Australian Earnings Resilience Retested

- Australian earnings trends decline in-line with global earnings trends in 2023.

- Index concentration that provided resilience in 2022, now appears less resilient.

- Sentiment for the big four banks has declined from 83 to 39 in 2023.

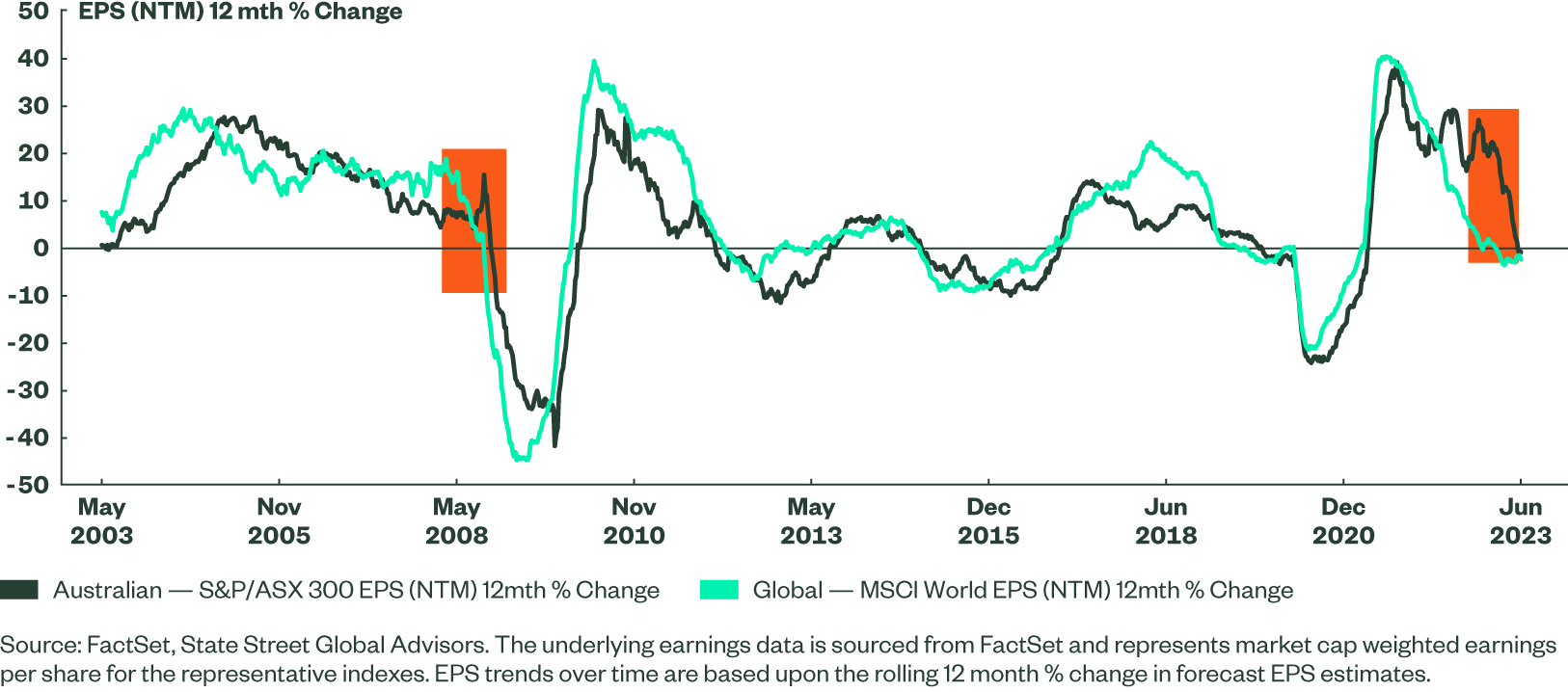

After a period of resilience, Australian earnings trends have declined in-line with global earnings trends in 2023. Figure 1 provides a 20 year perspective on the relationship between Australian and global earnings1. The global and Australian earnings cycles are closely linked to global economic trends. The sometimes unfortunate truth for Australia is that by having an open economy with many global linkages, we can do little to avoid being impacted by these global trends. As an example, in early 2008 (highlighted in Figure 1) we observed a similar disconnect when Australian mining companies continued to see upgrades and the domestic banking sector initially appeared resilient, before surrendering to global influences.

The right-hand side of Figure 1 highlights the recent changes. For most of 2022 the Australian equity market proved resilient to the earnings per share (EPS) slowdown in the developed world, maintaining EPS growth of approximately 20%. In 2022, the Australian companies exposure to iron ore, copper, oil and gas and our domestic economy were more resilient. In 2023, the outlook for financials, energy and materials has deteriorated and the 12-month EPS trend has declined to -1% as at 19 May 2023.

Figure 1: Australian EPS trends decline in-line with global trends (23 May 2003 to 19 May 2023)

Which parts of the market are influencing this slowdown in earnings? Figure 2 provides a sector break down of the year to date EPS % changes.

Earnings Trends in 2023

- Financials – the largest weight of the index, now has negative earnings momentum in 2023.

- Energy - the earnings trend for Energy has gone form the most positive in 2022, to the second most negative in 2023.

- Technology - the most negative trend in earnings in 2023 has come from technology sector. The impact of this negative earnings trend is less impactful due to the low index sector weight (only 2.5%).

- Materials - the materials sector has seen small positive earnings momentum year-to-date but has seen a de-acceleration from rates of growth in 2022.

- The most positive earnings trends in 2023 are Utilities (+15.9%), Industrials (+10.8%) and Health Care (9.7%).

Figure 2: S&P/ASX 300 GICS Sector EPS Trends year to date

| Sector (GICS) | Index Weight | EPS Trends YTD* |

| Financials | 26.8% | -2.6% |

| Materials | 24.1% | 1.1% |

| Health Care | 10.5% | 9.7% |

| Industrials | 7.1% | 10.8% |

| Discretionary | 6.7% | 3.9% |

| Real Estate | 6.3% | 1.8% |

| Energy | 5.7% | -25.4% |

| Staples | 4.8% | 3.1% |

| Communication | 4.1% | -0.8% |

| Technology | 2.5% | -49.9% |

| Utilities | 1.4% | 15.9% |

| Source: Factset, State Street Global Advisors. S&P/ASX 300 Index weights as at 19 May 2023. * EPS trends YTD are calculated by measuring the % change from 31 December 2022 to 19 May 2023 in the estimates for sector earnings for the next twelve months (NTM). | ||

The trend for Australian Banks is even more sanguine. Post the recent company updates in May, the investment analysts community have lowered their earnings forecasts for FY2 and FY3. Over 2023, the earnings expectations have declined by – 6.3% in FY2 and -7.6% in FY32. Most cited headwinds include, peaking net interest margins in the face of slowing loan growth and intense competition. Looking forward the outlook for the banking sector continues to be particularly uncertain. The increasing headwinds for the Big 4 banks is captured in our sentiment scores in Figure 3. The sentiment score for the big four banks has declined from 83/100 as at end December 2022, to 41/100 as at 26 May 2023. Quality has also declined from 66/100 to 58/100. In contrast, the valuation scores have ticked up slightly from 77/100 at the end of 2022, to 82/100 as at 26 May 2023.

Bottom Line

After a resilient 2022, Australian earnings have fallen in-line with global markets in 2023. The earnings slowdown has been especially impactful as it has occurred in financials and materials which together make up more than 50% of the S&P/ASX 300 Index. According to our proprietary scores, the Sentiment of the big four banks has declined materially in 2023.