The Consequences of the Global Liquidity Crisis for Emerging Markets Investors

The short – but extremely eventful – history of the COVID-19 crisis began in emerging markets (EM). As the crisis expanded to encompass the globe, it has morphed from an exogenous shock affecting mostly EM, to an oil shock impacting risk assets including EM, to its current manifestation: a liquidity shock to global markets, resulting in substantial outflows and plunging prices in EM. Asian currencies and Asian equity and debt markets have collapsed,1 culminating in the closure of financial markets in the Philippines on March 17.

It will be some time before EM investors are able to align their decision making to fundamentals2. At this point, liquidity is the key factor to watch. To that end, this commentary will focus on the impact of the current liquidity shock on EM debt and equity markets.

Dependence on Liquidity and Flows

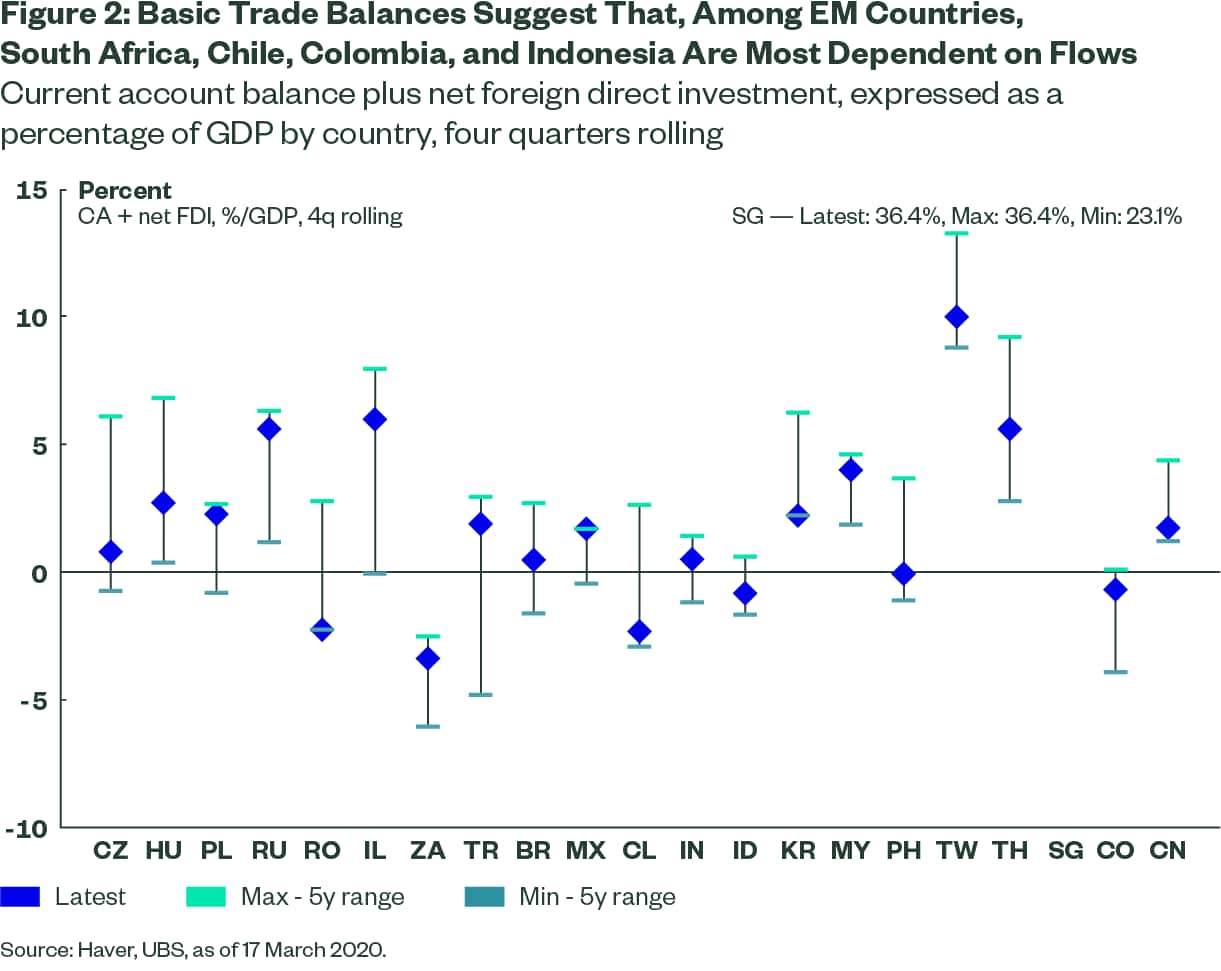

EM markets have seen a regime shift to what seem like end-of-cycle conditions in which liquidity, positioning, funding needs and fears of forced selling are front and center. Fund flows are an immediate area of focus. Many EM economies are running large current account deficits (see Figure 1) that they have compensated for through flows in capital accounts and foreign direct investment (FDI). FDI has been stable or declining in most EM countries, although lower oil prices have supported EM trade balances overall. Based on current account balances and FDI, South Africa, Chile, Colombia, and Indonesia are most in need of flows (see Figure 2).

Of course, the present inertia does not mean that emerging markets are free of fundamental challenges. Emerging markets’ potential for GDP and earnings growth are a serious concern. In addition, much-needed structural reforms are likely to be put on hold as EM countries focus their attention on combatting the outbreak.

For long-term investors in EM, the current crisis most closely resembles conditions during the 2008-09 Global Financial Crisis and the 2013 Taper Tantrum. When we compare current outflows with those crisis points, we are somewhere near halfway done – there is still room for more outflows.

EM economies’ dependence on flows and foreign direct investment therefore leaves EM assets vulnerable on a number of different fronts. EM countries have substantial short-term financing needs that have been jeopardized as EM markets experience heavy outflows. The liquidity squeeze in DM is further pressuring the full range of assets associated with the credit markets, including EM assets.

Takeaways for investors

During this crisis, EM assets (both debt and equities) have behaved like risk assets, rising and falling more or less in tandem with equity markets across the board. We believe this pattern is likely to continue as the DM liquidity shortage continues to pressure EM.

Various developments could come together to ease the liquidity shortage in EM. A liquidity injection from DM central banks would be helpful. Fiscal stimulus could also help to support fundamentals on a near-term basis. Ultimately, however, we believe the crisis will persist until a decrease in the rate of COVID-19 infection, particularly in the United States, begins to materialize, bringing with it increased stability in DM economies. Until then, markets are unlikely to trade on fundamentals, and liquidity will remain a crucial factor in EM markets – one that deserves close attention.

Even as EM markets face substantial challenges in the current crisis, we see potential for aggressive monetary and fiscal policy moves to support underlying fundamentals and for attractive bargains to emerge in EM securities. In the meantime, we encourage investors to bear in mind the costs of liquidation when liquidity is at a premium. For long term investors, we believe that EM assets will continue to be an important source of diversification and growth.