US Snapshot

The following report features five United States-specific findings from our 2022 Global Retirement Reality Report (GR3). This propriety, global trending study fielded annually since 2018 focuses on how individuals and institutions are preparing for, and possibly redefining, retirement across the world.

Finding #1: Concerns About Inflation, Medical Costs, and the Political Climate Dampen Americans’ Retirement Optimism

To understand how Americans think about retirement today, it’s important to understand the issues they believe pose the greatest threat to their future financial security.

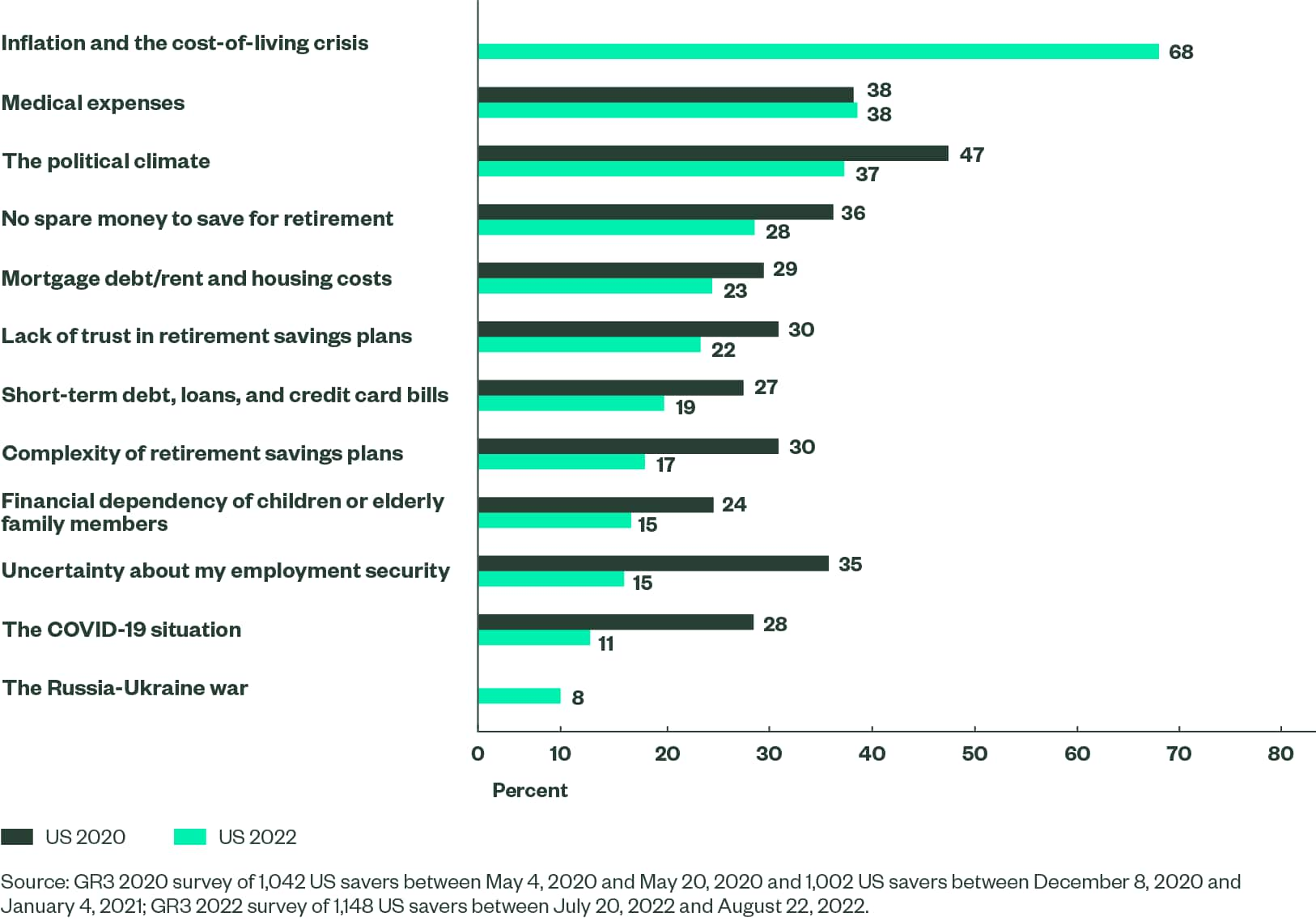

In 2022, inflation led the global list of negative impacts to retirement readiness, with 68% of US respondents citing it as a top concern. The associated cost-of-living crisis means necessities like energy, food, and housing have become more expensive, while people’s purchasing power has eroded. For savers and retirees, this means lifelong savings have lost value. In Finding #3: The longer Americans live, the more it costs, we’ll review the financial actions that respondents reported taking in response to the market environment.

Following inflationary woes was concern about medical expenses (38%), an issue that has consistently ranked as the first or second concern in the US, averaging 10 points higher than the global tally. The political climate (37%) took third place in 2022, after securing the top response in December 2020 (47%) against the backdrop of a tumultuous presidential election. Ongoing political animus has kept responses citing this concern high.

A lack of spare money for saving (28%) as well as mortgage debt/rent and housing costs (23%) rounded out the top five in 2022. Both concerns have lessened since 2020 (36% and 29%, respectively), though they have most likely been replaced, not reduced, by inflation.

Figure 1: What Factors Most Negatively Affect Your Confidence That You Will Be Ready to Retire When You Plan to? Please Pick Top Three.

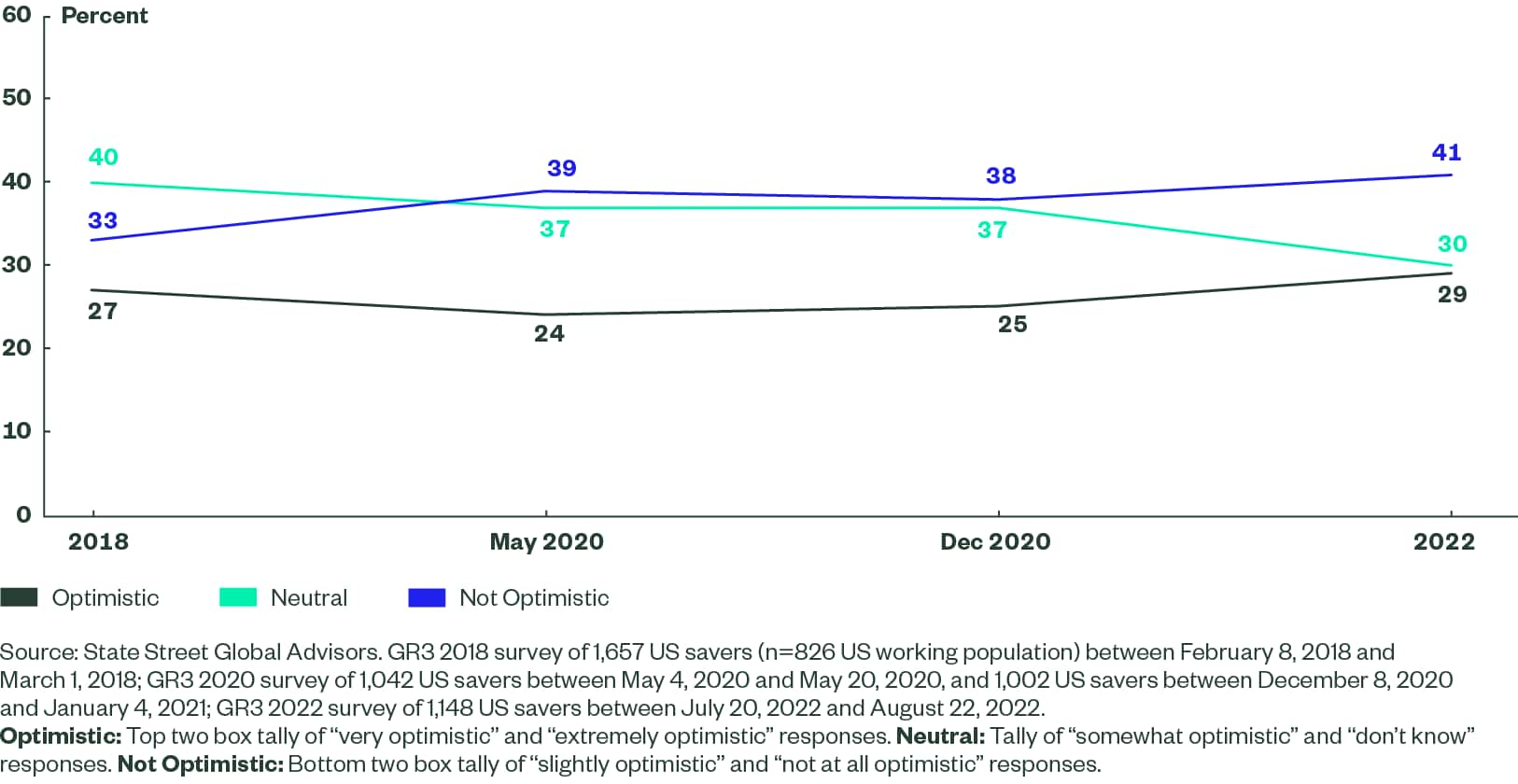

Americans’ top three retirement readiness reducers — inflation, medical costs, and the political climate — don’t portend a particularly rosy future, a finding supported by optimism trends.

In 2022, optimism about financial preparedness for retirement (29%) had rebounded by two points since its pandemic decline and surpassed sentiment cited in 2018. However, in comparison to changes in neutrality (10-point decrease) and pessimism (eight-point increase) over the same time period, the two-point rise in optimism seems minor. The bigger story suggests that people are moving out of the middle and toward the outer ends of sentiment.

Figure 2: How Optimistic Are You That You Will Be Financially Prepared for Retirement by the Time You Stop Working?

Finding #2: The Pandemic Has Impacted Women, Work, and Retirement

The pandemic altered how most people worked, a disruption that has enabled employees to reflect on their relationship with their job and consider their alternatives. The Great Resignation, also dubbed The Big Quit or The Great Reshuffle, is an employment attrition trend that includes workers who have changed jobs (or careers), joined the gig economy, downshifted, or left the workforce. According to the US Bureau of Labor Statistics, 47.8 million workers quit their jobs in 2021, an average of nearly 4 million each month, the highest labor turnover on record.1

Research from a cloud-based payroll and employee benefits company found that the quit rate for women was 1.1 percentage point higher than for men.2 This finding highlights the historical obstacles women have confronted around retirement readiness: having portions of their career and stretches of saving opportunity interrupted by family care — responsibilities that women assume more often than men — and earning less, therefore saving less, than men.3

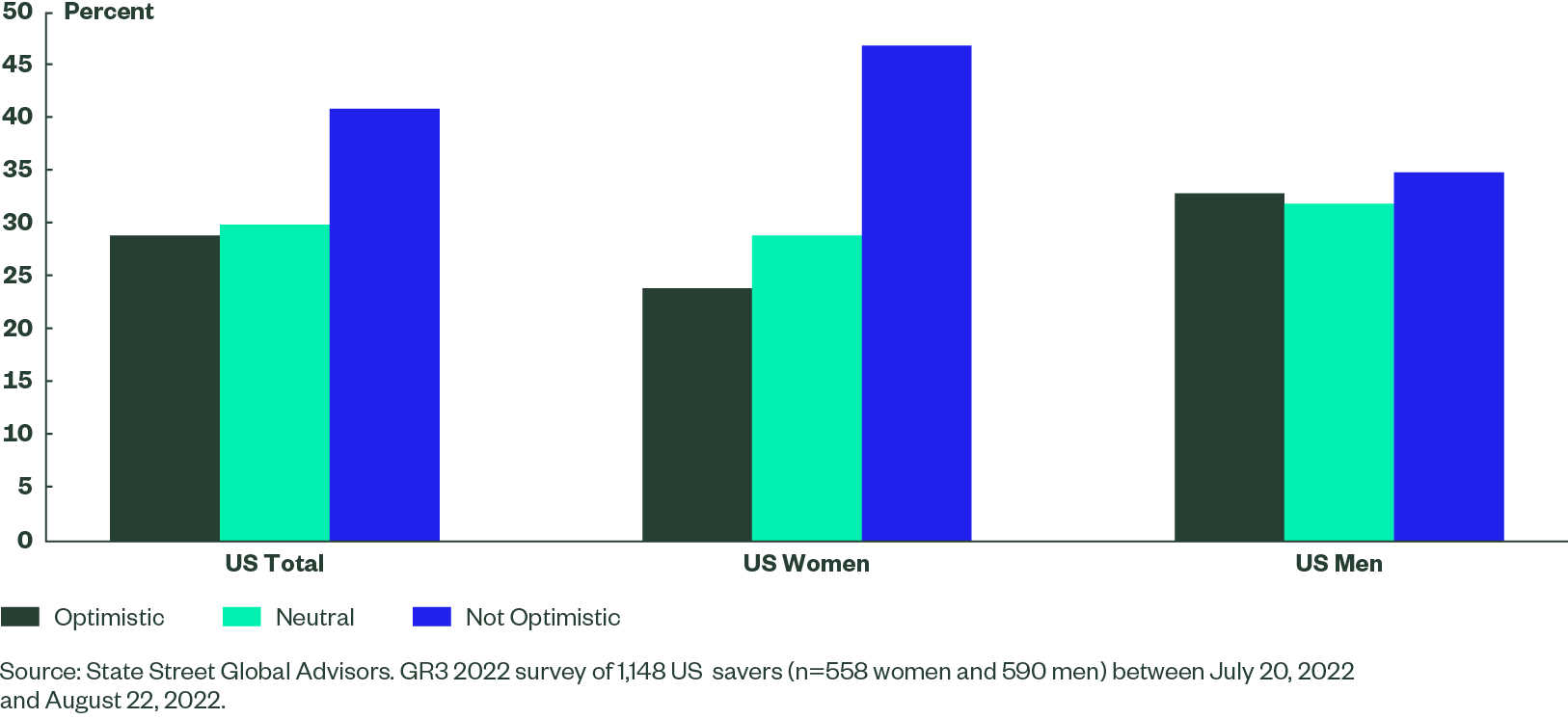

Considering these segmented retirement issues, State Street examined the data pertaining to optimism and areas of concern by gender and found women to experience greater levels of and different financial anxieties.

Figure 3: Optimism and Apprehension by Gender

2022 US Optimism by Gender

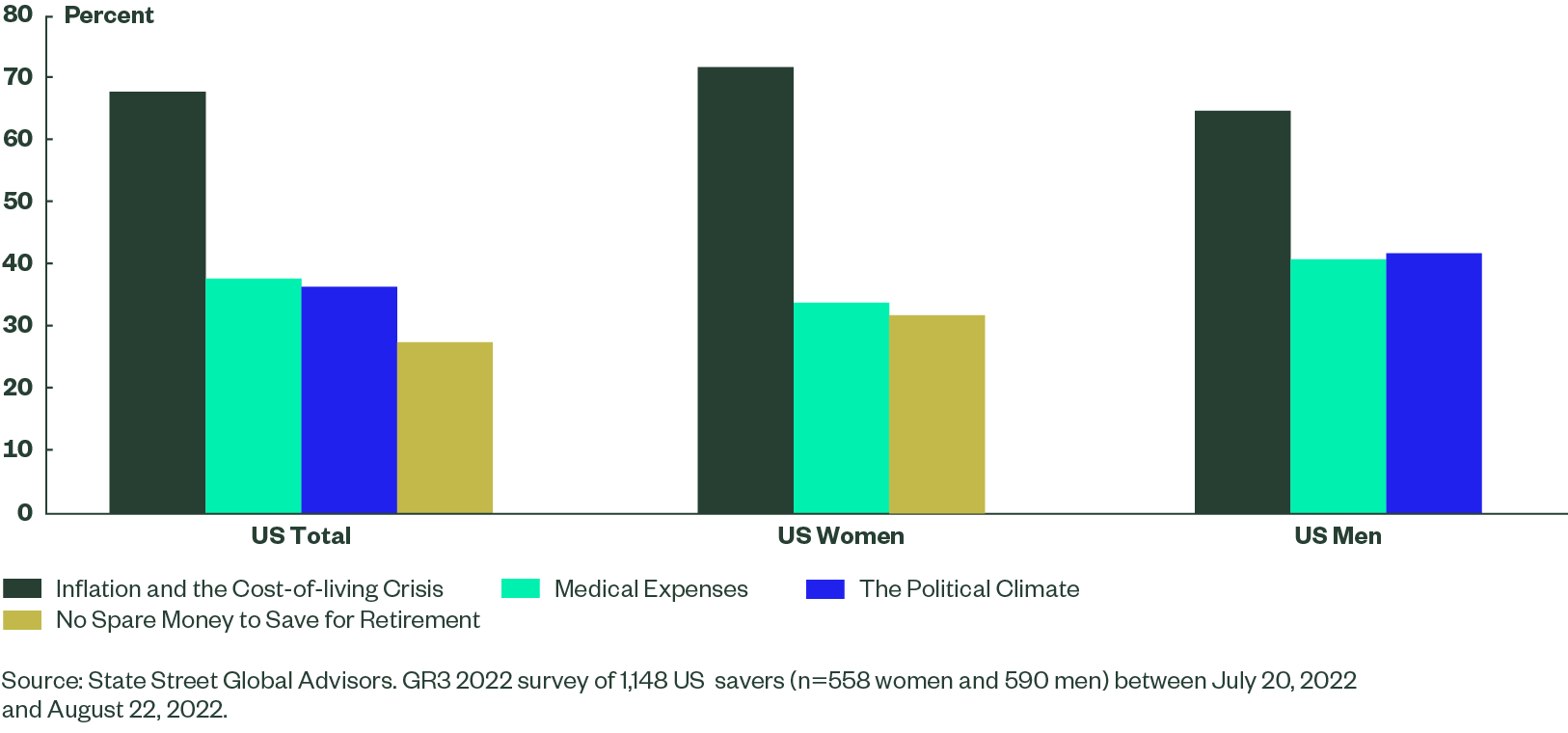

Top US Concerns By Gender

While the sample agreed that inflation posed the No. 1 threat to retirement readiness, women (72%) were more concerned than men (65%). In fact, women’s inflation fear overshadowed all other areas of apprehension, with the next ranking issue, medical expenses, lagging by less than half (34%). In third place for women was the lack of spare money to put toward retirement saving (32%), an issue that didn’t rank in men’s top three (24%). Overall, women seemed more rooted in tangible cash flow fears, while men’s focus was on more encompassing concerns.

When asked how their outlook on retirement had changed in light of The Great Resignation, both male and female US respondents:

- Expressed concern about the sustainability of Social Security funds given a wave of pandemic-era retirements, 4

- Expected to delay retirement in response to the cost-of-living crisis, and

- Were evaluating remote and part-time earning opportunities in later life.

Women shared unique perspectives on balancing family and knowing their professional worth. This latter insight was reinforced in the 2022 Women in the Workplace report, which cited recognition and opportunities for advancement as critical to women’s workplace satisfaction.5

“I always envisioned myself having a long career with busy hours and lots of travel. I have changed my career goals to be more stable and easier to accommodate a family.”

—American woman, age 18-34, income less than $40,000

“I am less likely to accept toxic workplaces and more focused on knowing my worth.”

—American woman, age 45-54, income range $60,000-$99,999

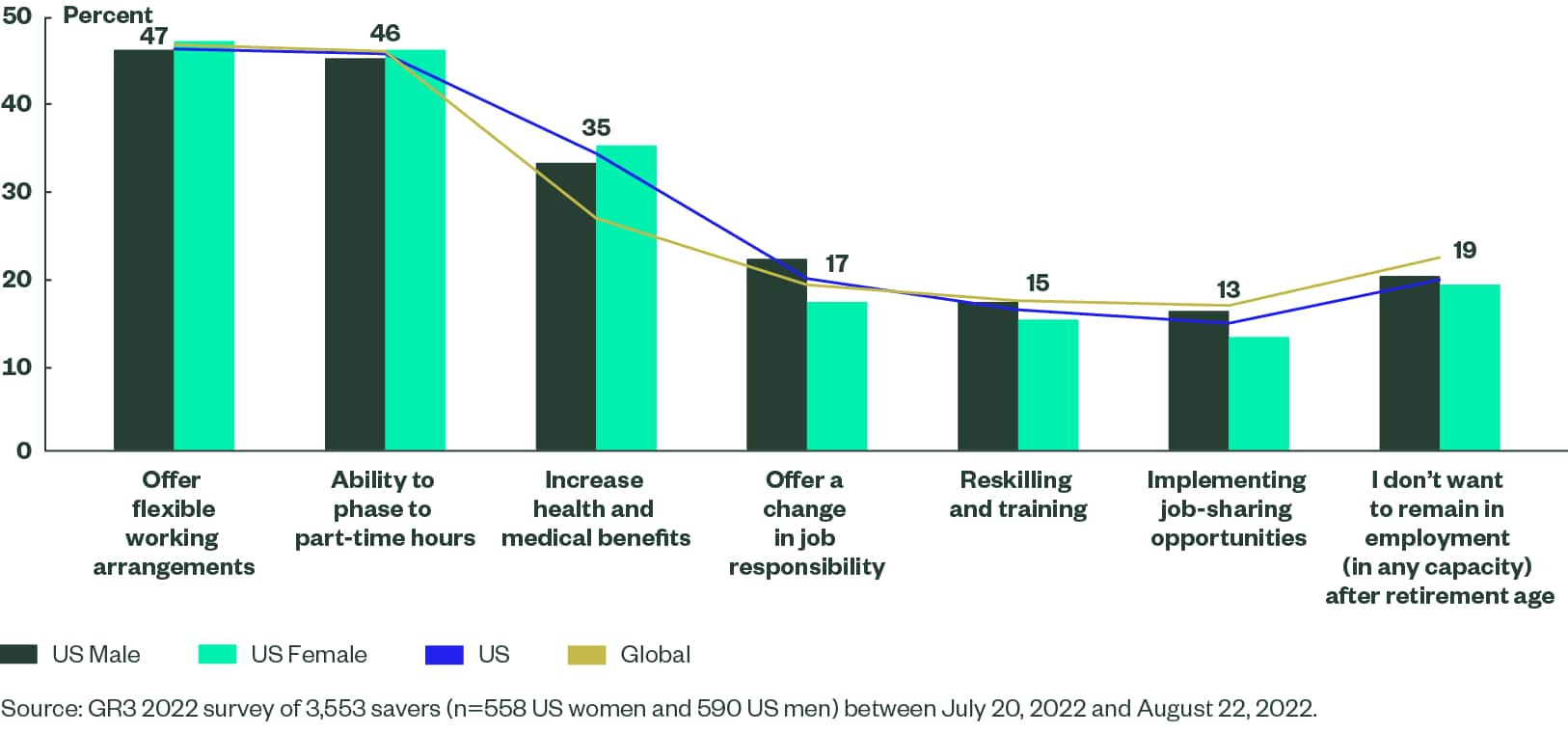

In light of the movement to reconsider the shape of (an extended) work life, this year’s GR3 survey explored the types of employer support that could help those interested in working to remain employed. Responses offered a possible glimpse of future work life. Looking at the data by gender (Figure 4), the US respondent trends generally aligned with the global sentiment, favoring flexible working arrangements, the ability to transition to a part-time schedule, and an increase in health and medical benefits, but the emphasis on these three areas was higher for American women. Interestingly, American women seem slightly less inclined to change jobs, reskill, job-share, or leave the workforce — they are simply seeking the ability to do their existing job. Their elevated quit rate suggests they are unable to do just that, implying that women aren’t leaving the workforce because they want to, but because they feel they have to.

A final note on health care: The US generally and American women (35%) specifically have put greater value on increased health and medical benefits than the global average (27%), echoing insights from earlier in this section on women’s financing focus and fears.

Figure 4: What Support Would Enable You to Remain Longer in the Workplace (Assuming You Wanted to)? Please Select All That Apply.

Finding #3: The Longer Americans Live, the More it Costs

The majority (84%) of US respondents expected to enjoy some version of retirement — either a full retirement (59%) or a future of partial work (25%). For those who didn’t see retirement on the horizon, a minority (6%) was eager to stay engaged in work life, while the remainder of respondents (10%) didn’t believe that retirement was financially feasible. But for most, retirement remained the destination.

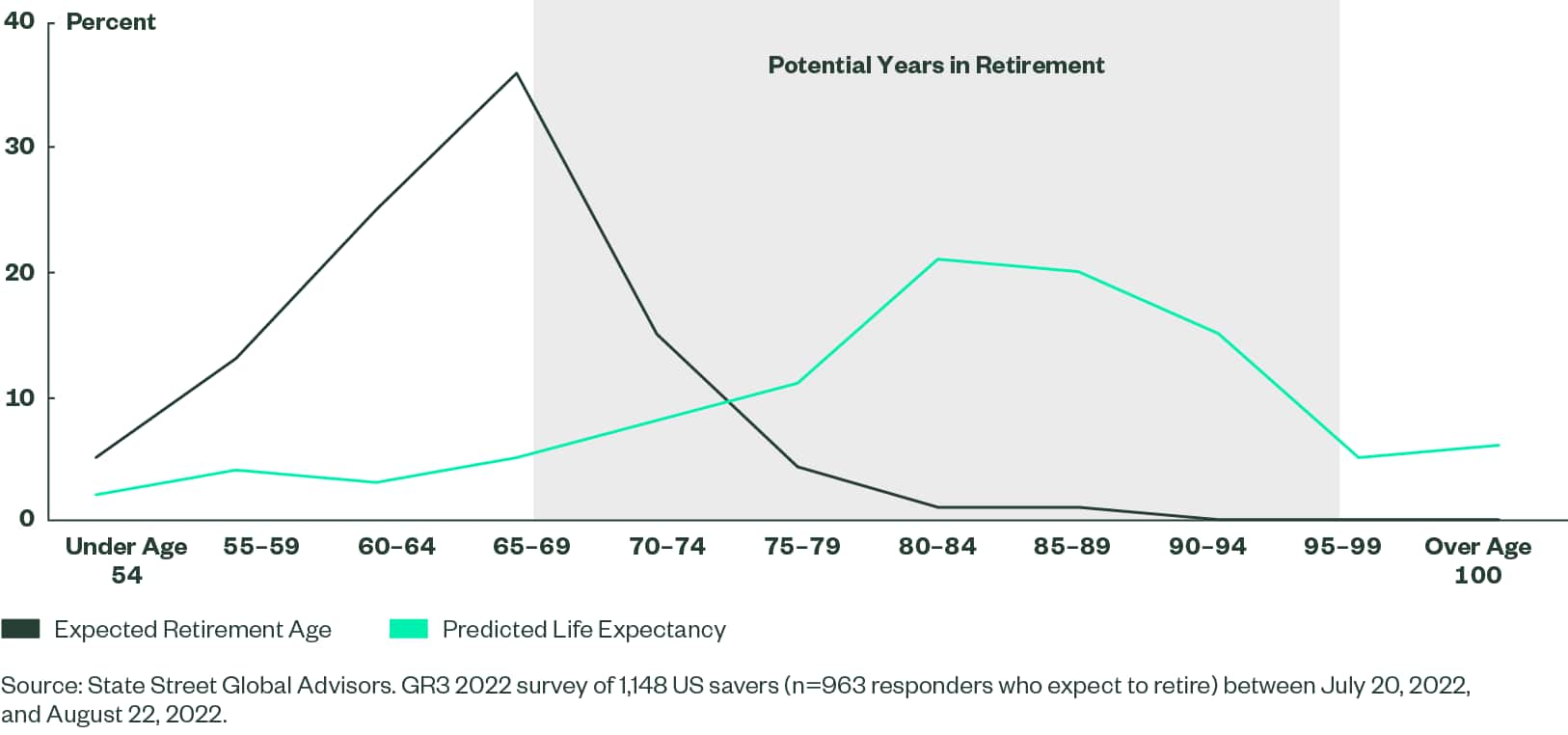

Consistent with the global results, the most popular retirement age range among US respondents was 65–69. However, in contrast to the global aggregate, Americans reported the greatest expectation of living past age 90 (26%). Aligned with this longevity expectation, US respondents showed the highest concern (30%) for making their money last in the later years of retirement, defined as age 80+, and for later-life health-care costs (per Finding #1: Concerns about inflation, medical costs, and the political climate dampen Americans’ retirement optimism).

Figure 5 : What Age Do You Expect to Retire? Assuming an Uneventful and Fairly Healthy Life, How Long Do You Expect to Live?

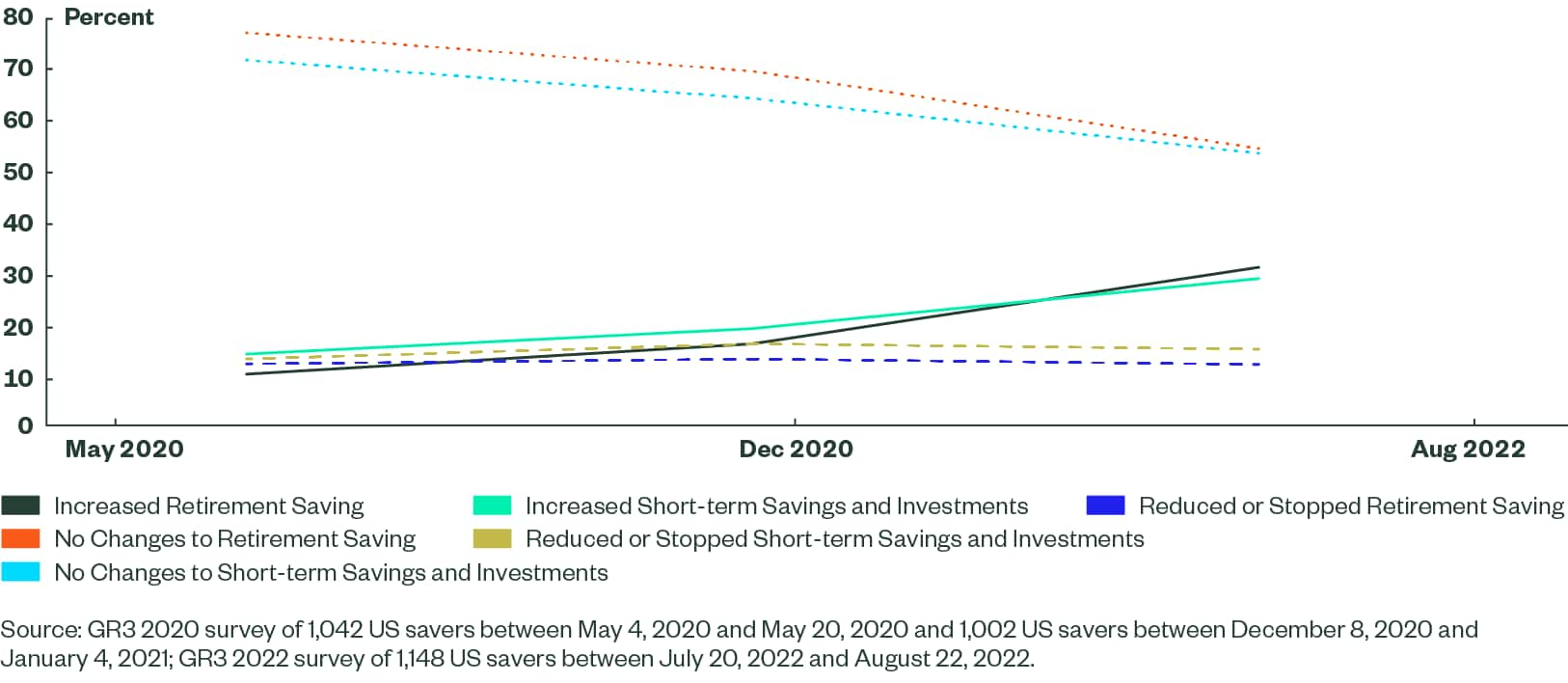

How are respondents reconciling reduced optimism and an expectation of increased longevity? By saving more.

In 2022, as compared with 2020 survey data, respondents from all countries reported an increase in retirement savings contributions and a corresponding decrease in reducing or ceasing savings. The US was notable in doubling its inclination to increase both retirement savings and short-term savings and investments from May 2020 to August 2022, a finding consistent with Federal Reserve data showing an additional $1.7 trillion in personal savings as of mid-2022 thanks to a combination of pandemic-curtailed spending, government stimulus, and an emergency-oriented perspective during that same time.6

Figure 6: During the Last 6 Months, Have You Made Any Changes to How Much You Are Saving in Your Retirement Savings Plan, Short-term Savings, or Investments?

When respondents were asked to elaborate on changes made to their retirement savings plans in 2022, Americans cited changes to the frequency of checking one’s balance — either more often (35%) or less (17%), most likely driven by the mercurial market — and increased contributions (34%). The fourth most selected answer was a tie between seeking financial advice (14%) and switching to lower-risk investments (14%).

Looking to previous GR3 data sets, the trends are consistent, but the emphases have spiked. Compared with the May 2020 survey data, increased balance-checking and seeking financial advice doubled (17% to 35% and 7% to 14%, respectively), suggesting that the savers in 2022 were paying more attention to their retirement portfolios than they have in years past — unsurprising, given undulating markets.

Finding #4: Americans are Developing a Retirement Income Point of View

While saving for retirement has long been understood and embraced by Americans — 73% believe they are primarily responsible for creating an adequate income in retirement, versus the 65% global respondent average — the previous section highlighted an increase in attention to contributions and portfolio risk management compared to years past. With a greater focus on saving for retirement comes new attention to spending in retirement, as survey-takers shared their definitions of and preferences for a retirement income solution.

For nearly half (48%), retirement income was synonymous with Social Security, a reasonable finding, given Americans’ familiarity with the entitlement. More interestingly, nearly a third (32%) defined retirement income as a drawdown plan that transitioned savings to spending. A 10th of the sample defined retirement income as an annuity, while the remainder didn’t know or didn’t think the product was for them.

Figure 7 : Which of the Following Most Closely Meets Your Understanding of the Meaning of “Retirement Income?”

48% | The income stream I receive upon retirement (e.g., a government entitlement) |

32% | A drawdown plan that my financial advisor or I put in place to transition my retirement savings into retirement spending |

10% | An annuity that provides a guaranteed income stream for the rest of my life |

9% | I don’t know how to define "retirement income" |

1% | A fancy finance product that’s not for me |

Source: State Street Global Advisors. GR3 2022 survey of 1,148 US savers between July 20, 2022 and August 22, 2022.

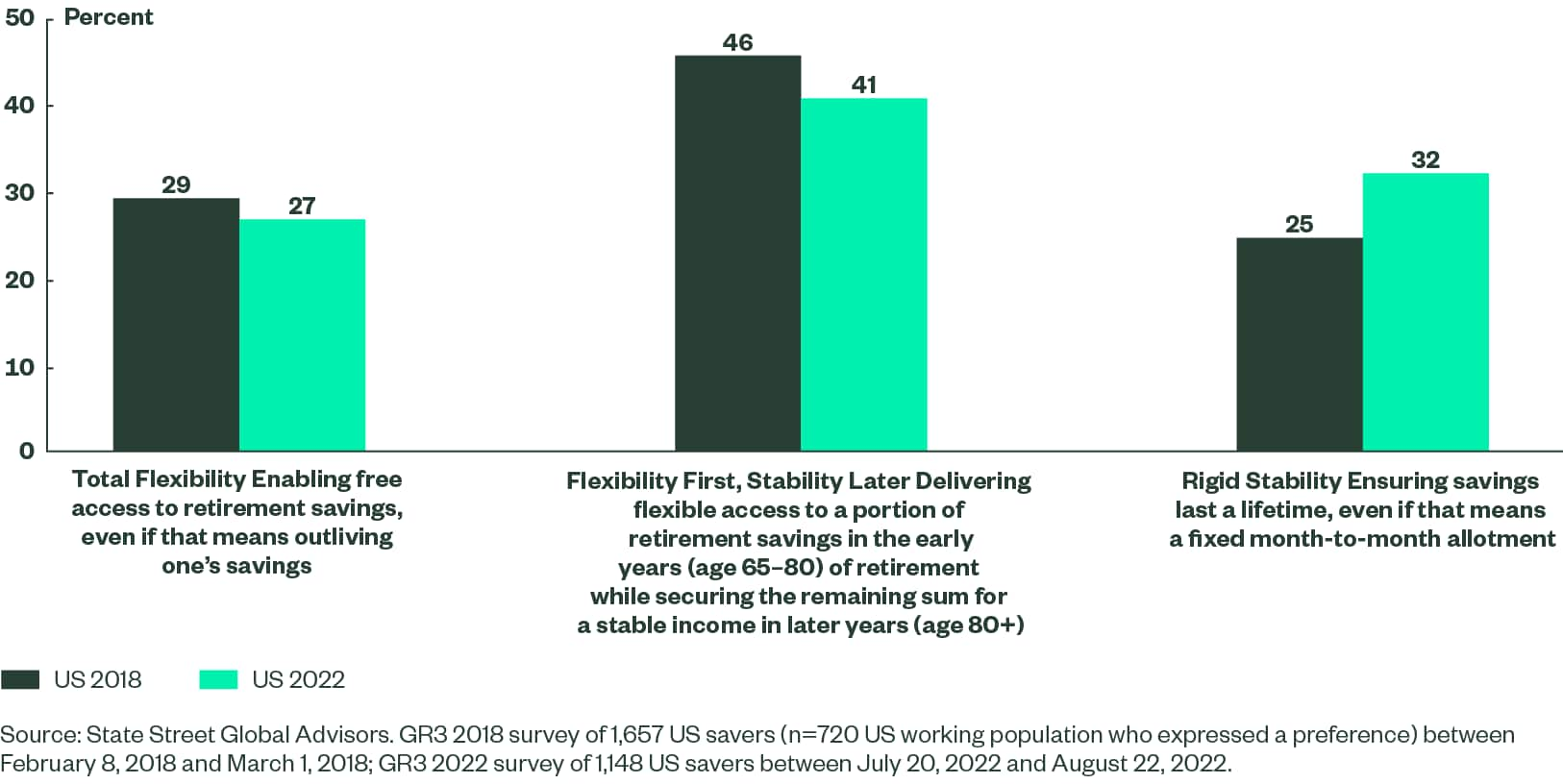

Moving to the shape of the solution, the GR3 survey has been tracking how much flexibility versus security savers are looking for in a retirement income solution. In 2018 and again in 2022, the most popular option globally was to have access to flexibility first, in the early years, and stability later, when it matters most (Figure 8). While this was true in the US, American respondents diverged from the global trend by showing an increase in preference for rigid stability from 2018 to 2022 and a modest decrease for total flexibility — and the hybrid option — during the same time period. With reports of looming Social Security depletion and more immediate cost-of-living concerns, security may seem like a rare commodity to Americans, particularly those who are nearing retirement.

Figure 8: From the Following Options Below Around How You Could Access Your Retirement Savings, Which Would You Choose? Please Pick One.

Finding #5: Employers Remain Critical to Americans’ Retirement Readiness

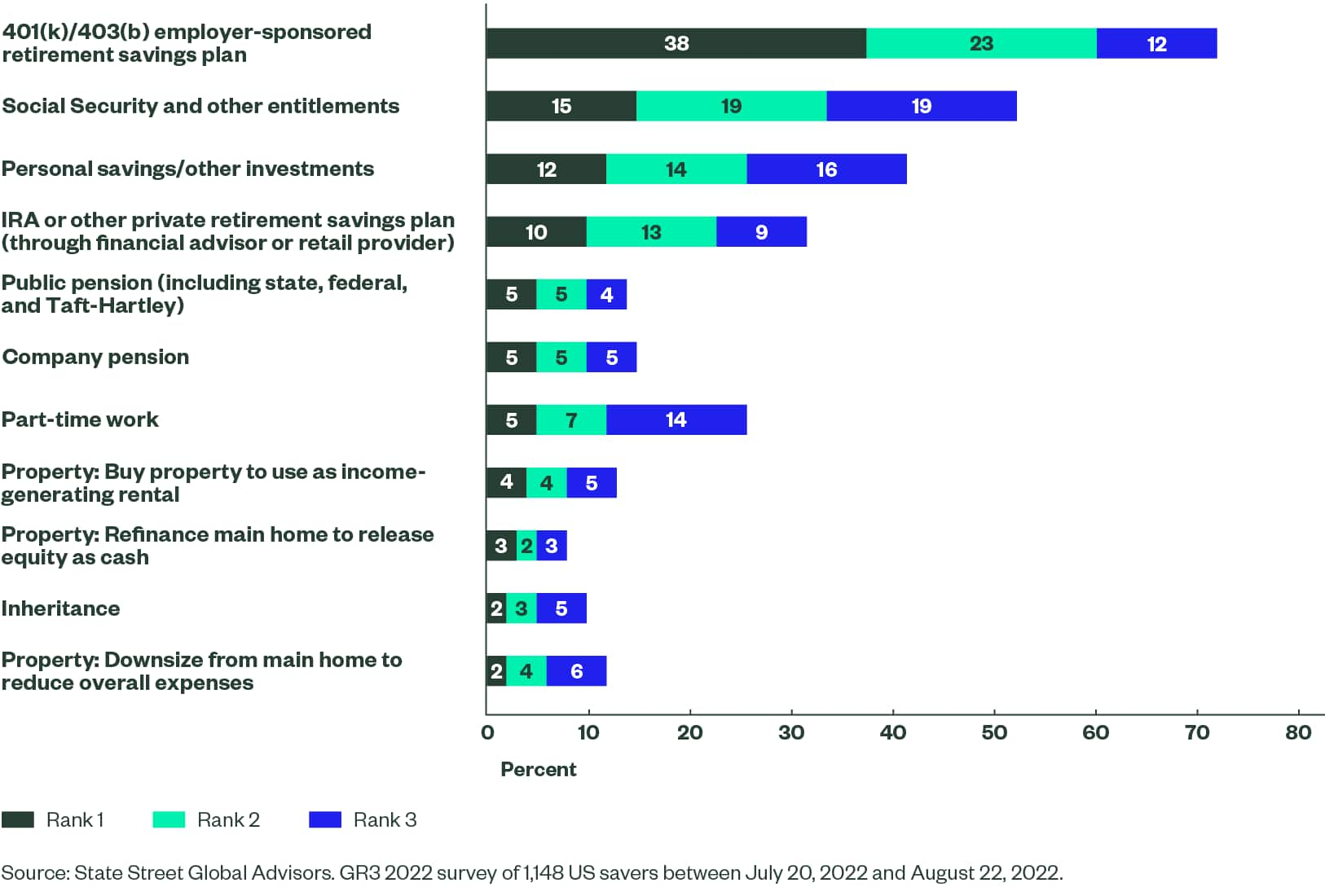

Employers have an opportunity to address participants’ lagging security sentiment. As illustrated in Figure 9, featuring US respondents’ top three expected sources of retirement income, the employer-sponsored retirement savings plan was the primary channel (73%), followed by Social Security (53%) and personal savings (32%).

Within this ranking, part-time work, while middling on the overall list, represented the third highest third-place rank (14%), following Social Security (19%) and personal savings (16%), suggesting that it is a back-burner option many are quietly considering.

Figure 9: What Do You Expect to Be Your Main Sources of Income in Retirement? Please Rank the Top Three Sources in Terms of Income Value.

Beyond being the source of retirement income, the retirement savings plan has the opportunity to be the vehicle for it, as 52% of US respondents said they’d most likely take the option of keeping money in their existing plan during retirement, rather than withdrawing it or transferring it elsewhere. State Street believes that those retirees who keep money in an employer-sponsored plan stand to gain from institutional plan pricing — which, due to economies of scale, is generally lower than retail fees — as well as vetted investment options, curated resources, and oversight from a familiar fiduciary able to support the transition from retirement saving to spending.

With regards to the employer resources available to help participants pivot to retirement, US respondents saw value in access to financial consulting, retirement calculators, and in-person or town-hall style educational forums. But when asked which resources they would want to see activated in their workplace, respondents were most intersted in having their employers implement a guaranteed income product, such as an annuity (67%).

By suggesting the product could be an annuity, the survey gained respondents’ perceptions on annuities (Figure 10) — and the overall sentiment was positive. Almost half (46%) of Americans said annuities provide safety and security, a salve in this current environment. One in four said annuities were an essential part of a retirement income solution.

Closing Thoughts

For employers, financial advisors, and policymakers seeking to support retirement access, coverage, and income, this year’s survey findings have yielded the following actionable insights:

- Americans are seesawing between saving and spending. During the pandemic, Americans were saving more. There were fewer occasions to spend, more government subsidies, and an emergency-centric mindset. But inflation and interest rate hikes have spiked spending and increased US appetites for more secure financial solutions.

- Flexibility comes first. Savers continue to seek a hybrid income solution that delivers financial flexibility first (in the early years of retirement) and follows with a stable income when it’s needed most.

- Annuities are not the enemy. Of the global sample, Americans were most aware of and keen on annuities, with some considering the product tantamount to retirement income. In today’s environment, higher interest rates have translated into higher payout rates on many types of annuities, enhancing the product’s value-add to participants.

- The financial advisor’s stock has risen as savers seek outside expertise. Compared with past GR3 surveys, and potentially in response to market volatility and savings trends, respondents’ inclination to seek financial advice has doubled. Not only does this finding bode well for advisors, but it bolsters the bridge between employers and advisors, making collaboration toward better retirement outcomes more organic.

- Employers are essential. Savers know they are responsible for their own retirement readiness and view their defined contribution (DC) plan as the primary source for their retirement income. Given the importance of the DC plan, employers have permission, if not a responsibility, to seed, manage, and expand retirement saving and spending conversations.

Survey Methodology

State Street Global Advisors commissioned global analytics firm YouGov to conduct an online survey across four countries, representing a range of retirement systems. The goal of the 2022 survey was to monitor retirement sentiment and compare trends across 2020, 2019, and 2018 data sets. YouGov surveyed 3,553 individual savers with access to employer-sponsored defined contribution plans between July 20, 2022, and August 22, 2022.

Region | Number Surveyed |

Australia | 618 |

Ireland | 607 |

United Kingdom | 1,180 |

United States | 1,148 |