Climate Scenarios: An Introduction

In recent years, various organizations have proposed investment frameworks to reach net zero. In this paper, we outline and provide high-level views of the climate models and scenarios used by different agencies. We also discuss the inherent assumptions of the inputs and outputs of the frameworks, including the resulting scenarios at various surface temperature levels and their relevance to the frameworks.

What Are Net Zero Goals?

The Intergovernmental Panel for Climate Change (IPCC) defines net-zero emissions as a state when anthropogenic (manmade) emissions1 of greenhouse gases to the atmosphere are balanced by anthropogenic removals over a specified period. Net zero matters because it has become a defining characteristic of the goals of many environmental organizations globally. Furthermore, countries that are party to the Paris Agreement of 2015 have been required to set emissions-reduction targets known as Nationally Determined Contributions, or NDCs. These NDC’s, updated every five years, are pathways that countries will follow to achieve their environmental goals. Finally, amid greater awareness of the rate of anthropogenic climate change, climate-aware investing has become increasingly common, and investors are closely scrutinizing companies’ net zero targets.

Given this, a wide range of target-setting protocols have emerged. Examples include the Institutional Investors Group on Climate Change’s (IIGCC) Paris Aligned Investment Initiative (PAII), the Science Based Targets Initiative (SBTi) for Financial Institutions, and the United Nations-convened Net Zero Asset Owner Alliance (NZAOA) target-setting protocols. Targets under these protocols mostly aim for a cap on global warming of 1.5 degrees Celsius above pre-industrial levels, which the models assume will result in net zero emissions by 2050—frequently described as 1.5 degree scenarios with no or limited overshoot. We look closely at these scenarios and their assumptions.

Overview of Climate Models

To take stock of potential climate change developments, environmental researchers have created a variety of climate models. Each model offers unique insights into the future of our planet. These models have been in existence since 1973, and have proven to be relatively accurate in respect of warming projections.2 Given inherent differences in modeling methodologies, the Working Group on Coupled Modelling (WGCM) was formed to enable greater coordination between different modeling groups, as well as to standardize model inputs and outputs, thereby increasing comparability.3

One important piece of technology has been the complex, mathematical, virtual simulations of the Earth’s climate system. The simulations are used to study the past, present, and future behavior of climate. The researchers “stress test” the climate system with physical and chemical processes known to influence climate, such as the greenhouse effect, ocean currents, and atmospheric circulation patterns. These simulations can be used to predict how the climate system might change under different scenarios; in particular, the models attempt to make predictions about future changes in temperature, precipitation, sea level, and other aspects of climate.

While dozens of climate models have been developed, in this piece, we focus on integrated assessment models (IAMs). The IAMs combine these simulations of future climate patterns with certain aspects of society and economics (also known as Shared Socioeconomic Pathways). The IAMs aim to predict how population, economy, energy use and other social elements could grow and interact with the natural environment over time, enabling us to better understand these interactions and interdependencies.

Organizations Providing Future Climate Scenarios

Today, a number of institutions use a variety of IAMs and other inputs to try to predict climate scenarios, an exercise that helps us to better understand the effects of climate change. Each institution has a different objective and audience. Some of the prominent institutions in this field are as follows (not an exhaustive list):

International Energy Agency (IEA) – An intergovernmental organization comprising 31 countries (primarily OPEC countries) established in 1974. The IEA aims to provide policy recommendations on the global energy sector. It recently expanded its focus to predicting how the world will fare in reducing CO2 emissions and reaching climate targets.4 The IEA releases an annual world energy outlook (WEO)5 based on the results generated by the Global Energy and Climate Model (GEC),6 an IAM developed in-house.

The Intergovernmental Panel on Climate Change (IPCC) – Set up by the United Nations in 1988 to perform further research into climate and associated risks, the IPCC has been at the forefront of climate research. It produces periodic assessments intended to inform policy decision related to climate change. The IPCC doesnot, however, carry out its own research. Instead, it aggregates and assesses the latest climate research via a peer review process,7 and compiles this research into an Assessment Report that is published every 6-7 years. The IPCC in 2023 published its 6th Assessment Report8.

Network for Greening the Financial System (NGFS) – Established in 2017 as a network of 114 central banks and financial supervisors, the NGFS aims to foster a better understanding of the financial risks posed by climate change. One key way NGFS does this is by developing and promoting the use of climate scenarios in financial decision-making.9 Like the IPCC, the NGFS also aggregates various IAMs and provides data outputs related to a number of representative scenarios. The NGFS published Phase III of their scenarios data outputs in November 2022.

Comparing Climate Scenarios: Common Assumptions, Inputs and Outputs

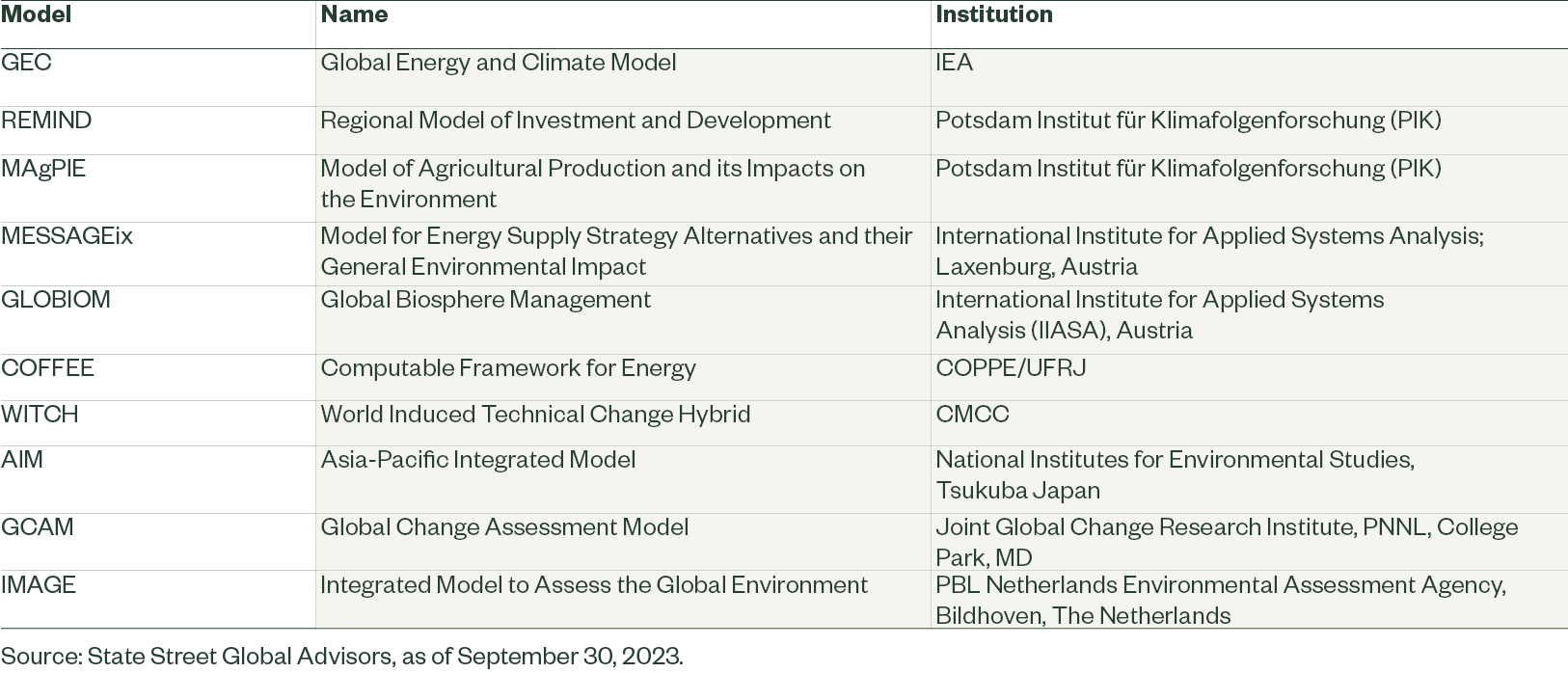

Variations in climate scenario predictions are largely due to differences in IAM inputs; however, outputs differ even when inputs are the same, as there are inherent differences in model construction. The following tables provide a high level view of the common assumptions and building blocks (not exhaustive) of these IAMs. The tables also show the common inputs and outputs that go into these IAMs.

Figure 1

Of the main outputs, energy usage/mix, temperature outcome, effects of policy changes, carbon pricing and future GHG emissions could be seen as most relevant to investors.

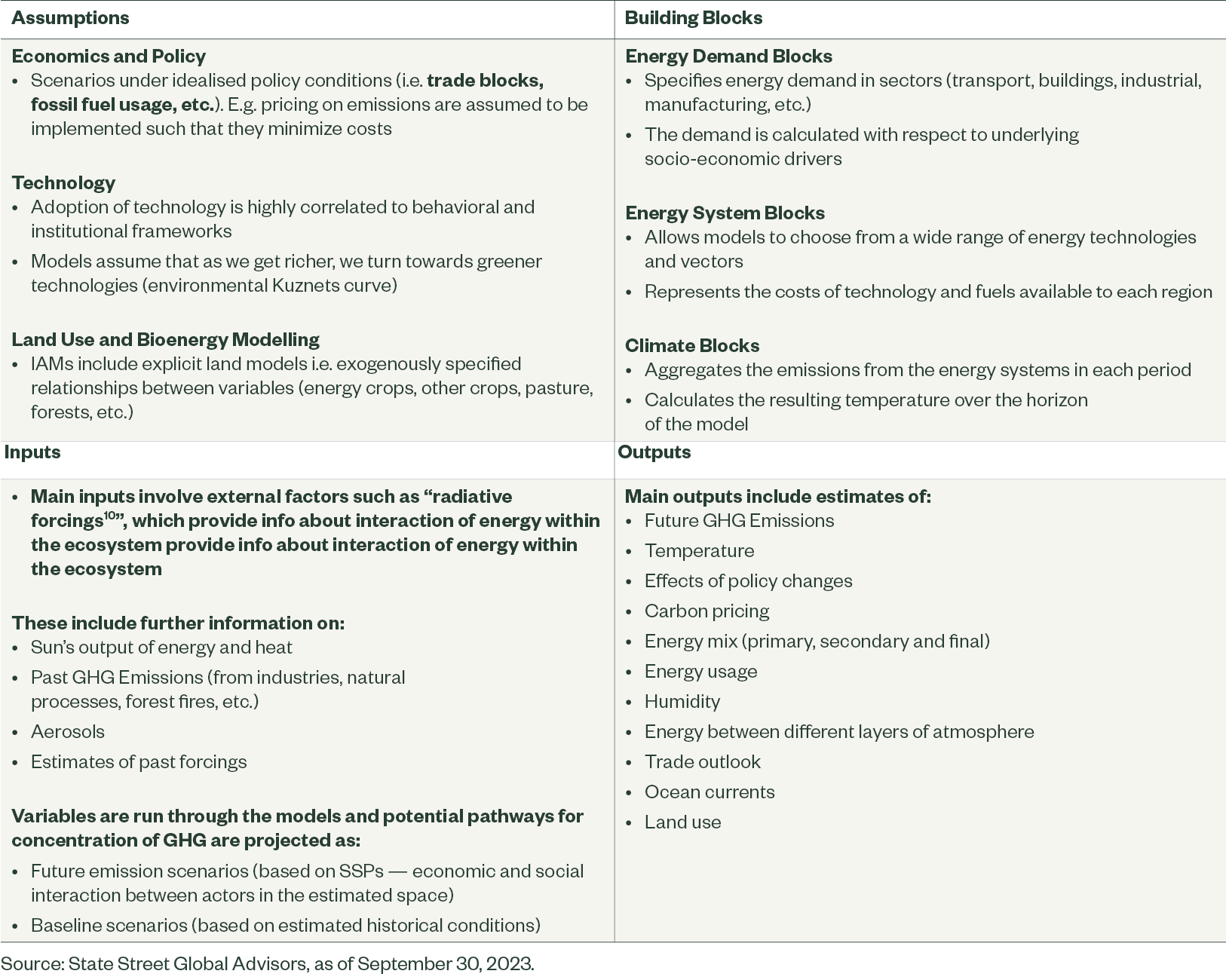

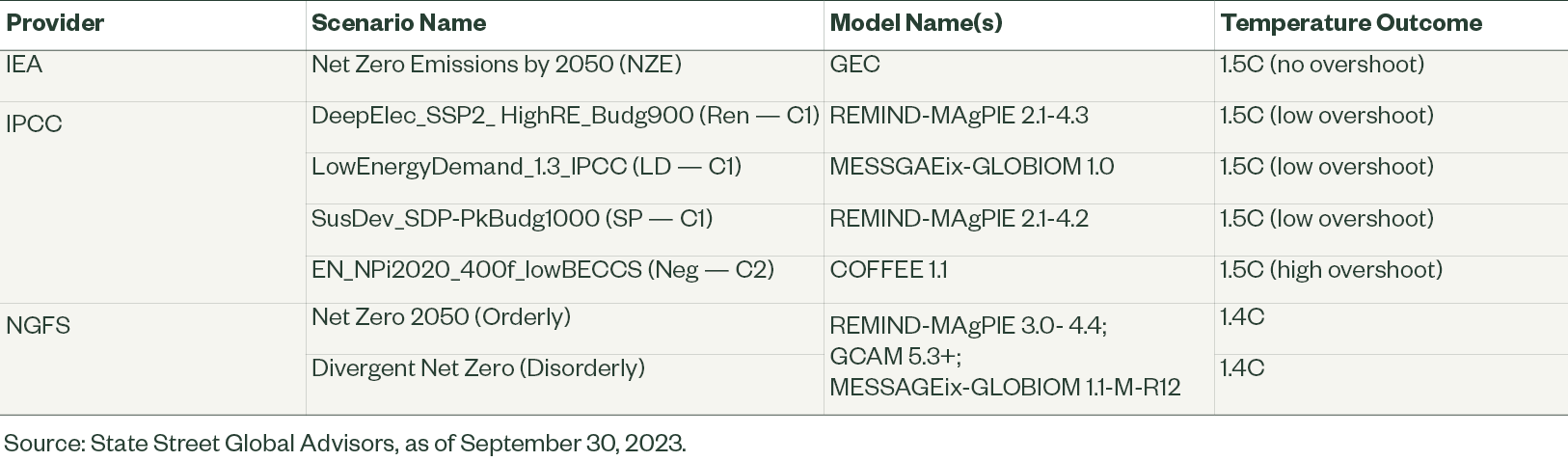

Examples of Climate Models and Scenarios

The following graphics provide examples of various scenarios and models used by the aforementioned agencies (not an exhaustive list). For example, the IPCC makes use of outputs published from models like the REMIND-MAgPIE, WITCH, COFFEE, etc, while the IEA focuses primarily on the GEC model.

Example scenarios include Ren-C1 and CurPol-C7 from the IPCC, while IEA provides scenarios like the NZE and STEPS. These scenarios are, in general, differentiated by their assumptions of modeling inputs/policies and temperature outcomes, in addition to others. Please see the glossary section for further details regarding these models.

Examples of climate scenarios and models with an expected temperature outcome of 1.5 degrees

Figure 2

Examples of climate scenarios and models with an expected temperature outcome at or below 2 degrees

Figure 3

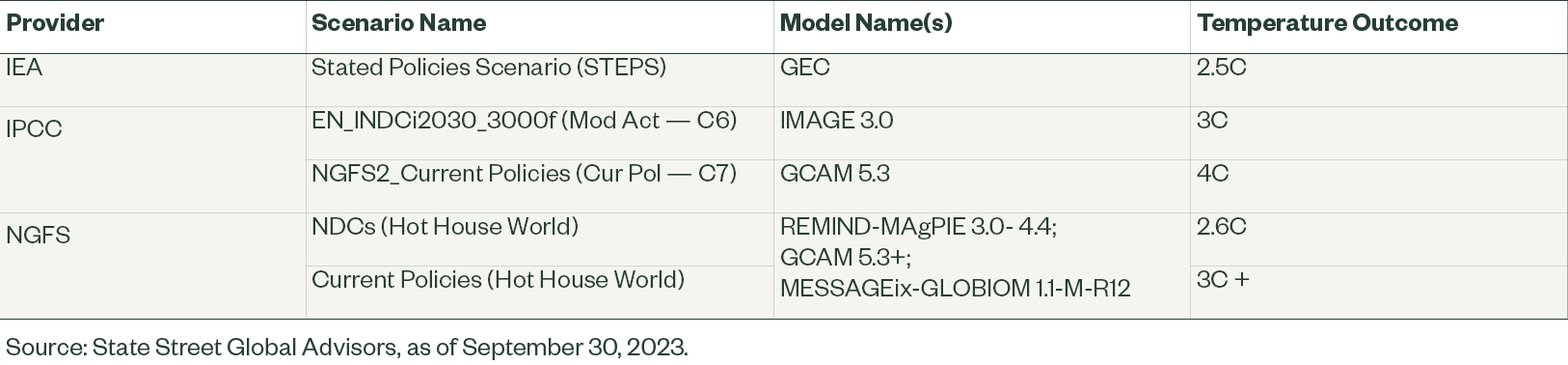

Examples of climate scenarios and models with expected temperature outcomes over 2.5 degrees

Figure 4

General Uses and Limitations of Climate Models and Scenarios

Climate scenarios or pathways are useful for a number of reasons:

1. Decision making: Climate: pathways help policymakers, business executives and other decision makers understand the potential impacts of their choices with respect to GHG emissions and climate change. This understanding could lead to better-informed decisions.

2. Planning and preparation: Climate pathways can be used to inform long-term planning and preparation for the climate change impacts, which could include sea-level rise, increased frequency of extreme weather events, and changes in the availability of water and other resources.

3. Climate negotiations: Climate pathways are an important tool in international climate negotiations, providing a basis for discussing and comparing emission reduction scenarios and analyzing their impacts on the global community.

4. Scientific research: Climate pathways are valuable for scientific research, helping environmental experts understand the relationships between emissions and the impacts of climate change. The pathways can also be used to test different mitigation and adaptation strategies.

At the same time, it is important to note the limitations of these climate scenarios. As noted by the NGFS, the NGFS scenarios are not forecasts: instead, they aim to explore the bookends of plausible futures (neither the most probable nor desirable) for financial risk assessment.

A similar statement can be made for the various other scenarios and providers, though the ultimate goal may not be financial risk assessment. In addition, a recent study has noted several limitations to scenarios as currently used for financial risk analysis. Namely, the pathways may potentially underestimate the pace of climate change; may not adequately quantify carbon budgets; and may lack consideration for extreme events and climate tipping points, as well as second-order effects like involuntary mass migration.

Relevance for Investors

Climate scenarios are most well-suited to scenario analysis and stress testing purposes.

Use cases for investors include:

- Performing Scenario or Sensitivity Analysis

For example, investors may convert scenario data into quantitative return implications for portfolio companies, i.e. climate value at risk (see Climate VaR and Financial Value: Assessing the Empirical Evidence).

Investors may also assess both physical and transition risks from climate change, i.e. which areas might be worst affected by climate change (due to regulatory changes, rising sea levels, extreme temperatures, or other effects). - Assessing ESG Performance of Portfolio Companies to Inform Investment Decision-Making or Engagement Activity

For example, investors may assess the “implied temperature rise” associated with a company’s emissions targets, or the company’s degree of alignment with a particular scenario (such as maturity scale alignment such as that recommended by the PAII framework).

Depending on the scenarios, investors can assess company ESG performance at granular sectoral/regional levels, though it is challenging to map climate model sectors/regions to those used by the industry (such as GICS). - Set Portfolio-level Targets Aligned with Projections of Selected Scenarios/Pathways

For example, EU PAB benchmarks impose emissions reduction goals as well as recommend green/brown revenue improvements based on 1.5 degree scenarios.

Additionally, several investors rely on these scenarios to set climate-related targets for their portfolios .

At the same time, it should be noted that it remains challenging to convert climate scenario outputs into implications for investors, and even more so for those primarily investing in secondary markets. As a result, this continues to be an area of further research.

Conclusion

In this paper, we have provided a high-level overview of how climate models and scenarios are built and used, and we have reviewed their limitations. Climate models have been used for several decades and play an important role in informing policy makers on the effects of climate change. These models also help investors who wish to analyse the impact of climate change on their portfolios.

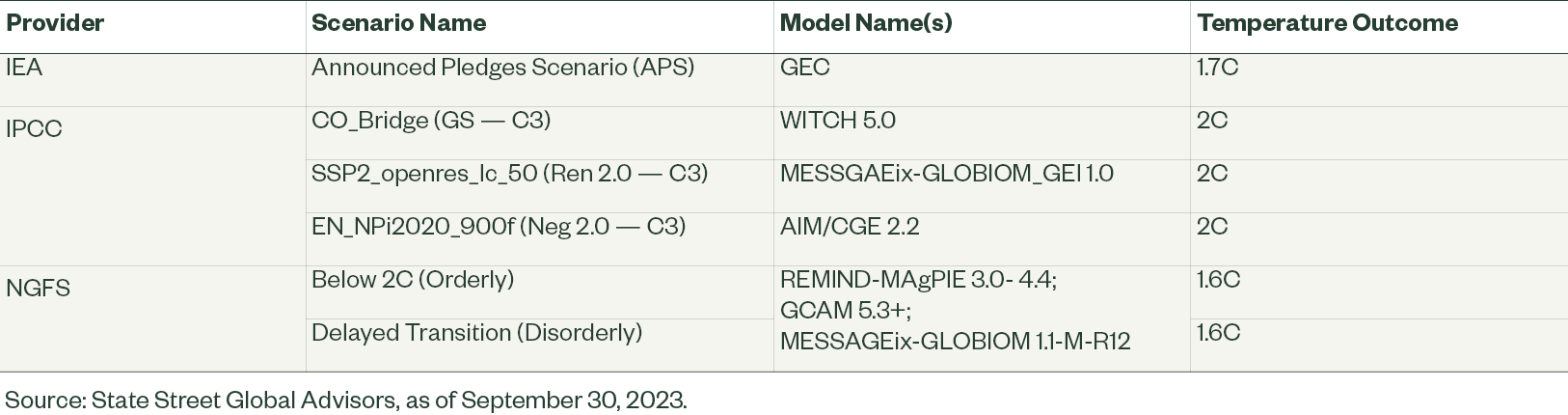

Glossary of Climate Models

Figure 5