UK Snapshot

Last year brought a continuation of inflation concerns as well as new issues to contend with, including conflict in the Middle East and fears of a potential recession. Our Global Retirement Reality Report looks at insights from 4,257 DC savers from five countries with developed DC pensions systems to assess their views on their retirement prospects and strategies. In this snapshot, we discuss the findings from the UK and compare the results other countries, and to our 2022 survey.

Key Findings

The cost-of-living crisis is still casting a shadow over retirement savings for UK respondents to our survey. Confidence and optimism about retirement remains low post-pandemic, largely driven by inflation.

Automatic enrolment has improved pension coverage, but there are still ways in which the UK’s system can be further improved to raise confidence and ensure better transparency. A lack of trust in pensions and concern over complexity could be addressed through forthcoming policy proposals.

Sustainable investing, taking account of environmental and social issues, is increasing in importance for many savers, and people are far more likely to express an opinion on this issue than they were 12 months ago.

Below, we share six key findings that can help pension schemes and employers understand what is keeping their members up at night, and how they can help support their members to prepare confidently for retirement.

Key finding 1: Stubborn inflation impacts retirement plans

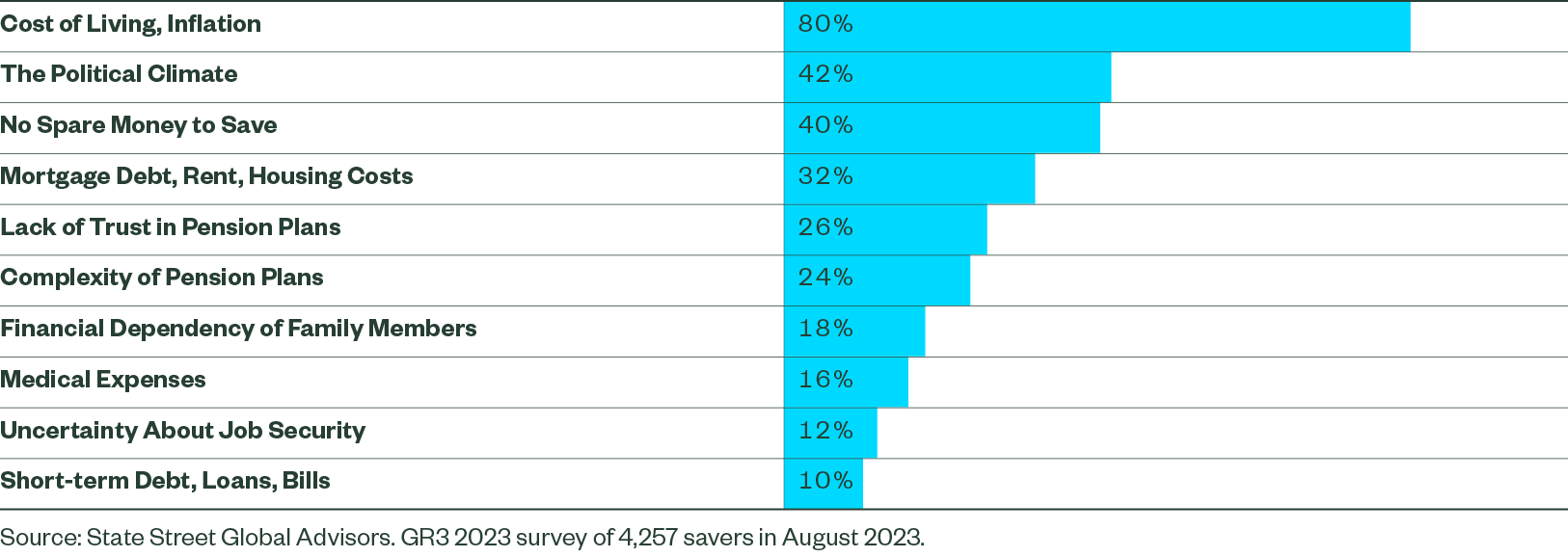

The UK has been grappling with elevated inflation of more than 5% for nearly two years. While the key measures of inflation have been falling steadily through 2023, it is clear that higher costs have had a profound impact on savers’ confidence in their ability to retire when they want to. Four in five UK respondents to our survey said the cost-of-living crisis had negatively affected their retirement confidence.

Figure 1: What factors most negatively affect your confidence that you will be ready to retire when you plan to? (Pick top three)

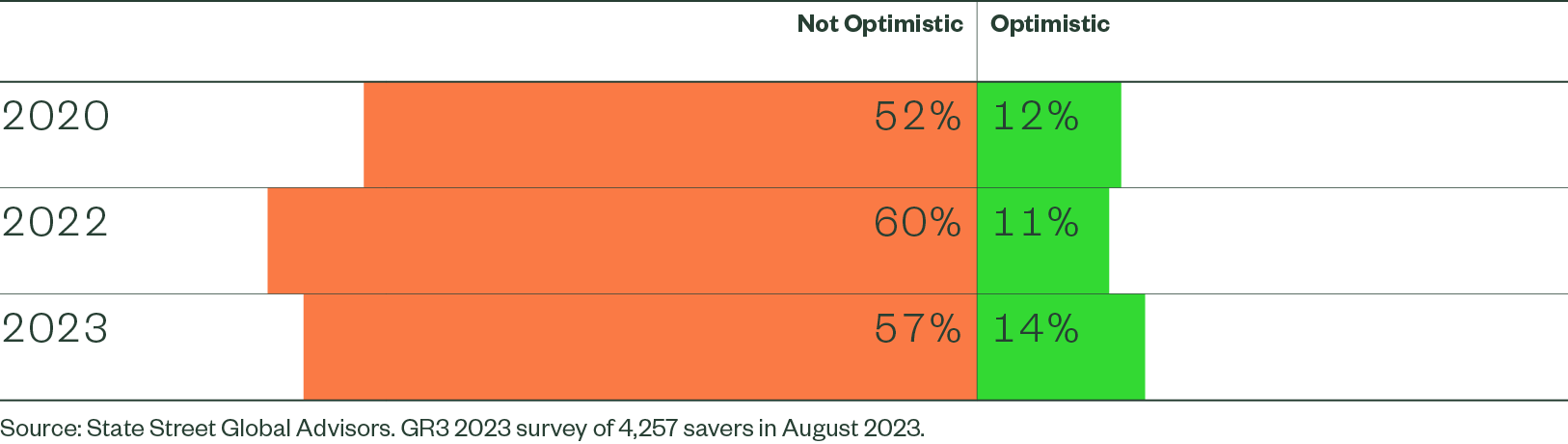

More than half (57%) of UK savers are not optimistic about being financially prepared for retirement. While this is a slight improvement on last year (60%), this lack of optimism pre-dates the cost-of-living crisis.

Figure 2: How optimistic are you that you will be financially prepared for retirement by the time you plan to stop working?

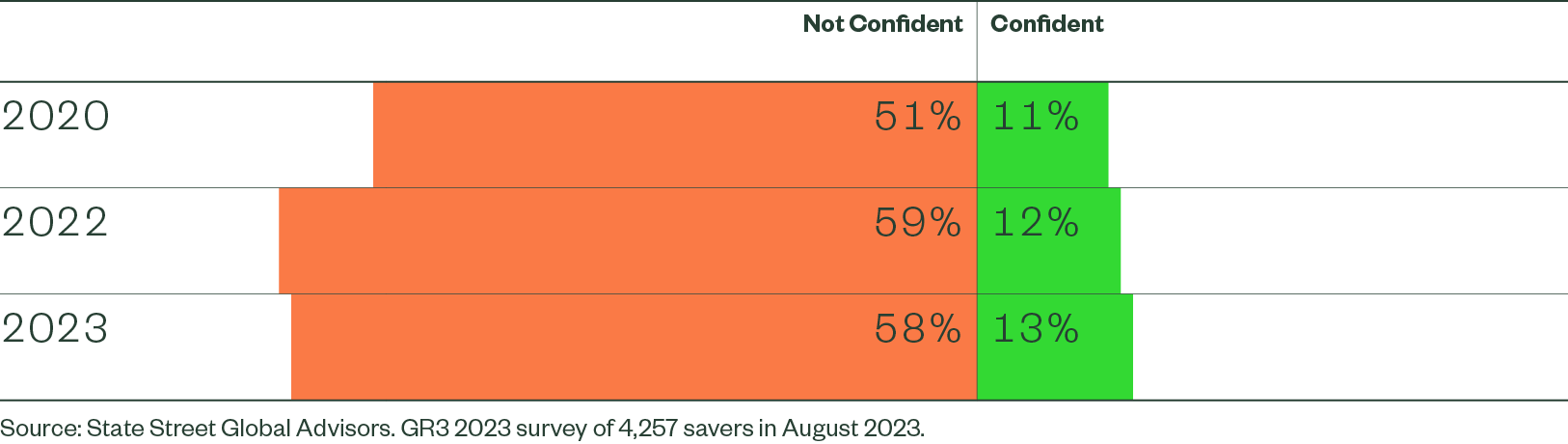

Figure 3: How confident are you that you will be able to retire when you plan to?

More than a decade after the introduction of auto-enrolment, this lack of confidence and optimism indicates that there is more to do to improve the retirement prospects of UK savers. Increasing the minimum contribution rate and expanding the eligibility criteria are two policy suggestions that have been widely supported as ways of strengthening the auto-enrolment regime.

“As the economy continues to get worse, as wages continue to stay low despite extreme price rises in all areas, and as the state pension age keeps going up, I’m feeling a lot more depressed about my prospects of retiring at a reasonable age.”

“I am 60 this year. I had planned to retire, however housing costs, the cost of living, running a car, etc. are so expensive that now I don’t have disposable income.”

Key finding 2: Paying pensions more attention

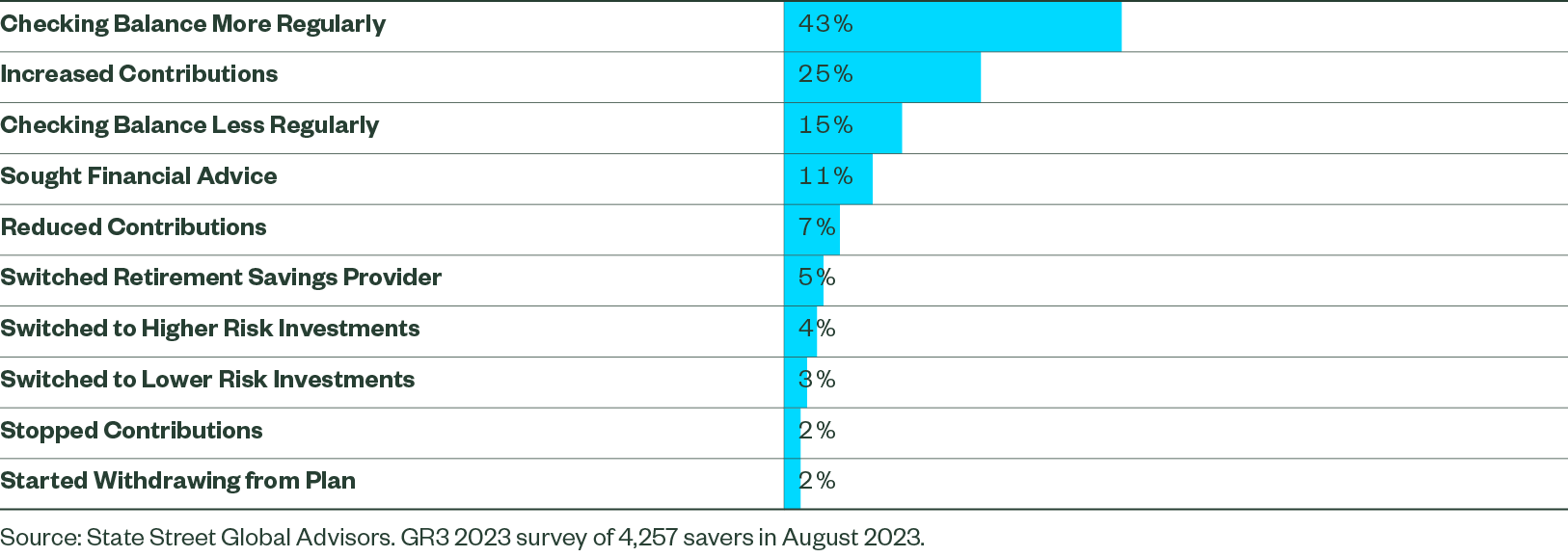

Despite the impact of the cost-of-living crisis on optimism and confidence, it appears UK savers are more likely to engage positively with their retirement savings. More than two in five (43%) respondents said they were checking their balance more frequently than they were 12 months ago.

A quarter (25%) even said they had increased contributions, compared to 7% who had reduced contributions and 2% who had stopped paying into their pension altogether. This reflects official data, which shows that the rate at which people actively opted out of their pension was just 0.8% in the 2022-23 financial year.1

Figure 4: Have you made any of the following changes to your retirement savings plan? Select all that apply

It is encouraging that UK pension savers are more likely to engage with their retirement savings and increase contributions through a financially difficult period for many. Future policy changes should take this into account, as it is important to enact change in a careful but positive way so as not to undermine confidence in the pension system.

“I have started following some social media accounts that pointed out even at 30 I should be thinking about retirement. I also realised how possible it is to retire earlier with the right preparations and savings.”

“I’m actually thinking about it now whereas I hadn’t before. I’d not paid enough into the system and now have a job to pay back into the system.”

Key finding 3: Complexity and trust

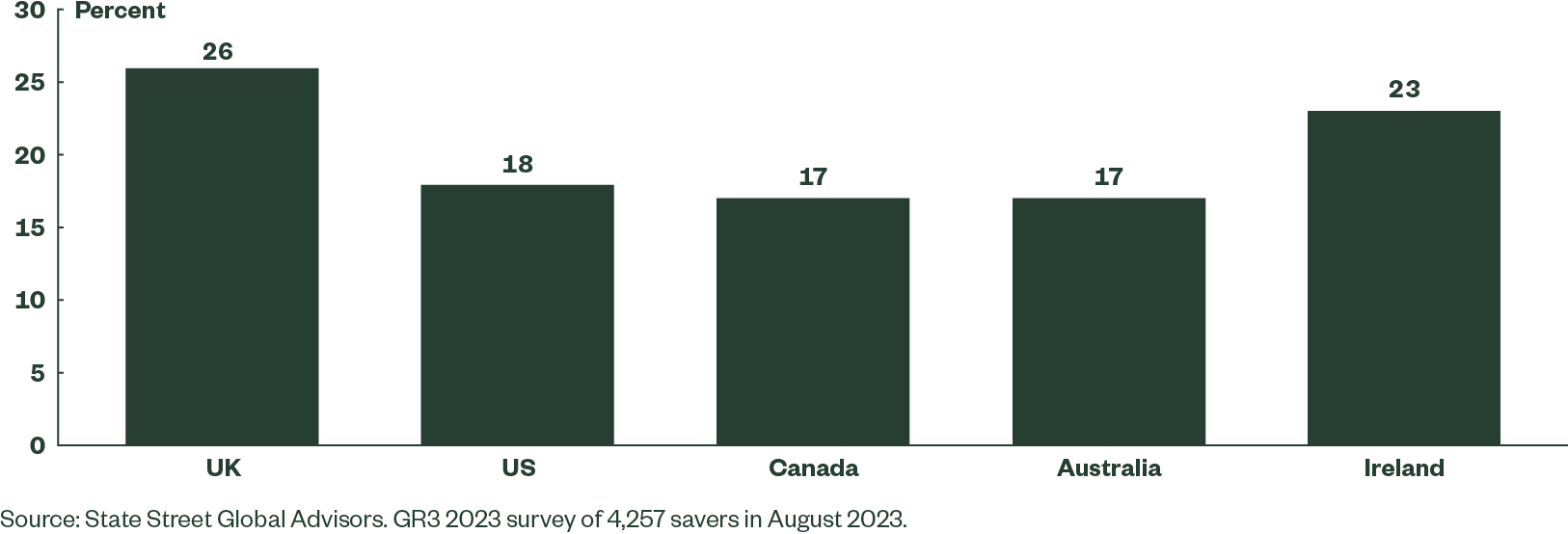

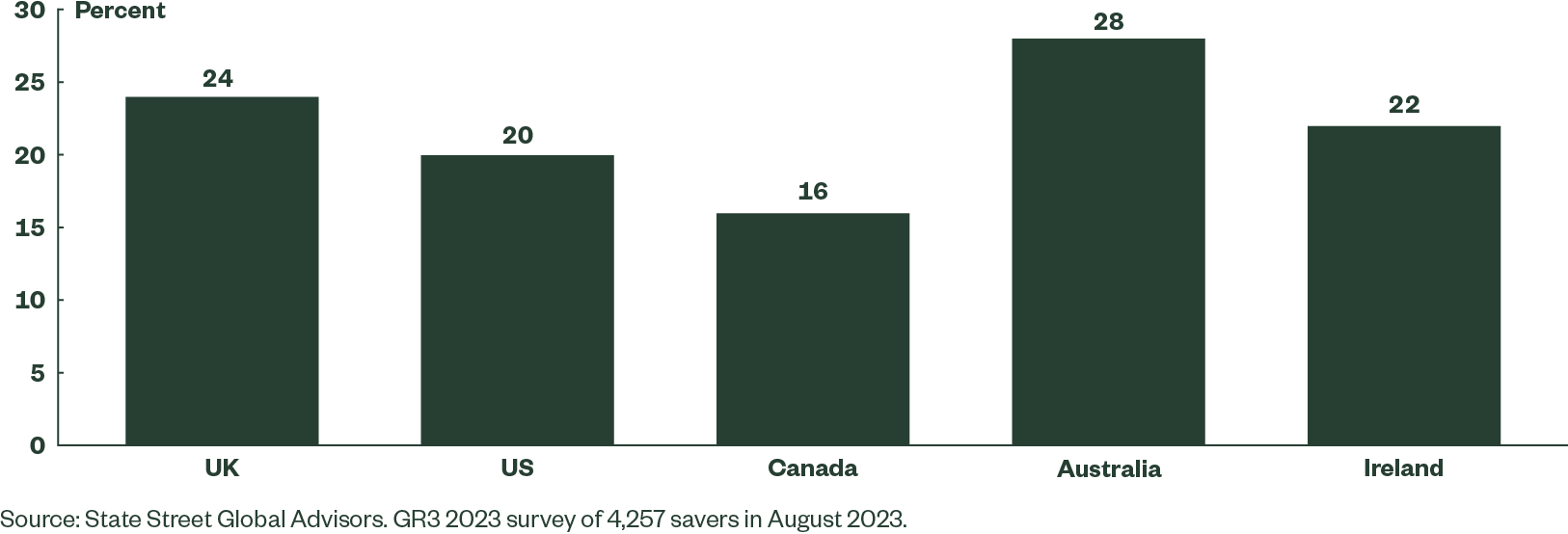

UK savers have less trust in retirement savings plans than those in other countries in our study. More than a quarter of UK respondents (26%) cited a lack of trust as a barrier to their retirement confidence. A similar proportion (24%) cite complexity as a barrier, underlying the need to simplify the system.

Figure 5: What factors most negatively affect your confidence that you will be ready to retire when you plan to? % selecting 'lack of trust in retirement savings plans'

Figure 6: What factors most negatively affect your confidence that you will be ready to retire when you plan to? % selecting 'complexity of retirement savings plans'

The Pensions Dashboard is one policy development that could significantly improve trust and reduce complexity. If successful, such tools could help give savers a full picture of their retirement savings, bringing additional transparency and helping individuals plan effectively for their life after work.

Key finding 4: The retirement income challenge

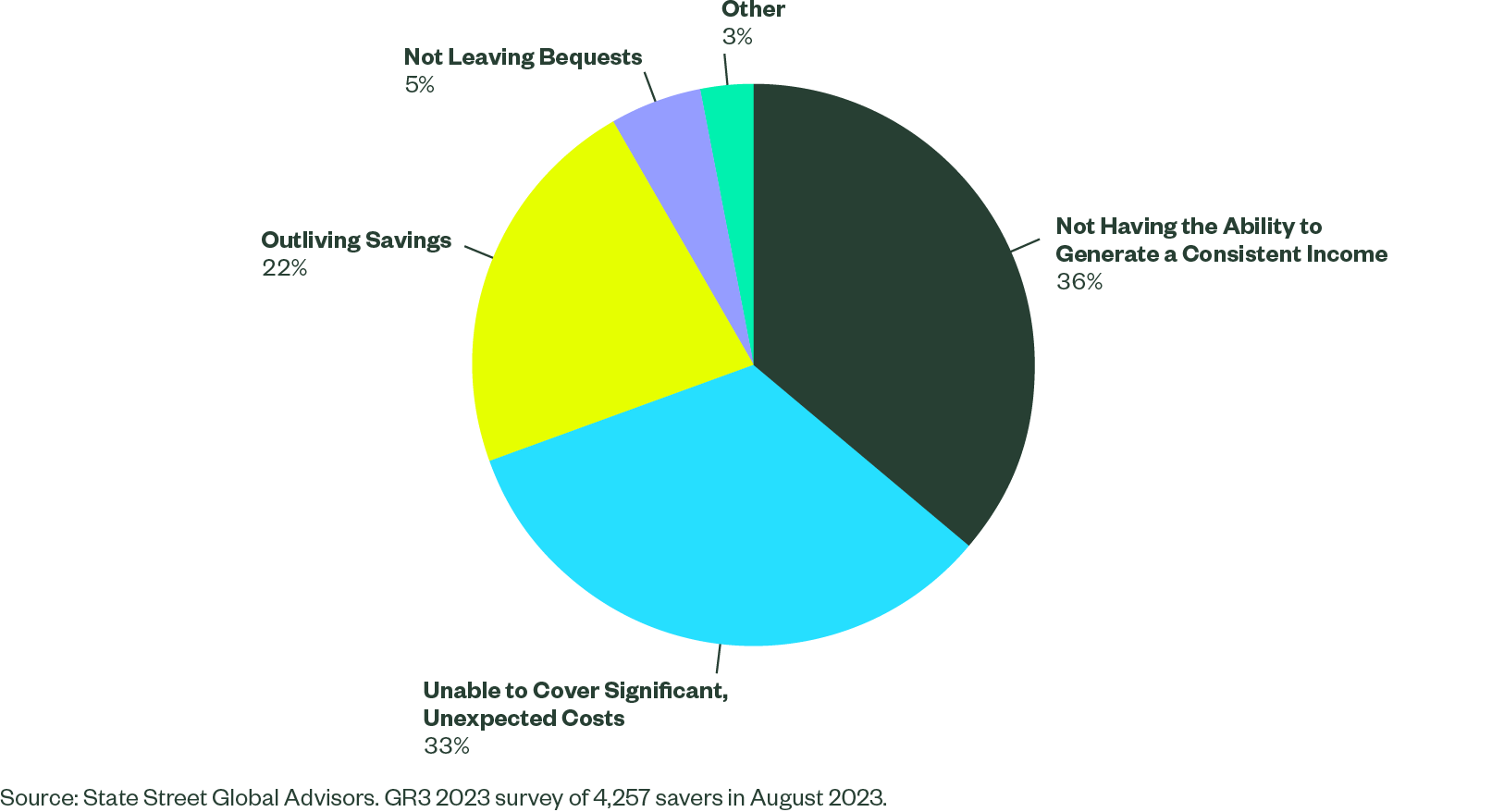

Auto-enrolment has significantly improved pension coverage in the private sector.2 However, the income challenge in retirement remains, with more than a third of respondents (36%) citing this as their biggest financial concern.

Figure 7: What is your biggest financial planning concern specific to retirement?

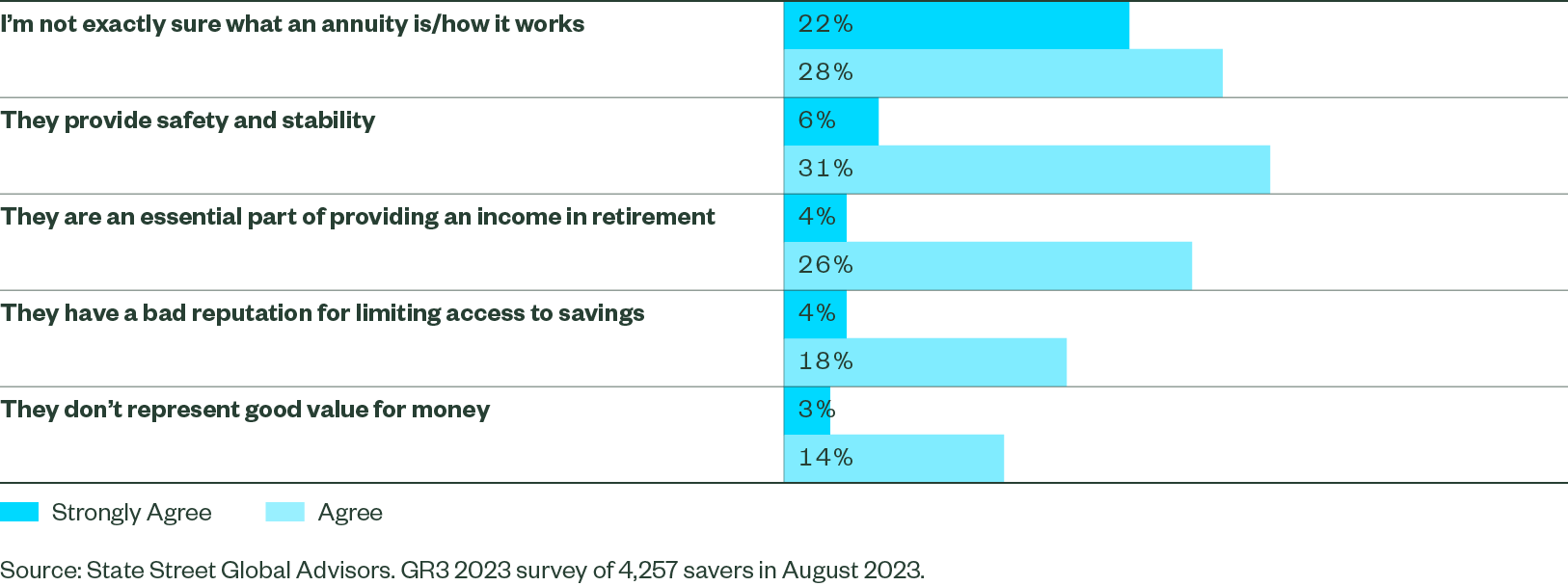

In the wake of the ‘pension freedoms’ policy change in 2015 that removed the requirement for savers to purchase an annuity at retirement, there was an immediate drop off in sales of annuities.3 However, annuity rates have risen in line with interest rates in recent years, leading to a modest increase in sales.4

There are signs among our respondents that confidence in annuities is growing. Far fewer UK savers said they thought annuities didn’t represent good value for money (17% in 2023), while there was an increase in the proportion of respondents who were more positive on the products.

Figure 8: To what extent would you agree or disagree with the following statements about annuities?

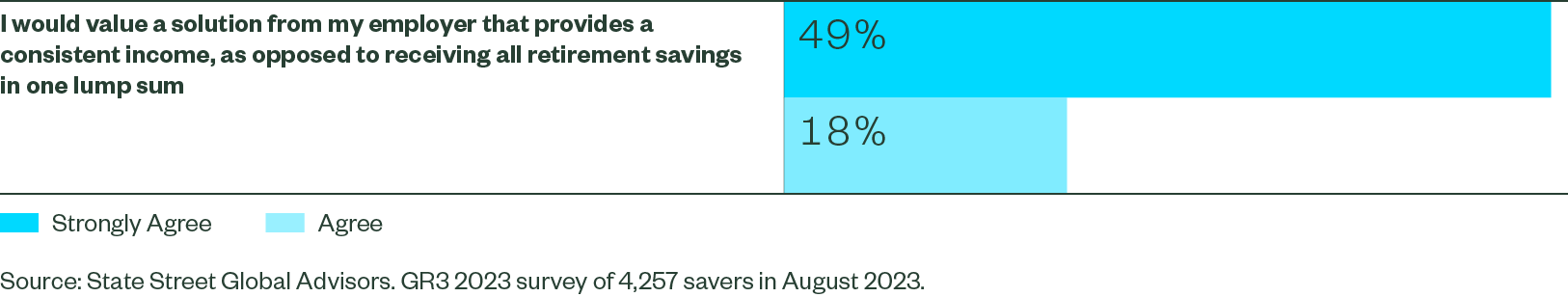

Generating a stable income is important to pension savers: 67% of respondents said they would value a product that generates a consistent income instead of receiving all their retirement savings in one lump sum.

Figure 9: To what extent would you agree or disagree with the following statement:

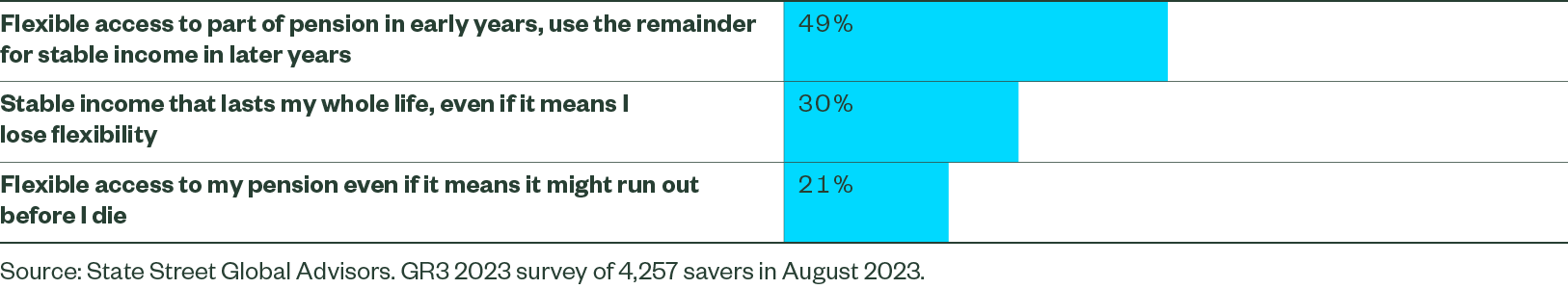

In addition, almost a third (30%) of respondents indicated that they would be comfortable with a stable, consistent income in retirement even if that meant giving up on flexibility.

Figure 10: From the following options around how you could access your retirement savings, which would you choose?

For the majority (70%), however, flexibility remains important. Almost half (49%) of respondents said they would prefer to have flexible access to their pension in the early years of retirement, before switching to a stable income as they get older.

Key finding 5: Accessing advice and guidance

Access to financial advice is a long-running issue in the UK. Recent research indicates that most UK adults believe that professional advice is out of their reach due to their financial position.5

But with a growing proportion of the population saving into defined contribution pension plans – and therefore with more responsibility for their own retirement prospects – access to advice is arguably more important than ever.

Uncertainty over annuities could also be helped by improved access to advice, guidance and information. Half of respondents (50%) said they were not sure about what an annuity was or how it worked, despite the high level of interest in being able to generate a stable income through retirement.

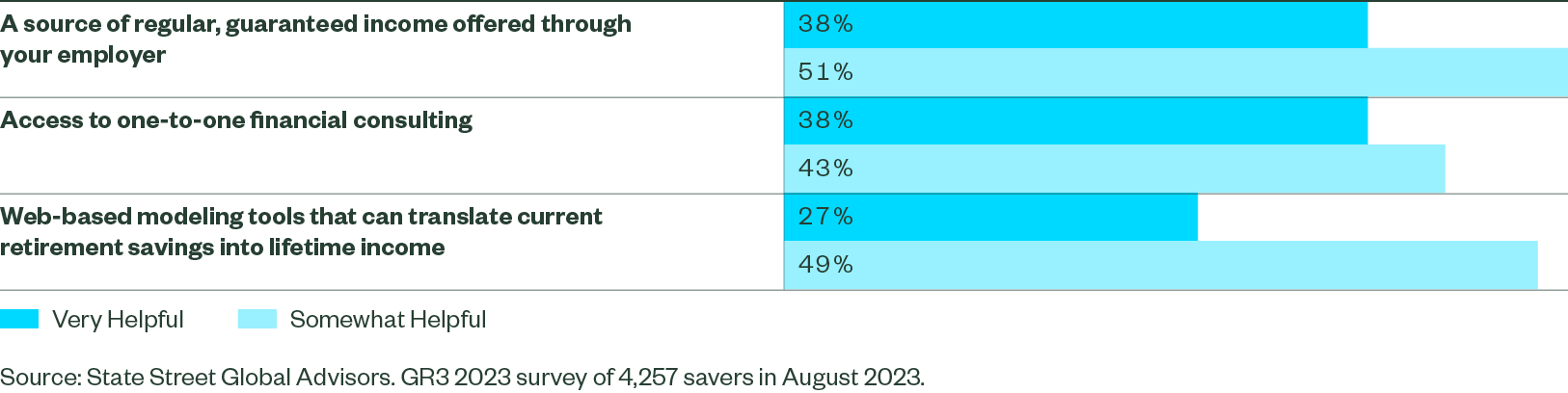

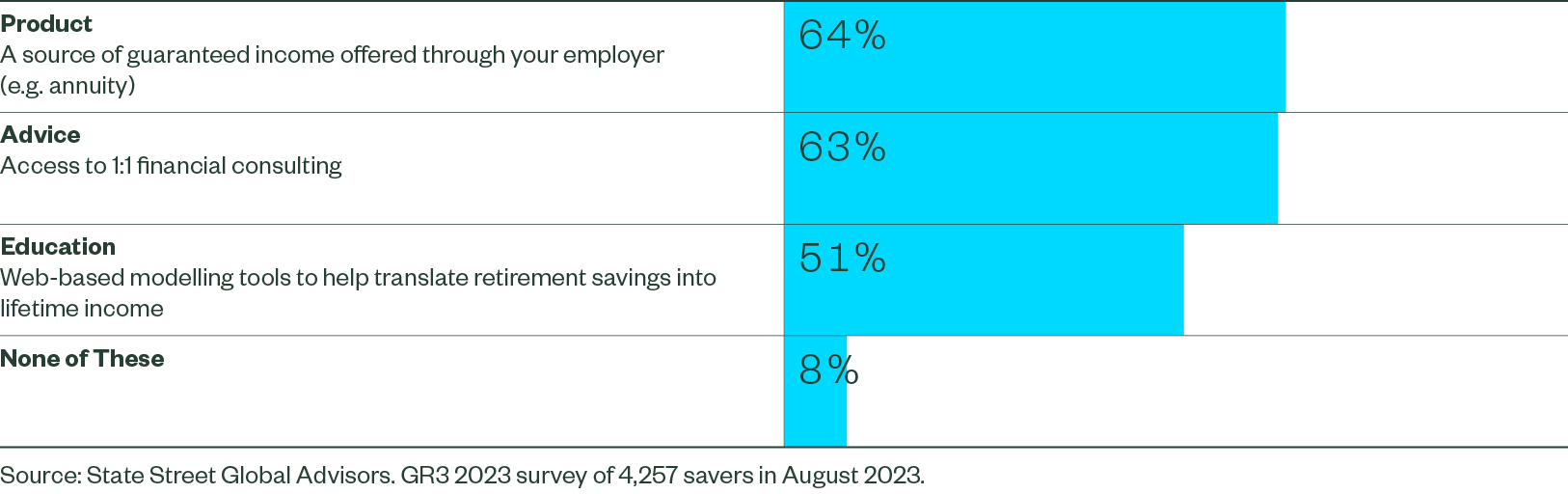

More than 80% of respondents to our survey said they would find it helpful to have access to one-to-one financial consulting to help them plan for retirement. Nearly two thirds (63%) said they would like their retirement plan provider to offer this service.

Figure 11: How helpful would each of these resources be in helping you manage your finances in retirement?

In addition, more than three quarters (77%) said that online tools would be helpful if they could translate an individual’s retirement savings into a lifetime income – effectively forecasting the kind of income they could expect from their current savings pot.

Figure 12: Which of the following resources would you like your provider to offer? Select all that apply.

Key finding 6: Sustainable investing

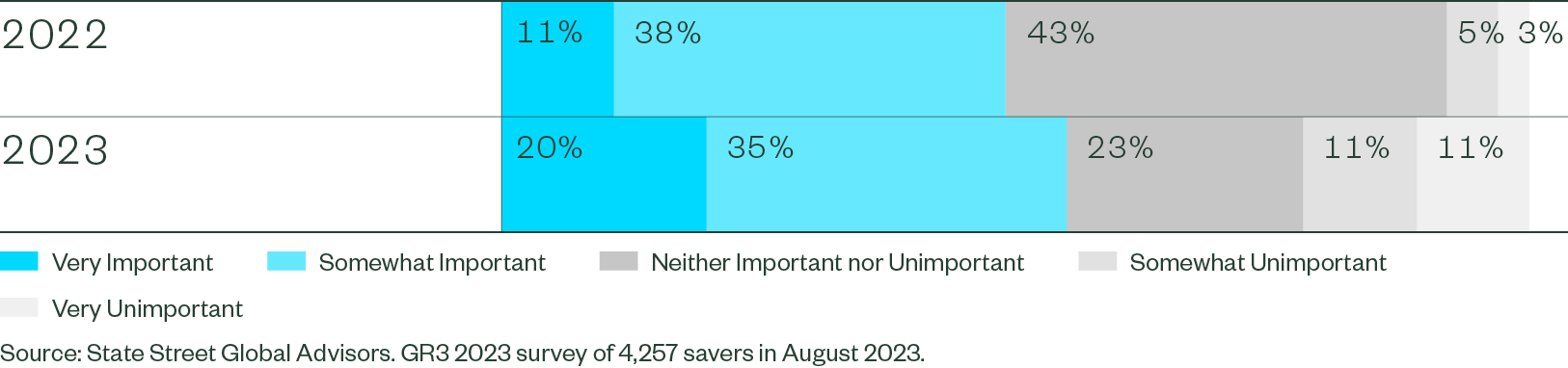

There has been a significant change in sentiment between our 2022 survey and the 2023 iteration regarding UK investors’ attitudes to sustainable investment, which takes account of environmental and social issues. Far fewer are ‘on the fence’ regarding the importance of sustainable investment, underscoring the importance of providers offering options to savers.

More than half (55%) of UK respondents say sustainable investment is either “somewhat important” or “very important”, up from 49% in the previous year’s survey. The proportion of savers for whom sustainable investment is unimportant also rose sharply from 8% to 22%.

Figure 13: How important is it that your pension is invested sustainably?

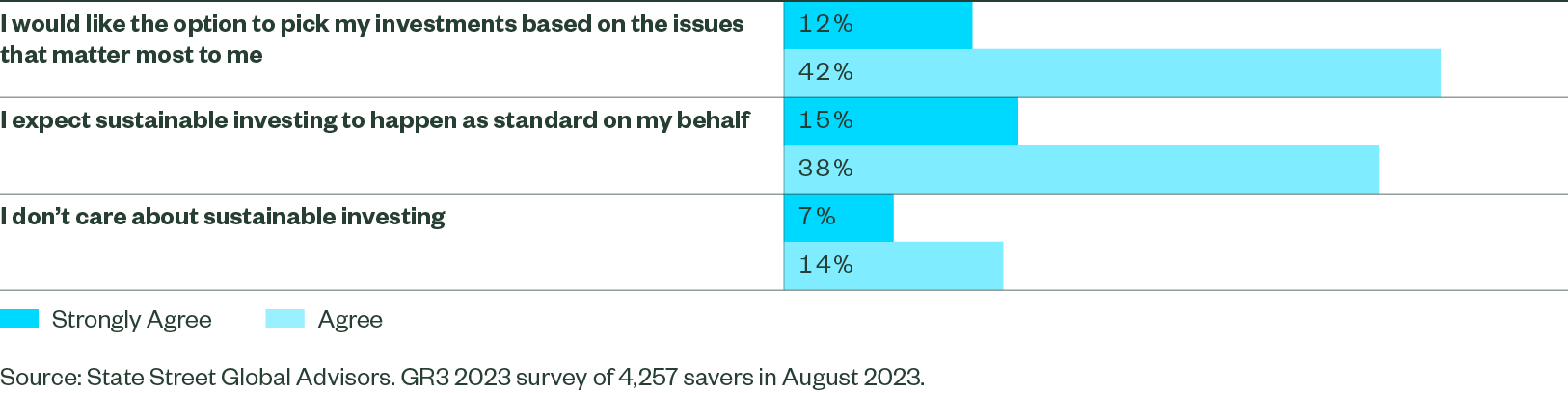

Figure 14: To what extent do you agree or disagree with the following statements with regards to sustainable investing?

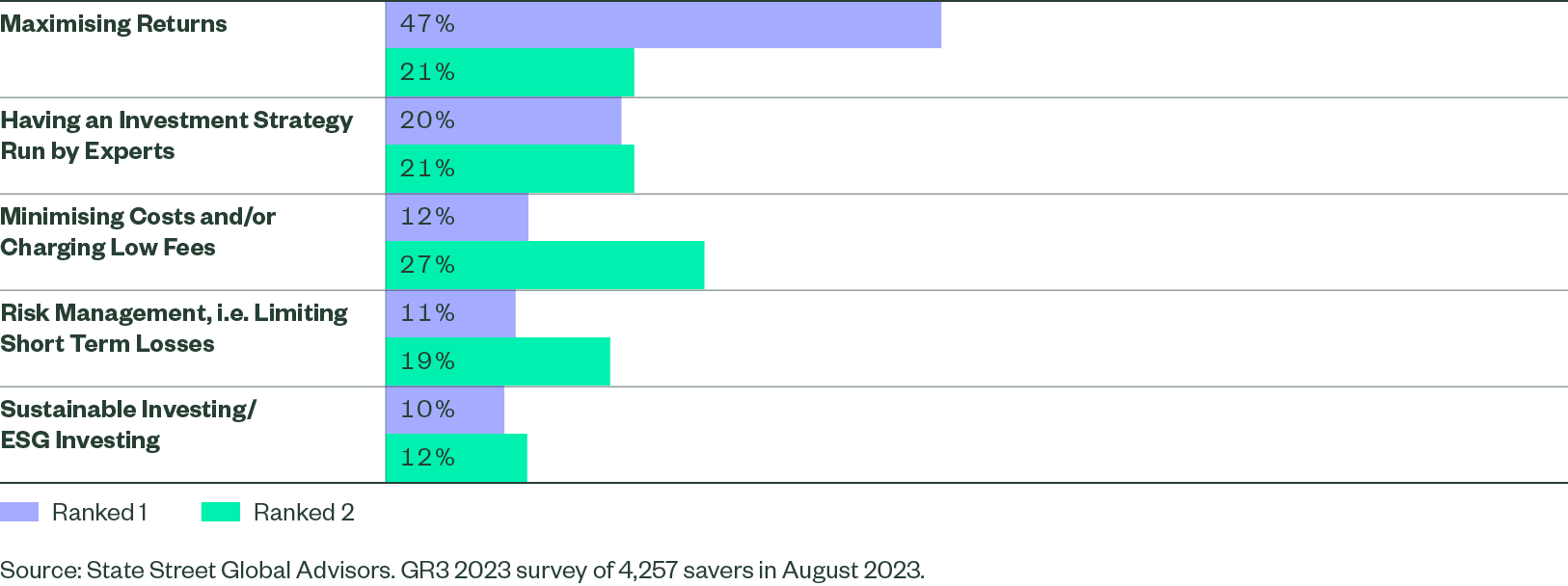

While sustainable investing has increased – or decreased – in importance for some, it still ranks below investment performance, risk management and fees for most investors. Almost half (47%) of respondents selected “maximising returns” as their number one priority for retirement savings, compared to just 10% who did so for sustainable investing.

The Financial Conduct Authority has recently finalised its product labelling regime for sustainable investment funds, which is designed to make it easier for investors, financial advisors and distributors to identify suitable products. Product providers still face a delicate balance between meeting the criteria for these labels, meeting investor demand for sustainable options, and delivering strong investment performance.

Figure 15: What are your retirement savings priorities? (Rank from 1 to 5)

Closing thoughts

UK savers have been affected by the rising cost of living in much the same way as savers in other countries covered by our research. Optimism and confidence about retirement prospects is low, but there are shafts of light in the form of falling inflation, low opt-out rates and indications that engagement with pension saving is improving.

There are several significant policy changes on the horizon that could reshape the retirement landscape. The Pensions Dashboard project, if carefully implemented, could provide improved transparency and control for individuals over their retirement savings.

After a difficult period for many people through the pandemic and the cost-of-living crisis, the future is bright for UK retirement savers.

Survey Methodology

Our global online survey, conducted during August 2023 with international data analytics firm YouGov, engaged a total of 4,257 individuals participating in workplace-sponsored savings plans (or the market equivalent) in Canada, Australia, Ireland, the UK and the US. Surveyed countries represent a range of retirement systems. Gender, age, and regional quotas were balanced to reflect employed populations within each country.

By gaining saver sentiment, we’re seeking to further our global goal of making retirement work for people, plans and policymakers in a changing world.