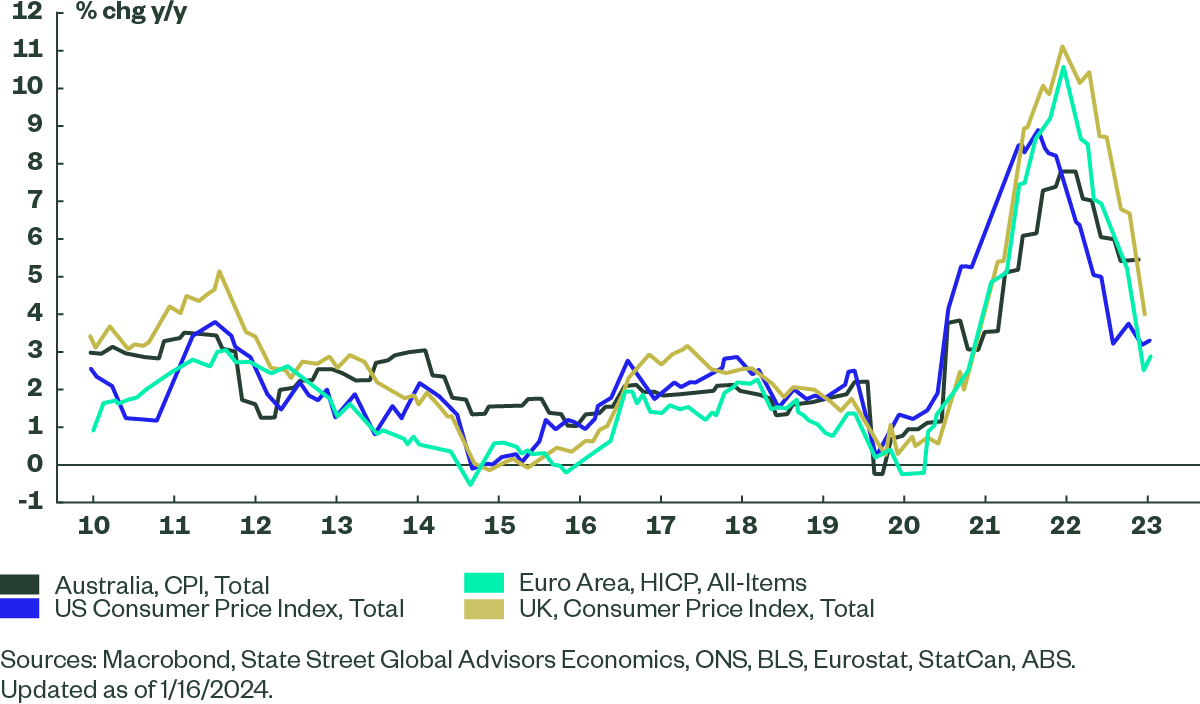

2023 was a positive surprise for the global economy. The year ended without the much-anticipated recession despite decadal high inflation and the consequential high policy rates. 2023 also saw inflation falling more than forecasted and this has pushed most global central banks to start thinking of policy reversals this year. These central bank pivots fuelled the year end equity rally, and also saw fixed income yields fall substantially. However, headwinds remain for the global economy as corporate earnings could be put under pressure by falling prices and weakening consumption. The headwinds are more pronounced for Australia. Compared to other developed markets, inflation deceleration in Australia has been slower as shown in Figure 1.

Figure 1 : Overall CPI

The monthly inflation for Australia in November 2023 was 4.3%, down significantly from November 2022 year earlier which was 7.1%. Yet this latest number is still well over RBA’s inflation target of 2 to 3%. The annual inflation number is due on 31 January, and this will be a better indicator of the actual inflation deceleration experienced.

Inflation in the US and Europe is declining much faster. As a consequence, both central banks have already discussed a timeline for policy reversal. Consumer sentiment is on the uptick for both US and Europe. In the US labour markets remain steady as unemployment rate has stabilised at 3.7% and average hourly earnings are up. The falling inflation, and stable labour markets are seen as a sign of an unfolding soft landing. Our economic growth forecast for the US has been upgraded to 2.4% in 2024. This is off the back of economic resilience, underscored by a strong GDP growth print in Q3 2023, and resilient consumption.

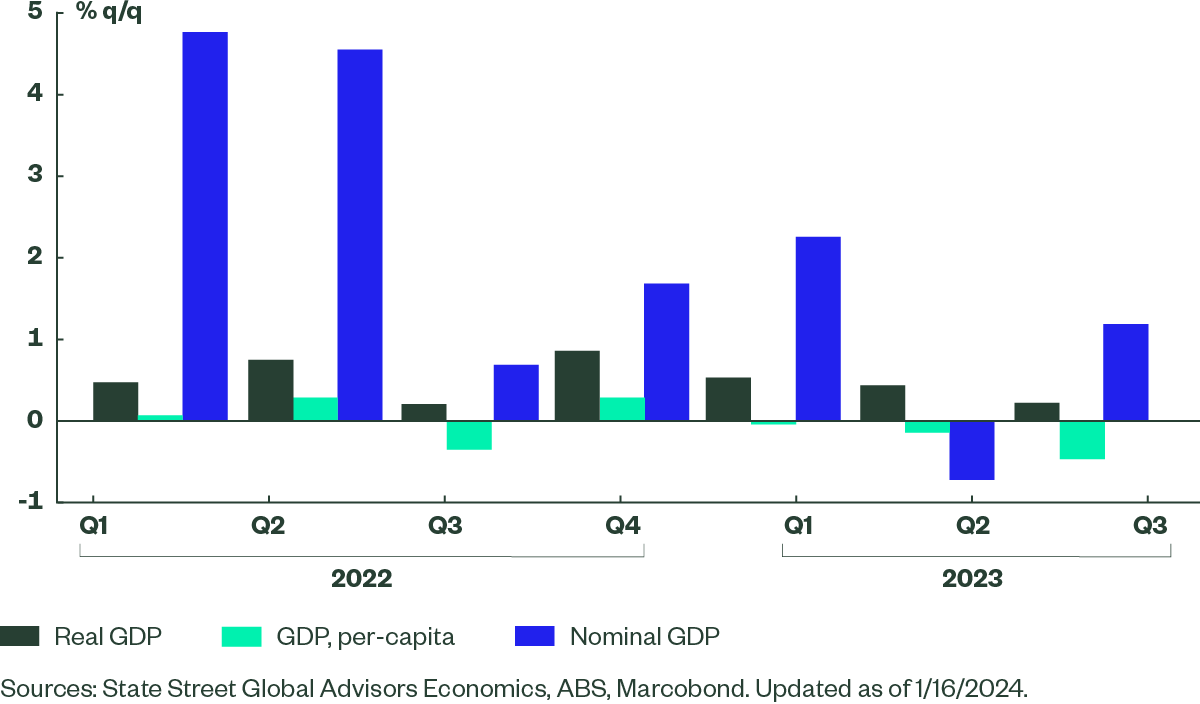

At the same time, the Australian economy has had a more negative impact from policy tightening than other markets. Household consumption, which has been falling since start of 2023, saw the lowest annual growth since 2020 (Covid-related) in November. In addition, the latest net exports numbers saw negative growth. The forward expectations remain gloomy, partly because of global slowdown and partly because of commodity price declines. Business confidence is also weak, at its lowest level since 2012 (excluding 2020, NAB survey). The labour market has also moderated with the unemployment rate rising to 3.9% in November and job ads, a forward indicator, have also softened. Figure 2 showcases the quarterly GDP growth over the last two years. Q3 2023 came in at 0.2%, lower than expectations of 0.5%. The primary drag on growth has been weak net exports and household consumption but high level of inward migration and the associated higher demand has kept growth marginally positive.

Figure 2 : Masked Weakness

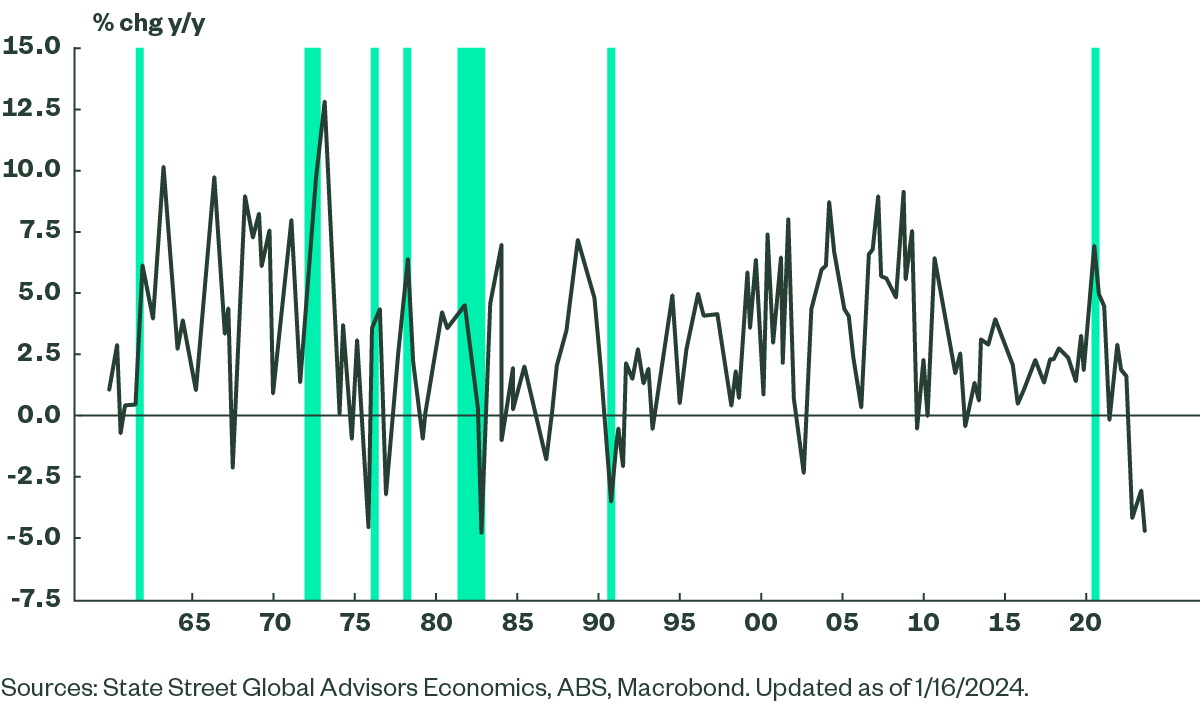

The 2024 outlook has its challenges. Firstly, consumption is likely to be weak. The consumption cycle in the last two years was primarily fuelled by pandemic-induced savings. These savings have fallen as households have adjusted to high policy rates and are now close to their long term average. This is especially true for Australia. Figure 3 showcases how Real Household Disposable income has been falling over the last year and now is at levels lower than the early 1990s.

Figure 3 : Real Household Disposable Income

Secondly, corporate earnings can be put under pressure by falling prices as demand wanes. Moreover the cost of credit is at decadal high and can exert additional pressure as growth subsides. Thirdly, global factors such as geopolitical instability in the Middle East has worsened. This has caused a reversal in the downtrend in shipping costs since the disruptions to shipping routes began. Inflation could make a return if supply chains are disrupted for a lengthy period.

Put together, all this means that the RBA’s challenges are greater than for other central banks. The lower global inflation has provided some headroom for policy wait and watch. However, domestic inflation still remains sticky, therefore the RBA is inclined to hold policy higher for longer than other central banks. This makes us less confident on a soft landing for Australia compared to its western counterparts as waiting too long may lead to the economy straying off the narrow path.

To deal with this uncertain outlook for the Australian economy, we recommend that investors seek shelter in fixed income. Given current high yields, slowing growth, and continued disinflation, fixed income offers attractive prospects for investors. It will not be plain sailing, however. As with several other asset classes, we expect recent choppiness to continue. Therefore, for those investors unwilling to embrace duration more fully, a good balance between domestic duration and domestic high-quality credit will likely serve well in 2024.