Choose ETFs for Your Bond Core

Yields are back. And so is bond market volatility. The unique attributes of ETFs — liquidity, transparency, and lower cost — can help.

Why Bond ETFs?

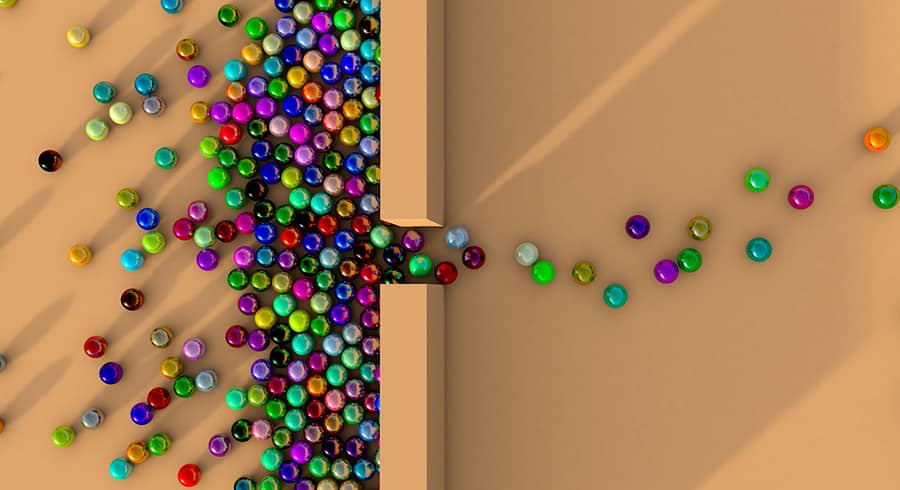

Diversification and Liquidity

ETFs offer exposure to multiple bonds in a single trade. And their robust liquidity means you can trade them faster and more cost-efficiently than individual bonds.

Broad Core Exposure

Bond ETFs can cover a range of exposures, whether broad or specific. So it’s easy to tailor portfolios to match your market views and goals.

Lower Costs

ETF management fees are significantly lower than those of managed funds, across both indexed and active strategies1. So you keep more of your returns.

Explore SPDR Bond ETFs

Benefits of Bond ETFs

Four Reasons to Consider Fixed Income ETFs

We explore four key reasons why investors might consider fixed income ETFs as part of a well-balanced investment portfolio.

A Framework for Selecting Fixed Income ETFs

This practical framework can help investors select the fixed income ETFs that best meet their needs, whether they’re seeking risk, yield or diversification.

Fixed Income Outlook

Given current yield levels, slowing growth, and continued disinflation, the bond market outlook looks increasingly attractive for investors.

Bond Market Insights

Bond Investing Expertise

SPDR Bond ETFs are powered by the same institutional expertise and resources that make us one of the world’s leading fixed income managers.

in fixed income assets 2

of bond index investing

fixed income strategies