Performance, flows, investor behaviour

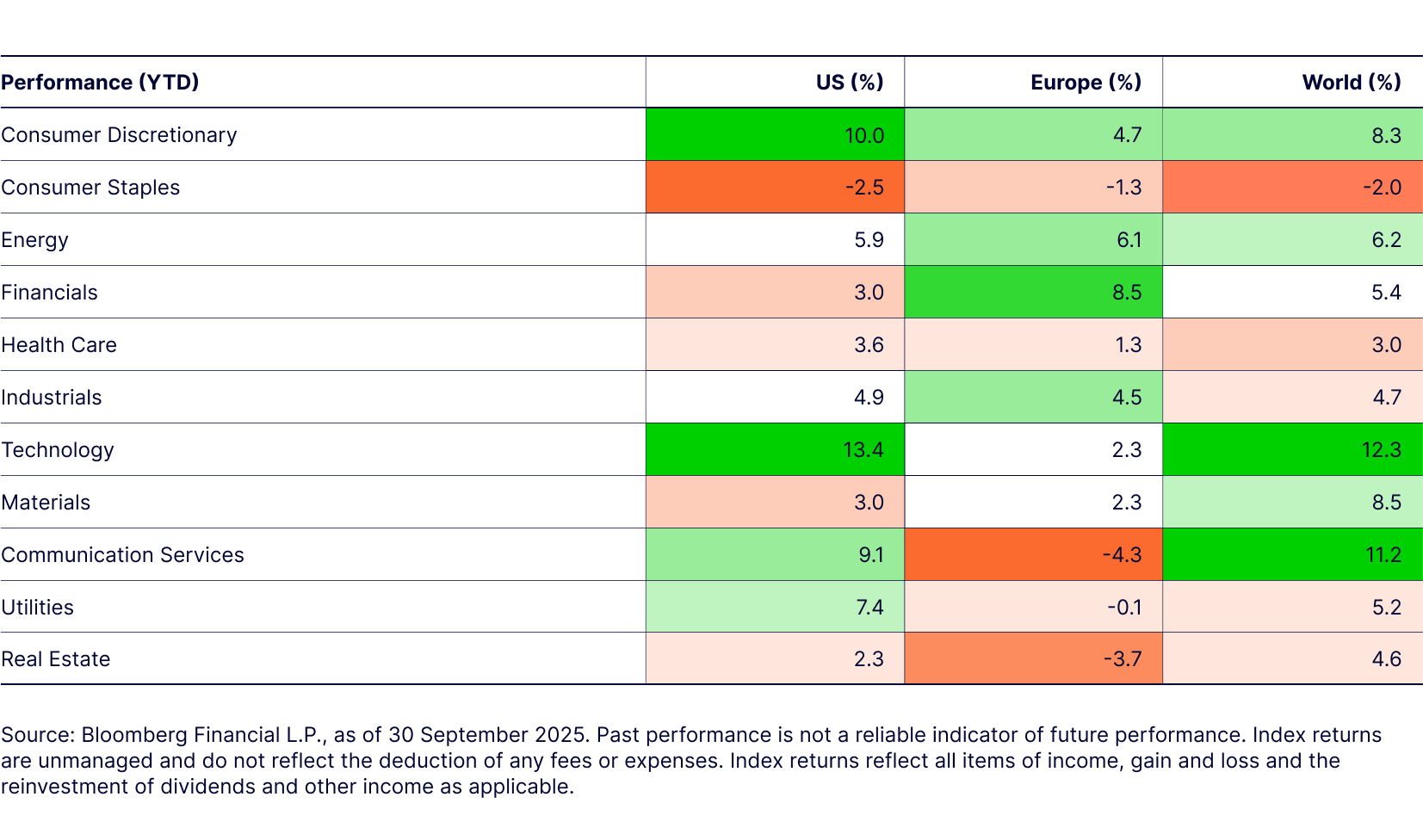

US: sell the tariff rumour, buy the tariff fact.

Europe: buy the tariff rumour, sell the tariff fact.

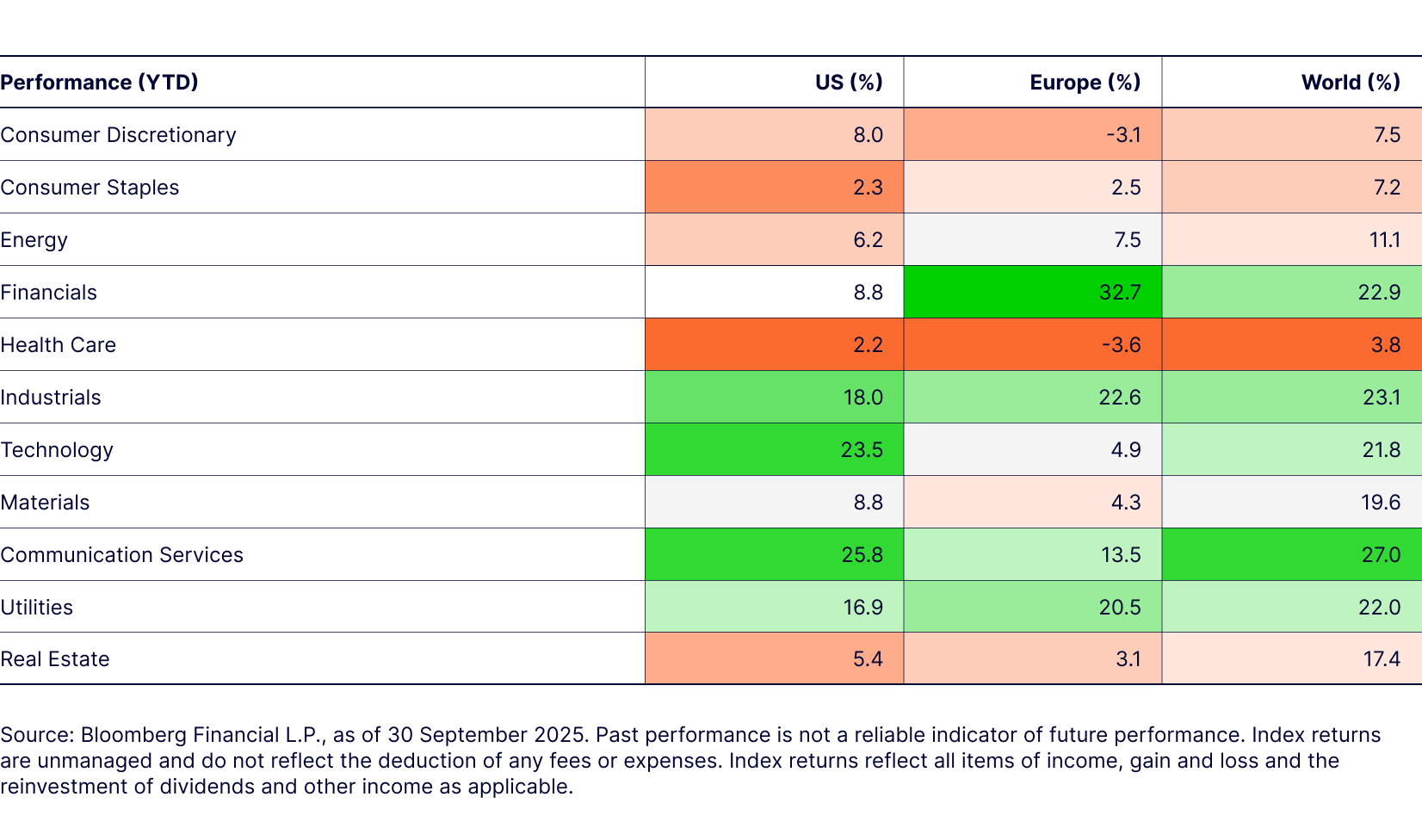

Rising global divergence meant equities faced diverse, sometimes contradictory trends in Q3.

The AI narrative buoyed the US economy while Europe grappled with a strengthening euro and the reality of tariffs, which proved worse than the spectre. US Information Technology (Tech)-sector dominance continued in September, but there was a retreat in Industrials and Financials, sectors which had previously outperformed in 2025. In Europe, Financials, led by the Banks, retained their strength. We saw the tentative signs of a turnaround in Europe’s Health Care sector.

Having sold the tariff rumour, US-focused investors bought the fact. They discounted the potential inflationary impacts of tariffs, shrugged off a ballooning budget deficit, and looked past rising geopolitical and policy uncertainty. Despite the uncertainty, investor sentiment remained strong as seen in the flows below.

Figure 1: Sector performance shows greater divergence

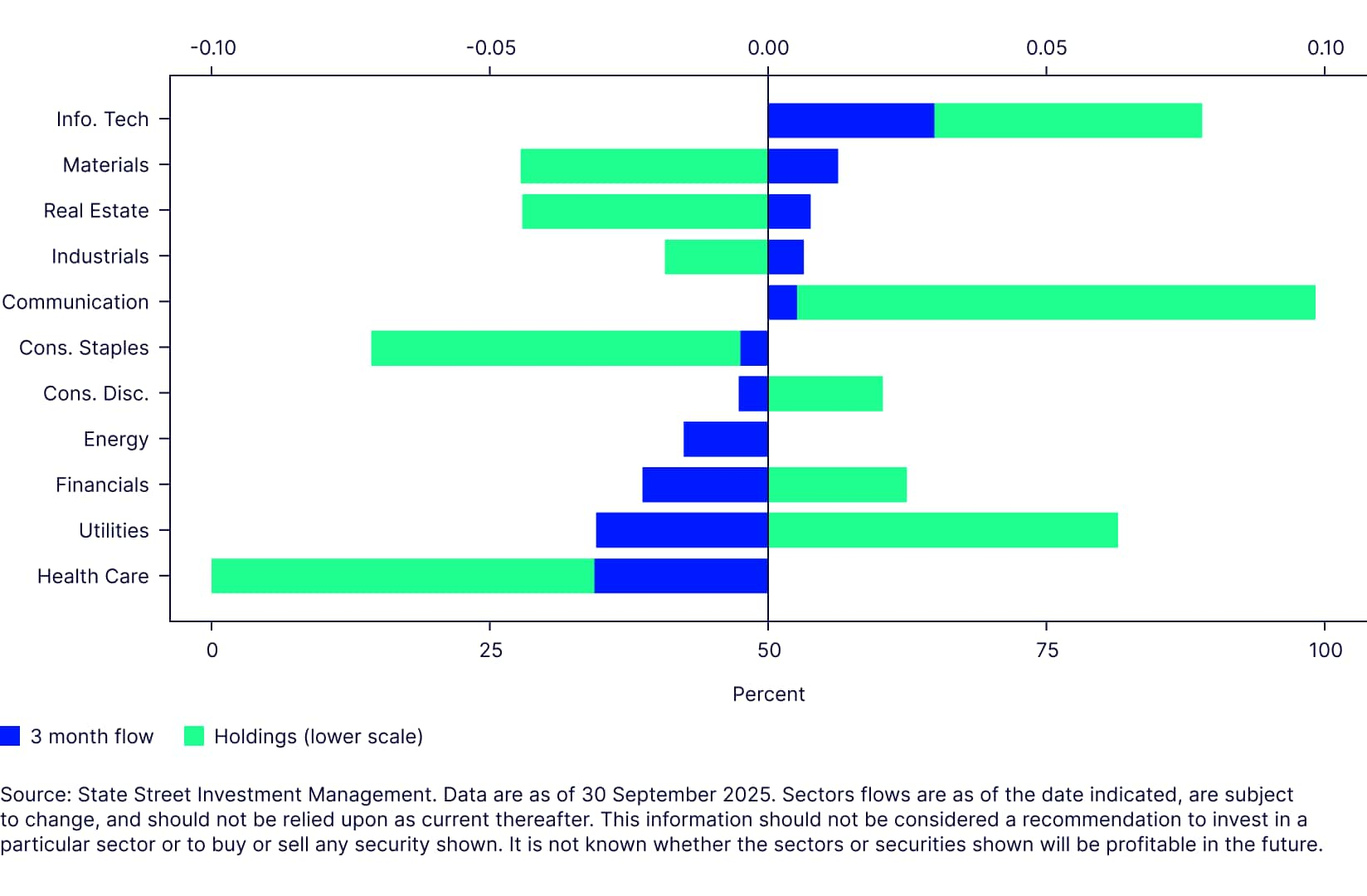

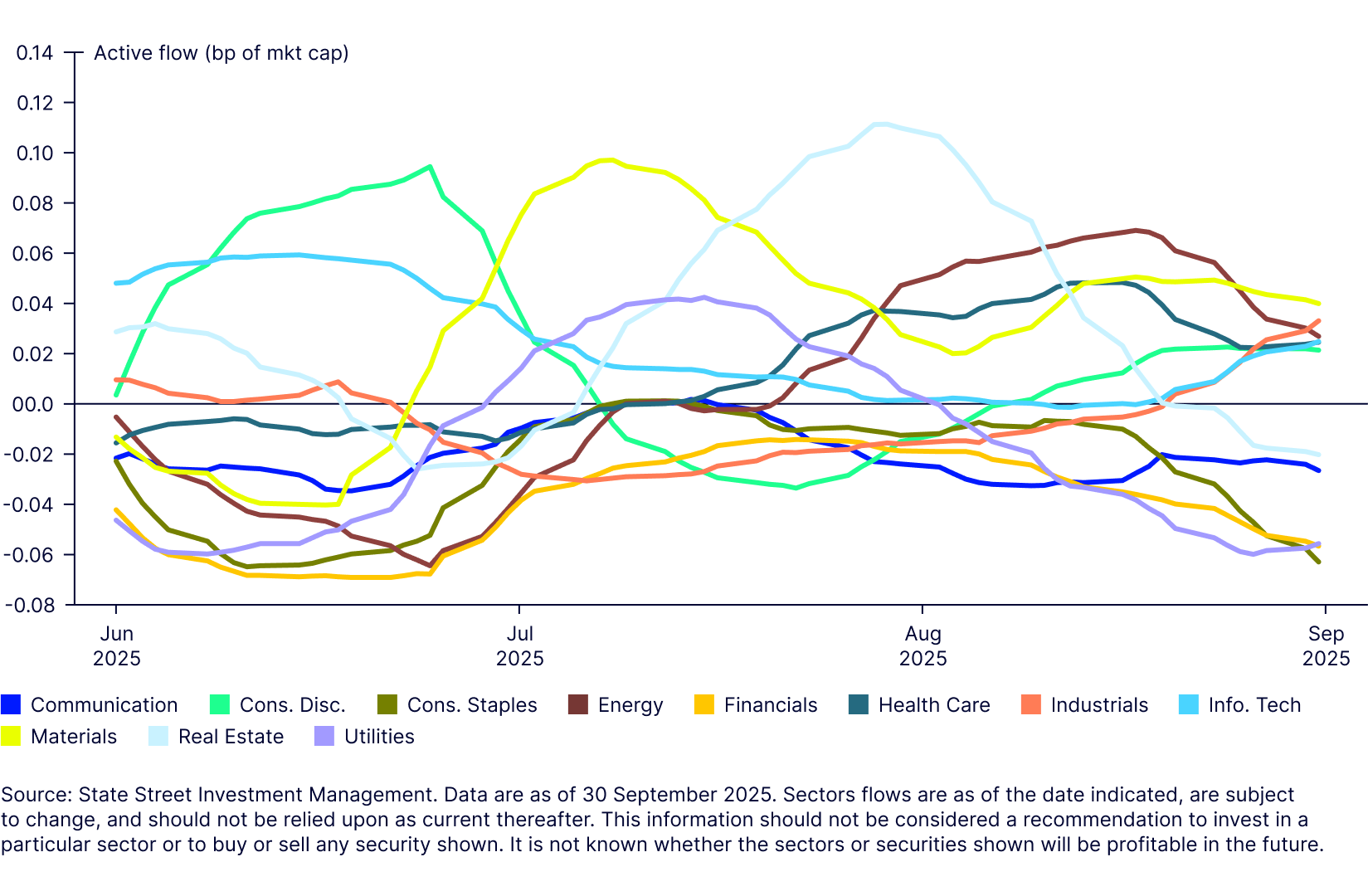

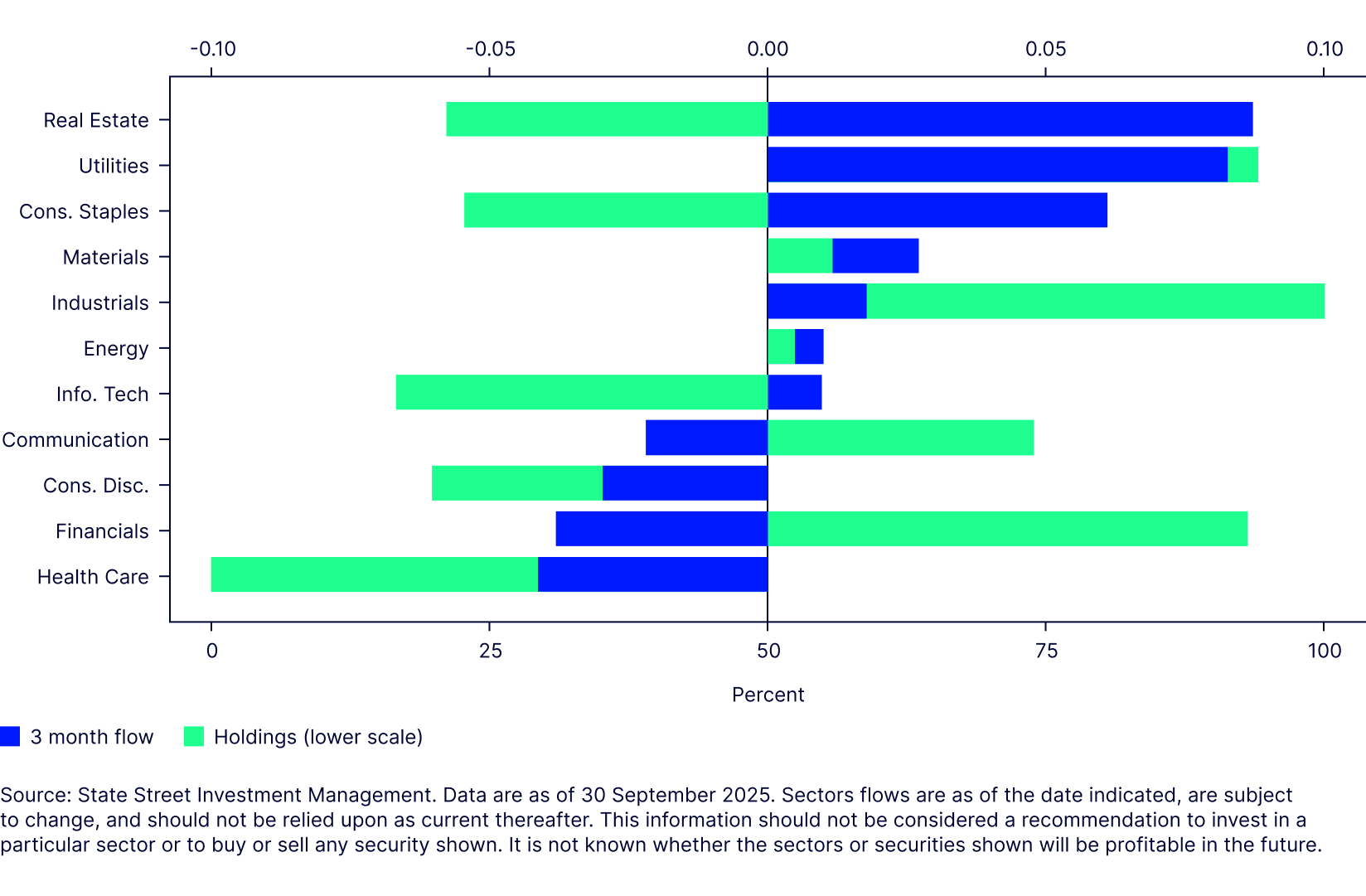

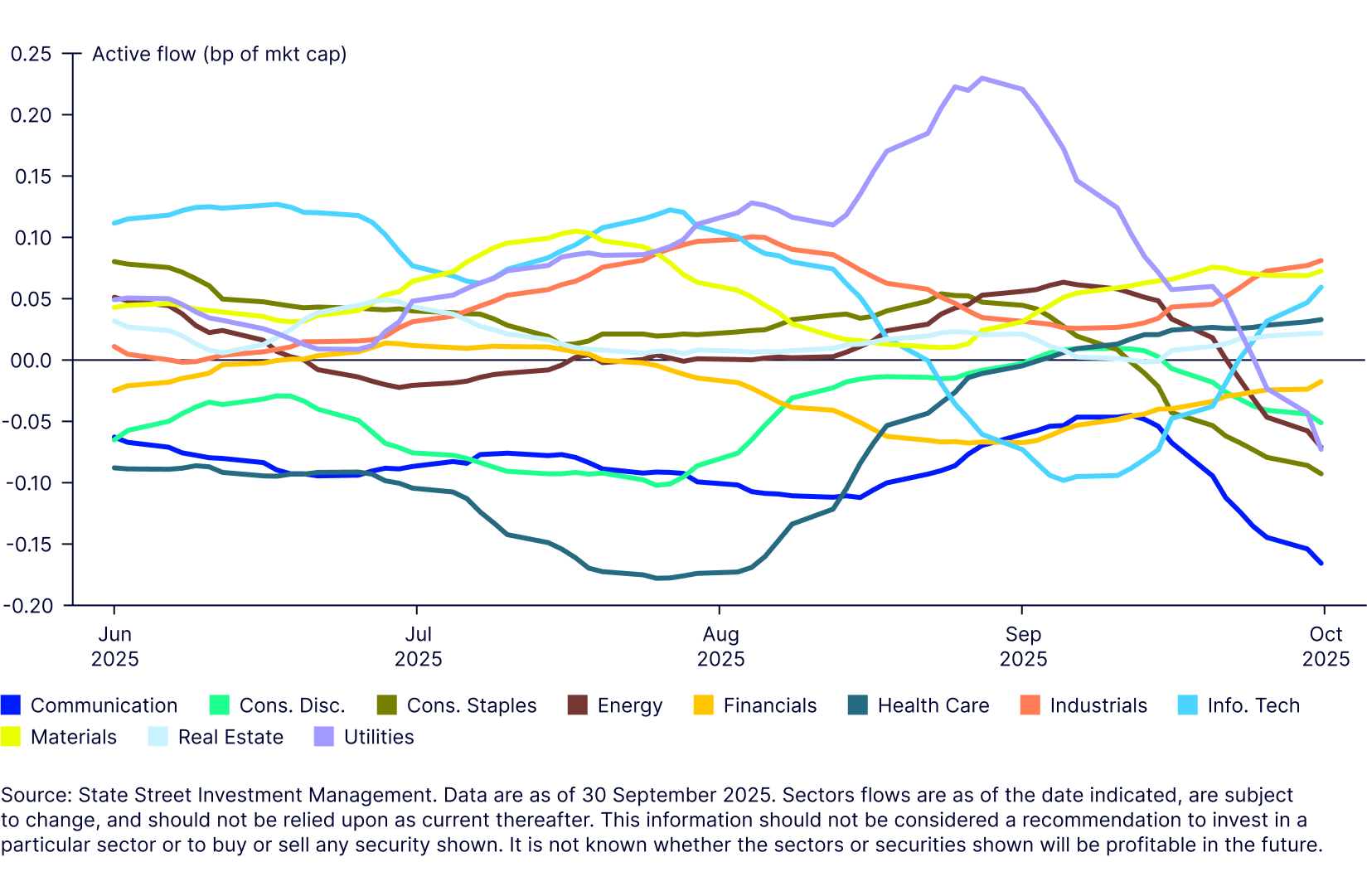

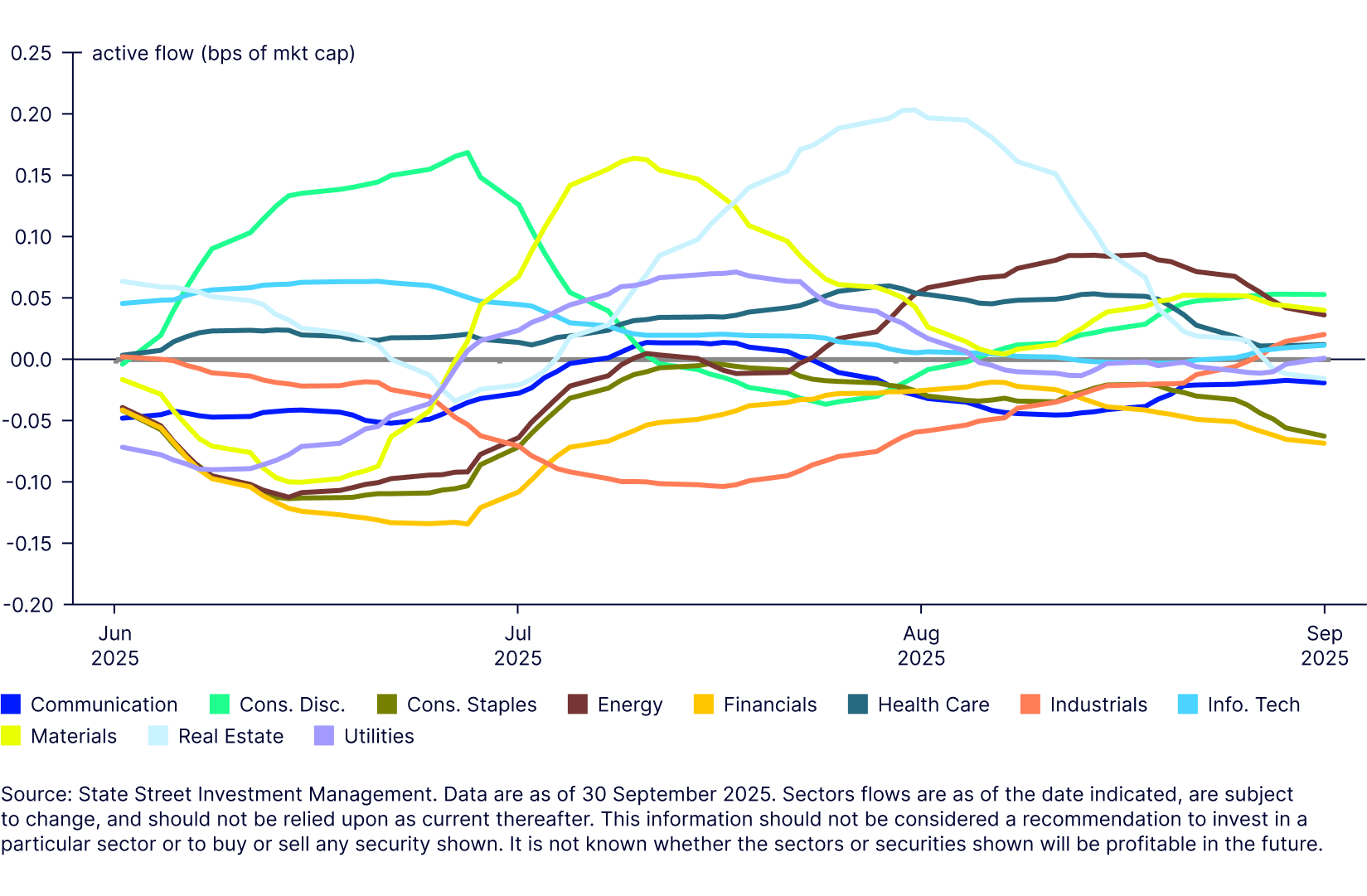

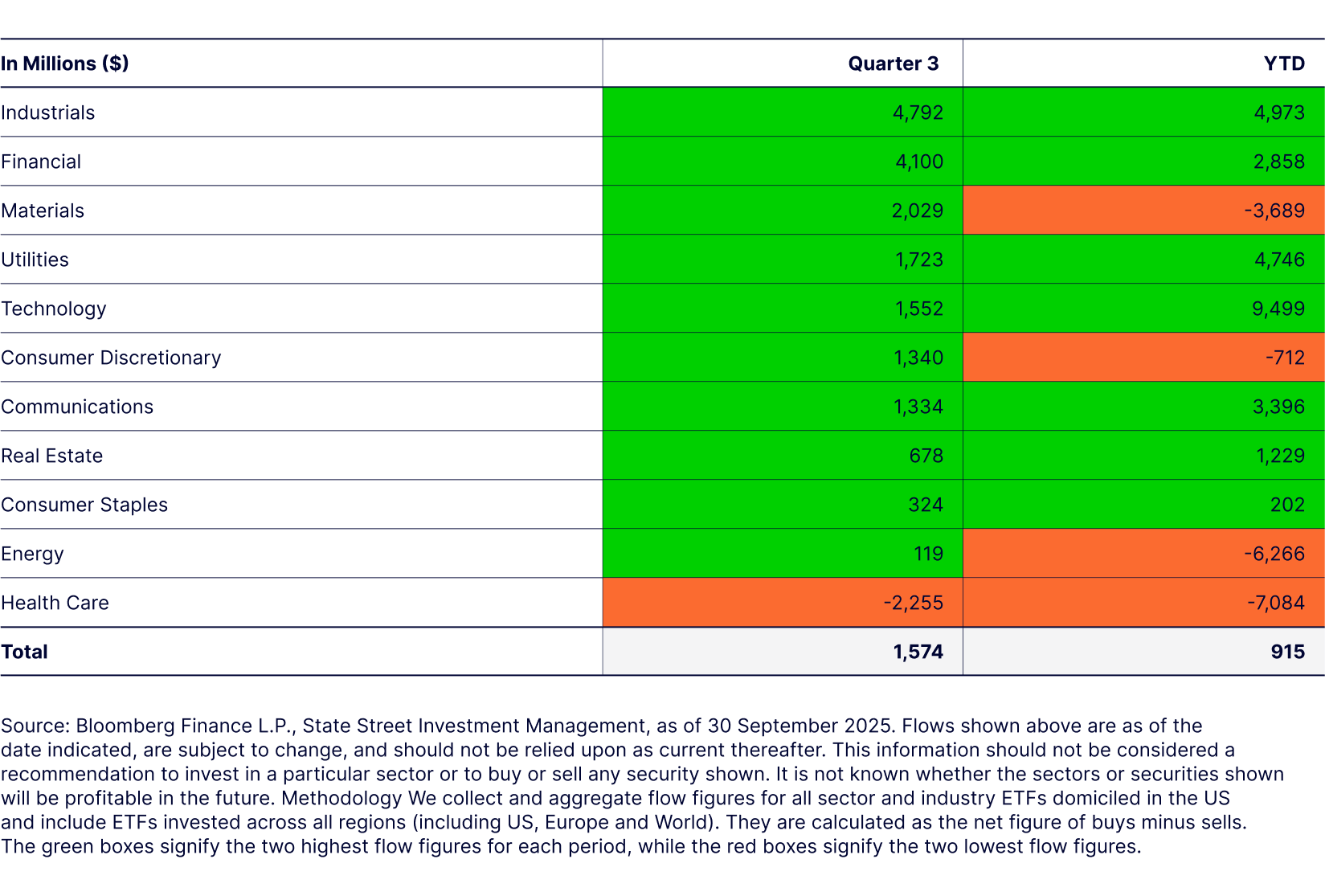

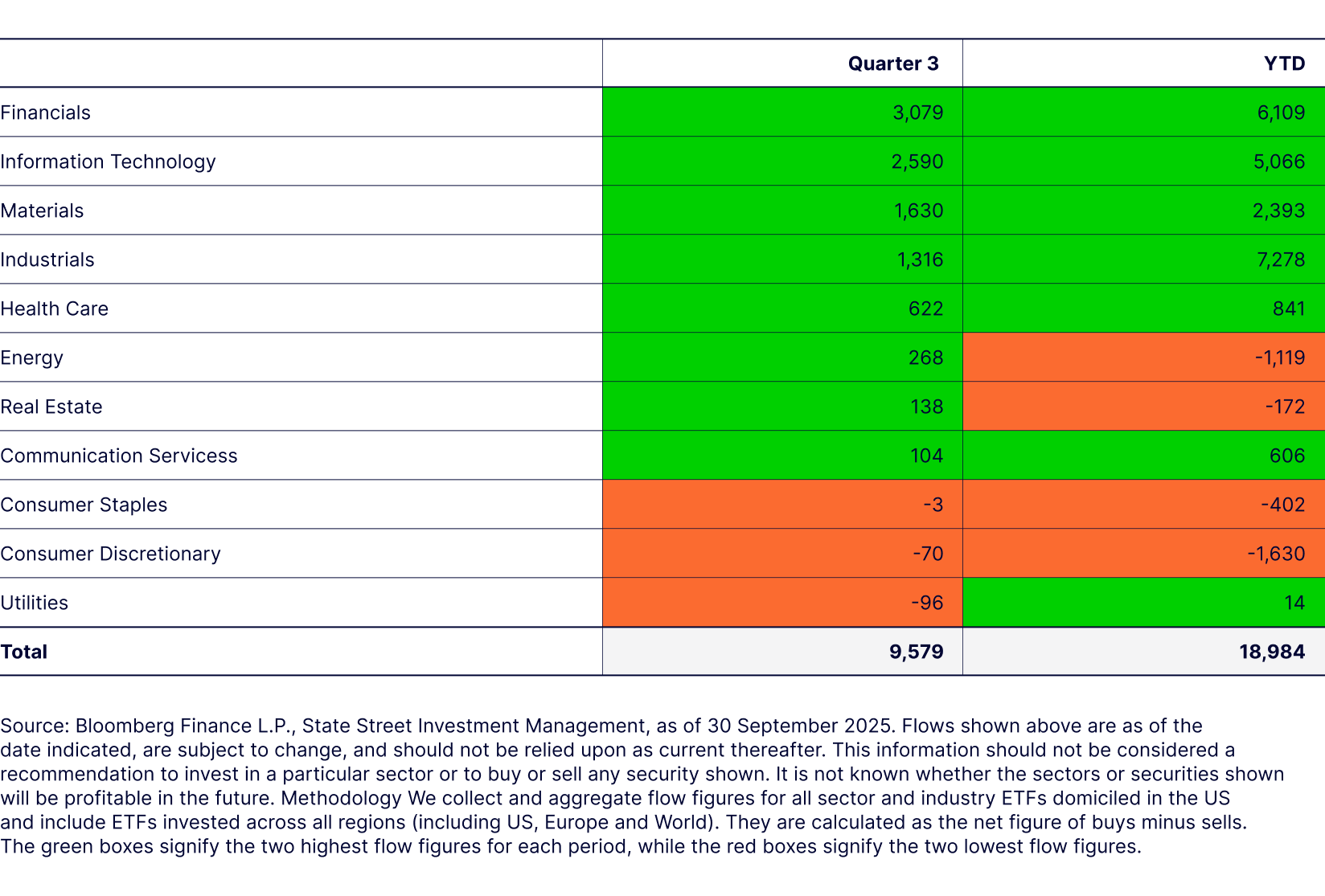

Net inflows into equity ETFs were significant in Q3—and investors increased allocations to sector ETFs. Net inflows were weaker for Tech-related ETFs. There was broader investor interest in Financials—including US and European Banks—after a good Q2 reporting season. Amongst other sectors, Materials, attracted by mining operations; and Industrials, which includes Defence & Aerospace. Investors demonstrated strong risk appetite, favoring cyclical exposures and reducing holdings in historically defensive Utilities. Health Care flows appear to be turning positive, especially in European-domiciled ETFs.

ETF flows

Figure 2: Continued broadening out of sector interest

European-domiciled sector ETF flows

US-domiciled sector ETF flows

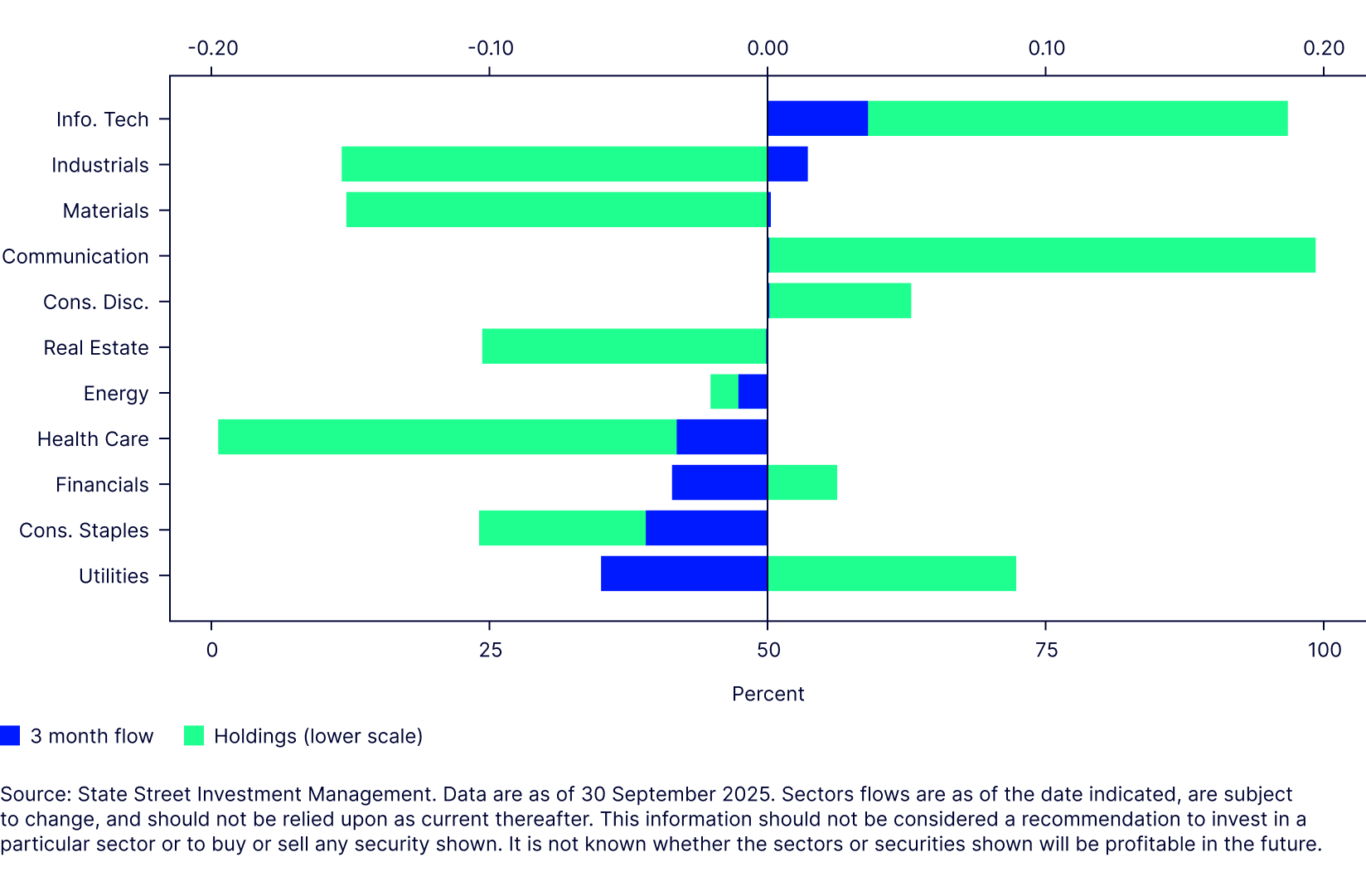

Investor behaviour overview: risk was on

Institutional investor behaviour — as measured by observations from State Street's US$46.7T custody business—again showed strong risk-on sector sentiment for the quarter.

Institutional investors further increased Tech overweights. Cyclical exposures such as Materials, including mining stocks, were in favour. In Europe there was notable buying of Real Estate stocks, including REITS.

Portfolio holdings reveal high allocations to Communication Services and Tech, reflecting the renewed strength of the Magnificent 7. Health Care holdings remained low everywhere compared with the last five years, reinforcing our preference for a cheap sector (more later).