Fixed income inflows strengthen as inflation trends improve

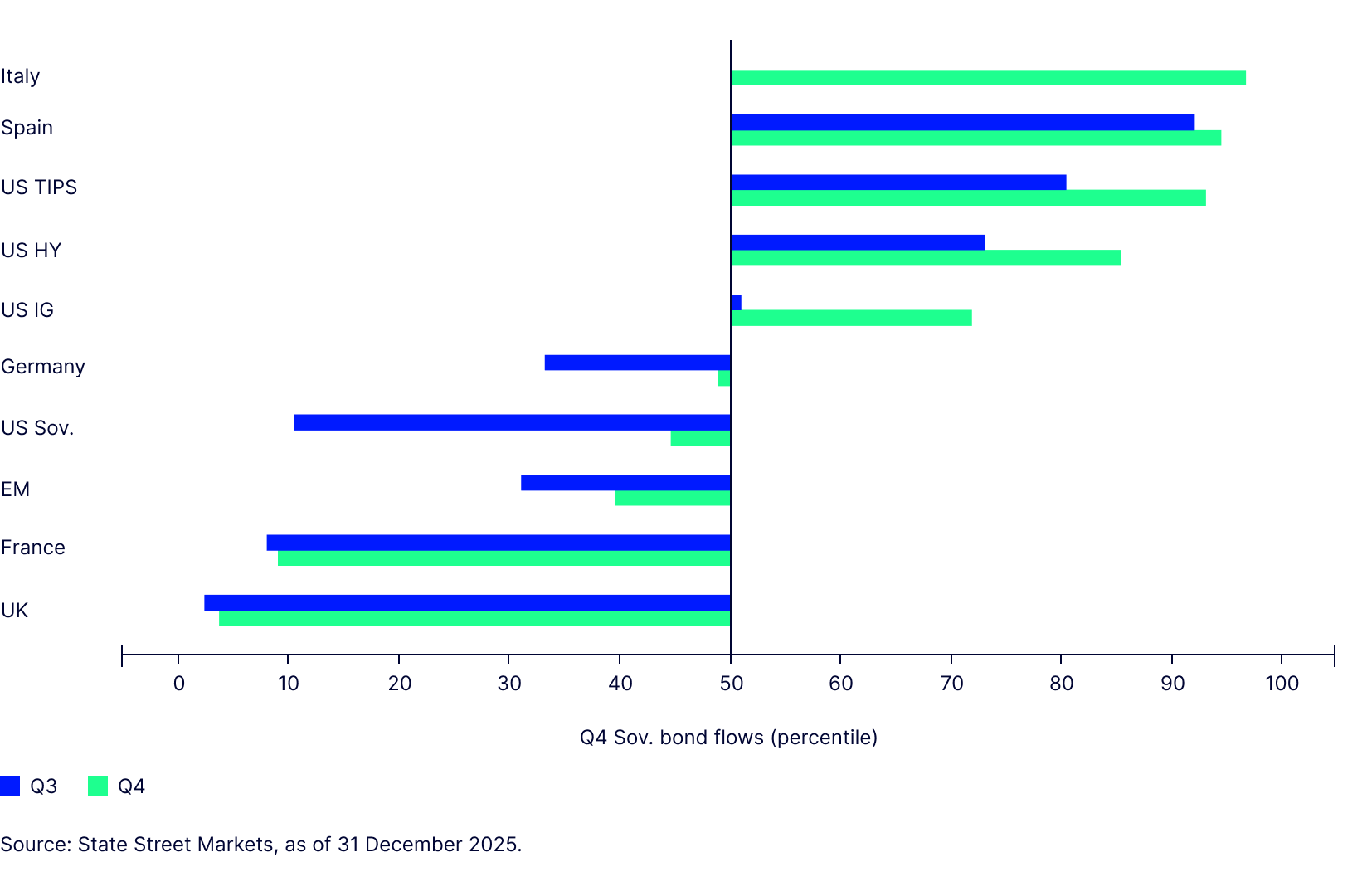

Long-term fixed income allocations increased in Q4, with strong aggregate flows, firmer demand for credit, and normalising appetite for duration. The outlook remains mixed: investor interest in inflation protection is strong, and support for emerging market debt remains patchy despite the better inflation outlook.

Long-term investor demand for US Treasurys across the curve is improving. Although demand for assets beyond the 1-3 year segment of the curve remains below historical median levels, appetite for the 7-10 segment of the curve crept into the 60th percentile of past flows. This was below the much stronger inflows at the front end but suggests that appetite for duration is returning.

Q1 inflation barometer

For this cautious optimism to be justified, inflation needs to keep declining. Our PriceStats data supports this view for now. After accelerating early in Q4, US inflation appears to have peaked and is easing in line with expectations. Q1 looks set to be the inflation bellwether for 2026, as relatively favourable base effects are offset by the inflationary impulse of fiscal stimulus.

Inflation trends in most emerging markets continue Q3’s more benign path, with lower numbers in historically higher inflation economies such as Turkey and Argentina, as well as Brazil, South Korea and Poland. This underscores the strengthening improvement in local currency bond fundamentals in many emerging markets.

Read our accompanying Q1 Bond Outlook here.